The New South Wales flood disaster continues to worsen, with 18,000 people being evacuated from their homes already and countless properties underwater in parts of the state.

Now, the Insurance Council of Australia (ICA) has declared the region a catastrophe, with ICA CEO Andrew Hall saying more than 5,000 claims have already been lodged from affected customers.

"The insurance industry has made this Catastrophe Declaration to activate services and support for affected homeowners and businesses and reassure them that their insurer is there to help," Mr Hall said.

"As many areas are currently inaccessible due to floodwater, insurers are expecting further claims in coming days as emergency services allow residents to return to their properties to examine the extent of their damage and losses."

The ICA is also monitoring South-East Queensland floods as well to see if such a declaration is required there.

Insurance help available for flood victims

A Catastrophe Declaration by the Insurance Council means help for affected customers is given 'urgent priority' over others, with the worst-affected getting the most urgent attention.

The ICA has activated its disaster hotline on 1800 734 621 to assist policyholders with questions about their claims.

Insurers will mobilise disaster response specialists to assist affected customers as soon as it is safe to do so.

See also: What is flood insurance and what is contents insurance?

Banking support available for NSW customers too

Australian Banking Association (ABA) CEO Anna Bligh said Australian Banks will also offer specialised help for those in the region.

“Once the cleanup begins, it’s important for people to know that they can talk to their bank to seek assistance”, Ms Bligh said.

“The message from banks is clear: don’t tough it out on your own, your bank is ready to help”.

The help on offer includes the extension of home loan deferrals, which was set to expire in just one week for COVID-19 impacted customers.

Other help on offer includes the following, although the extent of the help will differ from bank to bank:

- Waiving fees and charges, including break costs on early access to term deposits

- Debt consolidation to help make repayments more manageable

- Restructuring existing loans free of the usual establishment fees

- Deferring interest payments on a case-by-case basis

- Offering additional finance to help cover cash flow shortages

- Deferring upcoming credit card payments

- Increasing emergency credit card limits.

Banks with insurance arms are also offering help for home & contents insurance customers.

Commonwealth Bank for example is offering emergency accommodation for CommInsure customers and expediting claims, as are the other big banks.

"The record-breaking rain in New South Wales has had a devastating impact on households, businesses and communities, and we want our customers in flood-affected areas to know we are here to help them at this time," Westpac Chief Executive Consumer & Business Banking Chris de Bruin said.

"Our customer assistance teams are ready to talk to customers who need to access this support, and we have added extra claims consultants and mobilised local builders to help our insurance customers."

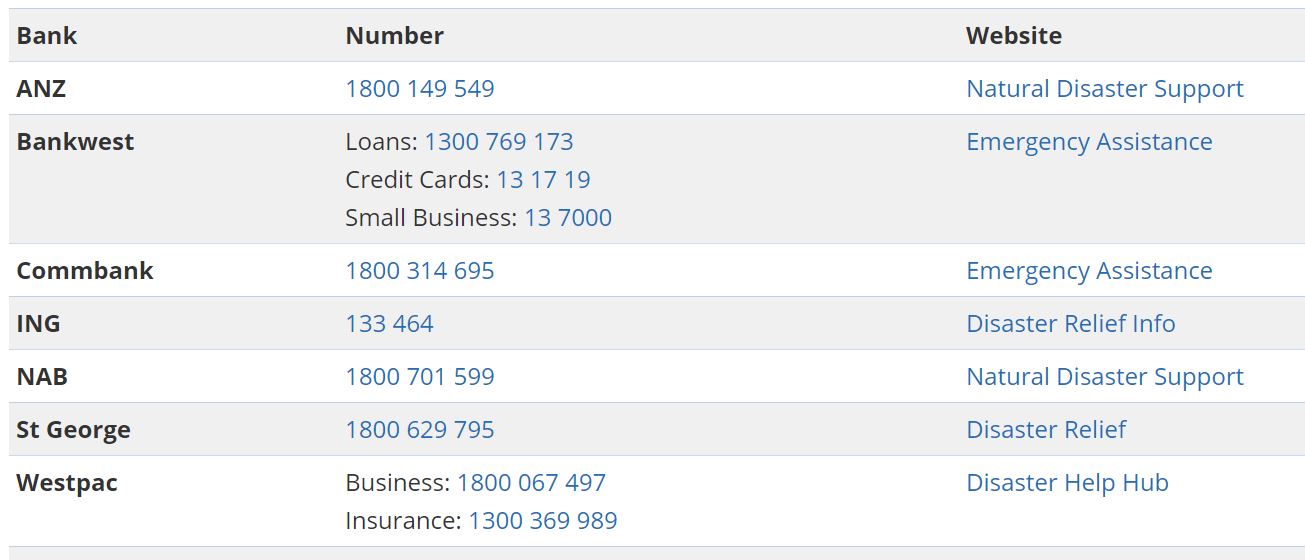

Emergency assistance numbers for key banks. Source: ABA.

What to do if you have flood and storm damage

If your house has been damaged by the floods, now or in the future, the ICA provides the following tips for both safety and to ensure you make a claim correctly.

- Safety is the priority - don’t do anything that puts anyone at risk

- Only return to your property when emergency services give the go ahead

- If water has entered the property, don't turn on your electricity until it has been inspected by an electrician

- Contact your insurance company as soon as possible to lodge a claim and seek guidance on the claims process

- You can start cleaning up but first take pictures or videos of damage to the property and possessions as evidence for your claim

- Keep samples of materials and fabrics to show your insurance assessor

- Remove water or mud-damaged goods from your property that might pose a health risk, such as saturated carpets and soft furnishings

- Make a list of each item damaged and include a detailed description, such as brand, model and serial number if possible

- Store damaged or destroyed items somewhere safe

- Speak to your insurer before you attempt or authorise any building work, including emergency repairs, and ask for the insurer’s permission in writing.

- Do not throw away goods that could be salvaged or repaired

Photo by Phillip Flores on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Bernadette Lunas

Bernadette Lunas

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Rachel Horan

Rachel Horan

Jacob Cocciolone

Jacob Cocciolone