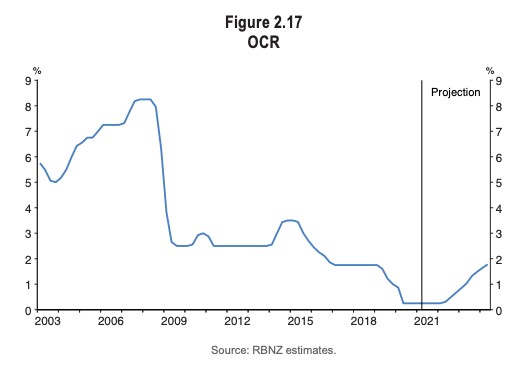

RBNZ is 'conditionally projecting' its first 25 basis point rate rise to 0.50% by mid-2022, and up to 150 basis points (1.50%) in hikes by 2024, bringing the maximum cash rate to 1.75%.

However, this is contingent on a few projections: annual GDP growth of 3.9% by late 2022; a 4.3% unemployment rate by the "second half of the projection"; inflation above 2% "by the end of the projection"; and annual wage growth of 2.6% "later in the projection", among other factors.

RBNZ said these figures are partially reliant on increased economic activity, fewer COVID restrictions, and a strong vaccination rollout.

In Australia, Reserve Bank Governor Dr Philip Lowe has maintained that the cash rate here will stay at 0.10% until 2024, however some experts have predicted the RBA will drop this deadline before then.

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

RBNZ Governor Adrian Orr's address yesterday seemed to echo Dr Lowe's latest statements on monetary policy.

"The Committee agreed to maintain its current stimulatory monetary settings until it is confident that consumer price inflation will be sustained near the 2% per annum target midpoint, and that employment is at its maximum sustainable level," Mr Orr said.

"Meeting these requirements will necessitate considerable time and patience."

Westpac NZ acting chief economist Michael Gordon said RBNZ's projections could be a little optimistic.

"It signalled that the Official Cash Rate could start to rise from the second half of next year, much earlier than our forecasts suggest," he said.

"It expects a significant lift in wage growth, even as the unemployment rate struggles to move lower.

"We recognise that our point of difference with the RBNZ hinges on the degree of capacity in the labour market, something that’s inherently difficult to judge."

RBNZ's 'overnight cash rate' projections

House prices also on the radar

RBNZ yesterday also highlighted house prices as one of its 'key factors' in its economic projections.

In March, RBNZ, which also acts as prudential regulator, introduced a variety of loan-to-value ratio (LVR) restrictions in an attempt to rein in its house price growth.

It has also stopped investors being able to claim mortgage interest as a tax deduction against rental income, while also tightening capital gains tax criteria.

Due to these policies, RBNZ expects house price growth to slow from 21.5% in 2021 to flatline in 2022, and then rise 'modestly' by 2.6% in 2023.

"This slowdown is both larger and faster than expected in the February Statement," the Bank's statement said.

"This is due to the Government’s housing policy package announced in March that is assumed to reduce housing demand from residential property investors and support housing supply.

"No further significant house price increases are expected until the latter half of the projection, when moderate house price growth returns."

However, because of this, RBNZ is predicting a slowdown in 'consumption', also called the wealth effect.

"Consumption is projected to be weighed down by the impact of weaker house price growth on consumer confidence and wealth accumulation, although a more resilient labour market provides some offsetting support," the Bank's statement said.

Experts here have said Australia is 'unlikely' to follow New Zealand's path to rein in house prices, with price growth here comparatively low at 3.6% through 2020.

Photo by Martin Bisof on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

.jpg)

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Harrison Astbury

Harrison Astbury

William Jolly

William Jolly