CoreLogic's Quarterly Rental Review for June 2020 showed national rents dropped 0.5% in the June quarter, marking the largest quarterly fall in rents since September 2018, with further falls expected in the coming months.

Capital city rents have borne the brunt of of the COVID-19 pandemic's toll on the property market, dropping by 0.7% over the June quarter, compared with a 0.2% rise in regional parts of Australia.

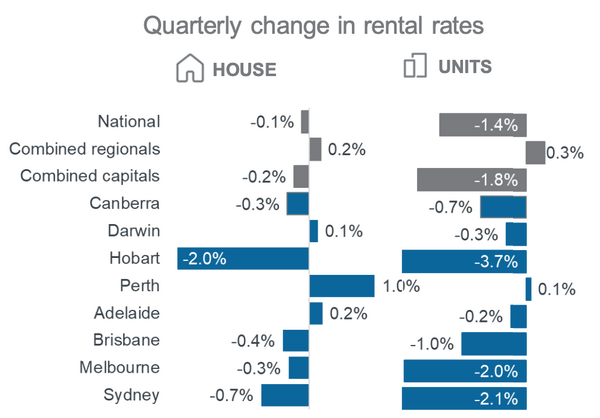

But the biggest asking rent falls were in Hobart which plunged by 2.3%, followed by Sydney (1.3%) and Melbourne (1.0%).

Asking rents for apartments fared the worst, with rents in Hobart dropping by 3.7%, while Sydney and Melbourne saw falls of 2.1% and 2.0% respectively.

Buying a home or looking to refinance? The table below features home loans with some of the lowest variable interest rates on the market for owner-occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Asking rents in Brisbane fell by 0.6% in the June quarter, eroding the increase of 0.6% in the March quarter.

Adelaide and Perth were the only capital cities to see an increase in rents over the June quarter.

Source: Corelogic

CoreLogic's Head of Research Eliza Owen said rents were beginning to rise nationally before the COVID pandemic.

“Prior to the fall in rent values over the June quarter, growth in rents had seen some momentum building, with the national CoreLogic rental index recording consecutive increases between September 2019 and March 2020," Ms Owen said.

"These signs of rebounding rent values came as investor participation in the market was falling from 2017, and subsequently, the rate of new supply additions in rental properties had been falling."

Change in rents:

| Region | Median rent | Quarterly change in rents |

| Sydney | $568 | -1.3% |

| Melbourne | $453 | -1.0% |

| Brisbane | $439 | -0.6% |

| Adelaide | $397 | 0.1% |

| Perth | $396 | 0.9% |

| Hobart | $454 | -2.3% |

| Darwin | $442 | -0.1% |

| Canberra | $566 | -0.4% |

| Combined capitals | $466 | -0.7% |

| Combined regionals | $390 | 0.2% |

| National | $441 | -0.5% |

But the economic impacts of the COVID-19 pandemic has led to significant rent falls in some parts of the country.

"Closed international borders created a significant shock to rental demand, as historically the majority of new migrants to Australia have been renters," Ms Owen said.

"Furthermore, job losses in sectors such as hospitality, tourism and the arts, which ABS payroll data estimates has been around 20%, have also impacted demand, because households in these sectors are more likely to rent than in other industries."

It comes after research from buyer's agency Propertyology found that house rents are predicted to rise in some parts of the country amid undersupply.

At the time, Propertyology Head of Research, Simon Pressley said sharp rent rises would be inevitable.

“Right now, 39 out of 52 Australian towns (75% of the country) currently have an undersupply, nine locations have a balanced market, and the remaining four are oversupplied,” Mr Pressley said.

"As local demand continues to rise, the pressure continues to push rents (and yields) higher.”

See also: Now that it’s a renters market, should you take advantage and find a new rental?

But rents in Melbourne and Sydney are expected to remain under pressure, with high vacancy rates of 3% and 3.8% respectively.

Data from ANZ and Corelogic released last week showed asking rents had plummeted by over 7% in some inner Melbourne and Sydney suburbs since COVID-19 hit.

The number of advertised rental properties skyrocketed by 57% in parts of inner Melbourne, while Sydney's inner city areas saw a 53% spike in rental listings.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan