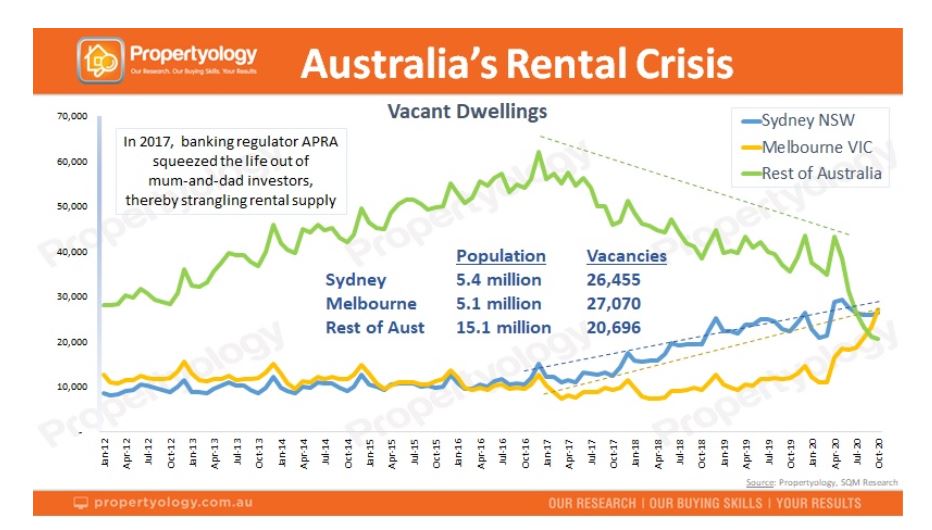

Buyer's agency Propertyology found even prior to COVID-19 most of Australia had an under-supply of housing, with five out of eight capital cities now seeing vacancy rates below 1%.

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

Lender Home Loan Interest Rate Comparison Rate* Monthly Repayment Repayment type Rate Type Offset Redraw Ongoing Fees Upfront Fees Max LVR Lump Sum Repayment Extra Repayments Split Loan Option Tags Features Link Compare Promoted Product Disclosure

Promoted

Disclosure

Promoted

Disclosure

Promoted

Disclosure

Disclosure

Propertyology Head of Research Simon Pressley said their claim was in contrast to the majority who thought little to no overseas migration would cause a downturn in the Australian property market.

"The reality is that Australia does not have enough housing supply for its existing 25.6 million population," Mr Pressley said.

"Propertyology is predicting that these next couple of years will produce the biggest increase in rents that Australia has seen in living memory.

"To secure a standard rental property over the next couple of years, it will not be uncommon for households to need to find an extra $2,000 to $5,000 per annum."

Sydney and Melbourne are a stark contrast to the rest of Australia, currently sporting a surplus of rental stock and falling rents.

Propertyology found as at the end of October 2020, there was a combined 53,525 dwellings advertised for rent for Sydney and Melbourne’s combined population of 10.5 million people.

The remaining 15.1 million are competing for just 20,696 dwellings in the other six capitals and increasingly popular regional locations.

Mr Pressley said the pandemic couldn't be blamed for everything, with the demand for housing in Sydney and Melbourne simply shifting to other locations.

"Fact: It is becoming standard practice for property managers in every corner of the country to frequently receive numerous applications to rent a standard house," he said.

"The intense pressure affords property managers the luxury of being particularly fussy when assessing the quality of tenant applications.

"Propertyology’s buyer’s agents have seen firsthand proof of multi-offer tenant applications and the successful tenant paying $50 to $70 per week above the market’s median rent. It’s a frenzy."

He added the rock-bottom vacancy rates weren't confined to the capital cities.

"From Maitland NSW, to Margaret River WA, Mount Gambier SA, Mackay QLD, and Mildura VIC, Propertyology is tracking an additional 50 individual towns across Australia with vacancy rates below 1%," he said.

"It is the tightest rental conditions that Australia has ever seen. Anyone who forecast a downturn clearly has no clue what ‘housing demand’ truly means."

See also: What's in store for struggling renters in 2021? (In-depth).

Good news for investors

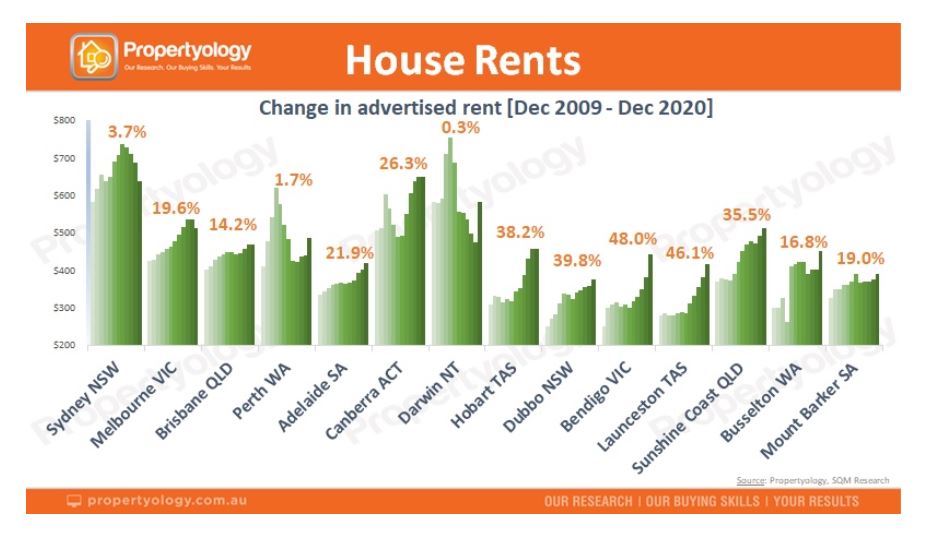

According to data by SQM Research, Canberra ($648 per week), Sydney ($638) and Darwin ($580) have the highest capital city advertised medians rents for houses.

Hobart rents have increased the most over the last decade, although they are still relatively affordable at $456 per week.

However, the biggest rent increases over the last decade have been seen outside of the capitals, with the shift to working from home likely to accelerate this trend.

Mr Pressley said rental supply was 98% determined by mum-and-dad investors, and decisions from the Australian Prudential Regulation Authority (APRA) had stifled this channel.

"The primary reason for Australia’s current rental supply crisis is traced back to a series of decisions between 2015 and 2019 by the banking regulator to restrain the activity mum-and-dad investors," he said.

"Property investors were active participants during Sydney and Melbourne’s last boom, ending in 2017.

"But APRA’s credit tightening policies were applied with a broad brush that, instead of two cities, affected all of Australia."

What's the solution?

Mr Pressley said the rental supply crisis was only going to get worse before it got better.

He said there must be support for mum-and-dad investors, and outlined five ways to kickstart recovery:

- APRA must treat adults as adults and introduce a credit policy which supports responsible borrowers. Moreover, they must be proactive in helping to improve loan application efficiencies. With modern technology and so much information at the banks' fingertips, it beggars belief that something which could be approved within a couple of days 30-years ago today takes a few weeks.

- Banks must stop charging investors a premium interest rate.

- State governments must stop charging investors higher stamp duty and placing a wad of moratoriums and restrictions on what an owner can do with their asset.

- City councils must stop charging investors a premium on council rates.

- The federal government must conduct a serious investigation into the conduct of insurance companies. From charging excessive insurance premiums to hiding behind fine print when a policyholder makes a claim, rorting of real estate products is a national problem.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Rachel Horan

Rachel Horan