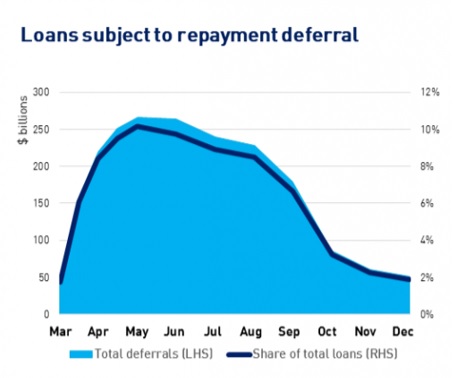

Data from the Australian Prudential Regulation Authority (APRA) found that at the end of December, the value of deferred home loans fell by $7 billion to $43 billion.

That's a significant drop from May, when home loan deferrals peaked at $192 billion.

It was a similar story for small business loans, with loan deferrals plunging from a peak of $56 billion to $6 billion in December, and down by $2 billion since November.

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

According to Treasurer Josh Frydenberg, the current value of deferred housing loans is over 80% down from the peak in May.

Similarly, the value of deferred small business loans has plummeted by more than 90% since May.

“As more households and businesses resume loan repayments, banks are in an even stronger position to continue lending in support of the economic recovery by helping those wanting to buy a home, invest or grow their business," Mr Frydenberg said.

Source: APRA

By state, Victoria has the highest number of loans subject to deferral eligible for capital concession, with 2.8% of loans deferred compared with the rest of the country at 1.4%.

According to APRA analysis, more than 10% of home loans were deferred at the peak of the pandemic - that number has now fallen to 2%

It comes as the March deadline for loan deferrals fast approaches, though some of Australia's major banks have said they've stopped accepting new applications for mortgage deferrals.

Household lending strong

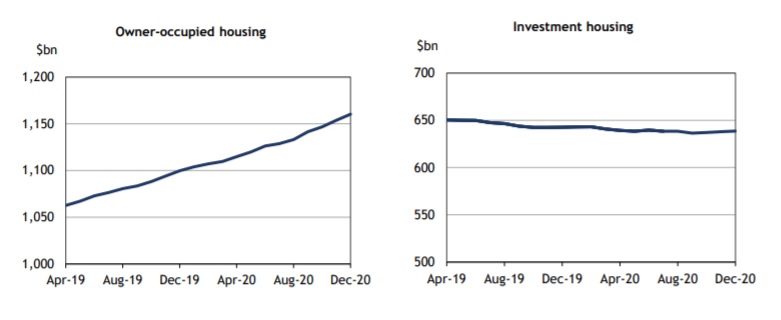

Home loan lending continues to surge as borrowers seek to take advantage of ultra low interest rates.

APRA's monthly authorised deposit-taking institution (ADI) statistics released today showed both owner occupied and investment loans increased.

Source: APRA

"This is consistent with the continued broad-based increase in national house prices and market activity, driven by strong demand for detached dwellings," APRA said.

Commonwealth Bank data released today also shows that lending for housing continued to surge over the final months of 2020, with lending for renovations growing at an "extraordinary pace" largely thanks to the government's controversial HomeBuilder scheme.

Photo by Ian Branch on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Harrison Astbury

Harrison Astbury

Rachel Horan

Rachel Horan