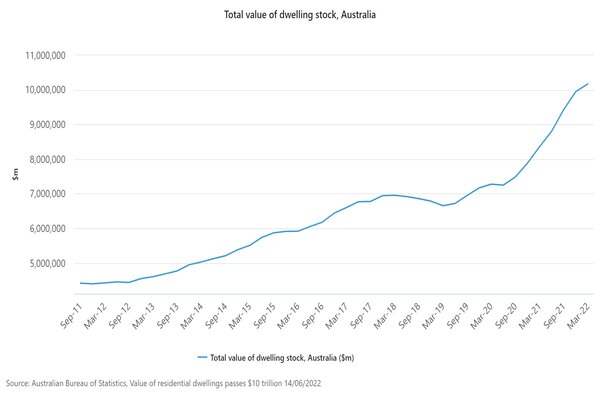

This brought the total value of Australia's 10.8 million dwellings to $10.2 trillion for the first time in history, to the March 2022 quarter.

The ABS reported that “of the total value of residential dwellings, $9,723.7 billion was owned by households.”

Of this, NSW accounted for 40.1%, followed by Victoria with 26.9%, and Queensland with 16.7%.

In a presentation on Tuesday, CoreLogic head of research Eliza Owen said the total value of residential real estate surpasses the value of the Australian Securities Exchange, the total value of superannuation, and the value of commercial real estate.

Mean price increased for residential dwellings

The mean price of residential dwellings in Australia rose by $16,600 to $941,900 this March quarter 2022.

NSW took the lead with the highest mean price of residential dwellings with $1,222,200, while the Australian Capital Territory followed with $1,028,000.

According to the ABS, the lowest mean price in the country was the Northern Territory with $509,100.

Median prices in regional NSW and VIC take over the capital cities

"Over the past year, growth in median prices in regional NSW and Victoria has outpaced growth in their capital cities for both houses and attached dwellings," ABS head of prices statistics Michelle Marquardt said.

In regional NSW, the median house price increased 29.1% to $800,300 while Sydney only saw a 16.4% rise to $1,245,000.

Meanwhile, the Victorian regions saw a rise of 17.4% to $640,000 while capital city Melbourne only experienced a 9.4% increase to $930,000 over the past 12 months.

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| ||||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

|

Image via Pixabay

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

William Jolly

William Jolly