Hosted by National Australia Bank (NAB), the virtual discussion weighed in on the opportunities and challenges facing the non-bank lending sector.

According to NAB’s report on the round table, the sector’s impressive growth in recent years has been helped by regulatory change, consumer sentiment, technology and new product offerings.

Non-banks do not hold authorised deposit-taking institution (ADI) licences, which means they cannot accept consumer deposits, such as by offering savings accounts or term deposits.

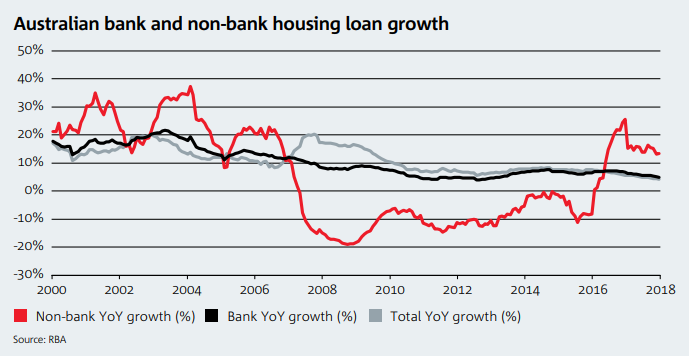

Major banks are said to dominate Australia’s $360 billion per year housing credit market, but the non-bank share has grown to an estimated $75 billion.

While non-banks are governed by the National Consumer Credit Protection Act, they are not bound by the regulations of the Australian Prudential Regulation Authority (APRA).

So when APRA introduced stricter capital requirements in 2015, many licensed banks were required to tighten their lending standards.

NAB reports this led borrowers with more complex loans, such as self-employed workers, to move to non-bank lenders which were able to assess and underwrite such loans.

Chris Andrews, Chief Investment Officer at non-bank institution La Trobe Financial, told the round table this movement will represent a permanent structural shift in the Australian mortgage market.

“Banks are going to be more restricted to those mum and dad loans and an automated underwriting model, and speciality loans will be funded by alternate lenders,” Mr Andrews said.

Chief Financial Officer at non-bank lender Liberty Financial Peter Riedel said he expects the definition of a non-standardised mortgage to change towards the purpose of the loan and nature of the asset, as opposed to the current model which focuses on the nature of the customer.

“With banks changing their appetite, we as an alternative lender have benefited and we feel that’s likely to persist for some time,” Mr Riedel said.

In the interests of full disclosure, Savings.com.au is part of Firstmac, which is a non-bank lender.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Denise Raward

Denise Raward

Rachel Horan

Rachel Horan