Moody's Investor's Service found Australian housing affordability deteriorated in February, reversing the improved trend seen in the second and third quarter of last year, during peak-COVID.

On average, two income earners needed 24.6% of their monthly income to make monthly mortgage repayments in February, compared to 23.0% in September, and 22.7% in June and July, when new mortgages were the most affordable in a decade.

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Property prices have increased 4.7% over the five months to February, with demand from owner-occupiers and first-home buyers being key drivers of the growth.

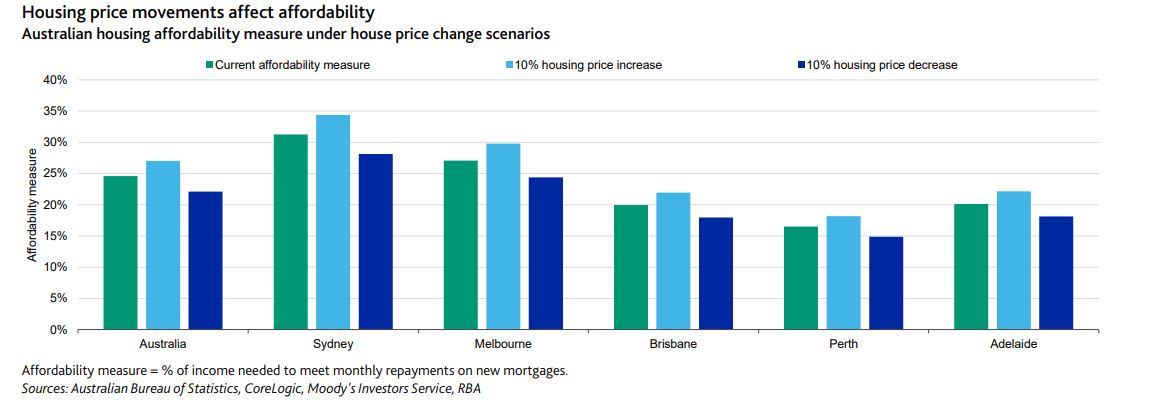

All capital cities saw housing affordability worsen in the five months to February, with Perth the most affordable and Sydney the least.

However, housing affordability remained better than the ten-year average of 26.1% and well under its peak of 30.7% in April 2011, as the average mortgage interest rate has nearly halved to 3.65% since 2011.

But the worst may be yet to come, with affordability to continue to deteriorate as prices rise this year, according to Moody's analyst Pratik Joshi.

"Our model shows that housing prices or interest rates would have to increase materially (by 24.9% or 225 basis points respectively) for affordability to deteriorate to its worse level in a decade," Mr Joshi said.

"A 15% increase in housing prices combined with 100 basis point increase in interest rates would have the same impact.”

Westpac has forecast property prices will rise 20% in the next two years, while Commonwealth Bank believes a 16% rise is on the cards.

Moody's reported that as government schemes like JobKeeper come to an end, household incomes would further fall, worsening housing affordability.

Where is housing affordability worst?

Moody's found new buyers in Sydney needed 31.3% of their household income to meet mortgage repayments in February, the worst in the country.

Melbourne was the next worst, needing 27.1% of household income, followed by Adelaide (20.1%), Brisbane (19.9%), and Perth (16.5%).

The report found for every 10% change in housing prices, the percentage of income households needed to service their mortgage changed by 2.5 percentage points on average.

If house prices increased by 10% in Sydney, the amount of household income to meet mortgage repayments would increase by 3.1% percentage points to almost 35% of household income.

For affordability to be the worst in a decade, house prices would need to increase on average 24.9%, but only 18.3% in Sydney, 20.4% in Melbourne, and a whopping 38.9% in Brisbane.

Interest rates helping affordability...for now

The Reserve Bank of Australia (RBA) has stated the cash rate is unlikely to rise before the end of 2024, which is keeping interest rates at record-low levels.

Moody's reported interest rates would have to rise significantly for affordability to reach a decade-high, which seems unlikely for some time.

"For housing affordability to deteriorate so that it is worse than at any point in the last 10 years, average mortgage interest rates would have to increase to 5.9% for Australia on average, or 5.3% for Sydney, 5.5% for Melbourne, 7.0% for Brisbane, 9.0% for Perth and 7.1% for Adelaide."

"If median housing prices increase 15% and average mortgage interest rates increase by 100 basis points, the share of income households need to meet mortgage repayments would increase 6.8 percentage points on average in Australia, 8.6 percentage points in Sydney and 7.4 percentage points in Melbourne."

Photo by Kon Karampelas on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Rachel Horan

Rachel Horan

Arjun Paliwal

Arjun Paliwal