There are laws that protect your rights as a landlord, and the rights of the tenant, so make sure you understand these before renting out your investment property. It’s also important that you, as the landlord, familiarise yourself with the relevant legislation in your state or territory. However what the legislation probably doesn’t cover is if the tenant in question is a reasonable human.

Ray White Aspley Business Development Manager, Jordan Slinger told Savings.com.au securing the right tenant is the most important part of having a rental property.

“If you can be confident the tenants are looking after the rental property like their own, providing the property with regular cleaning, maintenance and care, this can improve the chance of selling the property for a strong price down the track,” Mr Slinger said.

Property manager or no property manager?

A property manager has the responsibility of managing the day-to-day obligations for a landlord. Essentially, if you have tenants in your investment property, then you can outsource your responsibilities as a landlord to a property manager.

You can go without the use of a property manager, but doing so typically results in much more admin for you to handle yourself. A good property manager will spare you the time and effort, at a fairly reasonable cost. Property management fees typically cost about 4-7% of your weekly income - this of course can vary.

Key responsibilities of a property manager include:

-

Advertising your property on rental websites and hosting inspections

-

Finding and screening potential new tenants (and pets if applicable)

-

Organising the collection of rent and ensuring the correct amount is being paid, on time

-

Preparing and finalising entry condition reports

-

Creating and ensuring the signing of the lease

-

Handling all the nitty-gritty paperwork

-

Managing day-to-day interactions with tenants

-

Inspecting the property on a regular basis

-

Responding to requests for repairs and maintenance and arranging tradespeople

-

Handling tenant turnover

Mr Slinger said the property manager plays a crucial role in the longevity of your investment property.

“The property management team helps the owner and works for the owner,” he said.

“From signing up the client to renting the home, finding the right tenants and ultimately operating the day to day duties of a property manager ensure the property and client is managed properly.

“The property manager is, if not close to the most important part of an investment property and ensures the return on investment.”

Outline your expectations

There are common questions every tenant will expect to find answered on an advertised property. As the landlord you need to decide your own standards and rules. These will help to keep your property aligned with your values. However, making these too strict may deter potential tenants. On your listing, outline your rules for:

-

Smoking

-

Pets

-

Length of lease

-

Bond payment

-

Frequency of payment

-

Number of tenants

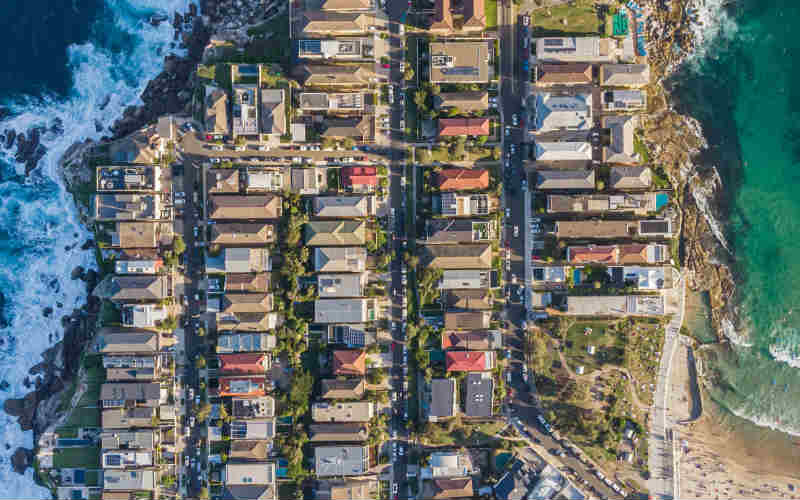

Advertise your property

How you advertise your property and the platforms you advertise on will help attract the right tenants. Outlining the weekly rent and features of the property are key details. What to include on the ad:

-

Price of rent per week

-

Price of bond (typically four weeks' rent)

-

Property size - number of bedrooms, bathrooms, car parks

-

Laundry facilities

-

Yard features e.g. pool, etc.

-

Date available

-

Lease length

-

Address

Below these important details you can also provide a more detailed description of the property and include key features, as well as other information that may attract tenants such as nearby options for transport, parks, cafes, nightlife and so on.

Inspection details

It is also important to include information on when the property can be inspected and how to register. This step can often be organised by a property manager, and is a key step in finding the right tenants. This is also a process that can be tricky to navigate, as inspection times can often coincide with other properties in the area. Many inspections occur on a Saturday morning, and if you choose not to employ a manager, you will need to attend the property yourself in order to unlock the property for interested tenants.

Due to the pandemic, inspections can typically be held virtually or with limits on the number of people who can enter the property at the same time.

These inspections can also be a great opportunity for you or the manager to ask some general questions to potential tenants. A good property manager will ask why people are moving, when they are looking to move, and what their price range may be. These initial questions will help you get a feel for potential renters, and if your property is being advertised at a fair rate.

Screen applicants

There are financial and situational screening questions that you as the landlord have the right to ask to ensure the tenants will be able to afford your property.

Mr Slinger said common documents to ask potential tenants are:

-

Payslips

-

Rental ledger from previous agency

-

Bank statements

You can ask the following to determine their reliability:

-

References from an employer

-

Non-professional reference

-

References from previous landlord

Mr Slinger also outlined some important things to consider when applicants apply:

-

Have they provided all the information listed in the application with additional documents to give themselves every chance of being approved?

-

Were they present at inspections?

-

Have they reinforced they will look after the property?

-

Can they afford the property?

A typical rule for any landlord is the 30% rule. What this means is your applicant/s income should be roughly three times more than the rent. Anything over this threshold is generally classified as ‘rent stress’. However, this can vary. For example, $50,000 rent on a $150,000 income is very different to $10,000 rent on a $30,000 income as some essential living costs stay the same. Many student renters also typically rent at over the 30% threshold.

Applying the 30% rule could help you screen applicants and prevent having tenants who can’t realistically afford the property. Tenants under rental stress may be unable to meet repayments, and end up missing rent or having to move. They may also be unable to afford basic upkeep of the property required under the lease, such as lawn mowing.

This could cost you, as the owner, time and money to re-advertise the rental and start again. It’s important to remember that many Aussies may have other bills to pay other than rent, these include:

-

Phone bill

-

Internet bill

-

Car loan

-

Personal loan

-

Credit debt

-

Monthly subscriptions

-

Gym memberships

All these can add up and mean that someone who falls under the 30% rule still is unable to afford rent. This is why asking for relevant financial and situational documents can help you find tenants who can afford a rental.

Also read: What to look for in a rental

How many tenants do you want?

Depending on your property type, you also will need to decide on the number of people you want in your property. If you own a one bedroom townhouse or unit, you’ll probably need to decide if you will accept couples, or a single tenant. Due to fire safety, many states also have maximum building occupancy limits.

People’s circumstances change, so having more than one tenant may provide some security, but ultimately, you have the authority to decide. According to the Equal Opportunity Act, you cannot discriminate against any of the applicants based on their:

-

Gender

-

Age

-

Race

-

Religion

-

Marital status

-

Sexuality

-

Having children

-

Pregnancy

-

Mental illness

-

Disabilities

This means it is best practice not to advertise to one demographic in particular, as it may be seen to be favouring one group over others.

Savings.com.au’s two cents

A lot of stories circulate about unruly tenants, but first and foremost it’s important to control how you manage a property as a landlord. Whether that be through a property manager or managing yourself, make sure your expectations are clear. This includes having suitable lease conditions, and that you have done the appropriate checks and balances of prospective tenants - a property manager will do this for you.

Image by Surface via Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan