The affordable and liveable property guide for Hobart Metro analysed all suburbs within a 10km radius of the Hobart CBD.

According to the report Warrne, Mornington and Clarendon Vale offer affordable and liveable options for prospective house buyers.

| Suburb | Median house price | Distance from CBD | Annual median price growth |

| Warrne | $462,625 | 5.1km | 15.7% |

| Mornington | $561,250 | 5.9km | 29.0% |

| Clarendon Vale | $435,000 | 9.4km | 52.6% |

If you're looking to buy a unit, the report found that Oakdowns, Bellerive and Kingston were the most affordable and liveable suburbs.

| Suburb | Median unit price | Distance from CBD | Annual median price growth |

| Oakdowns | $560,000 | 10km | 27.3% |

| Bellerive | $586,250 | 6.2km | 44.5% |

| Kingston | $535,000 | 10km | 16.7% |

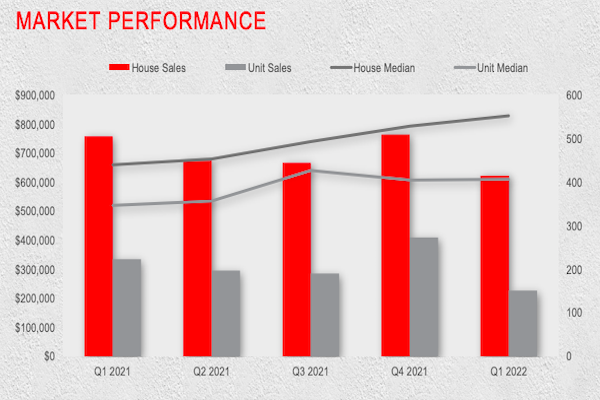

According to the report, median property prices in Hobart Metro increased by 25.5% for houses to $828,500 from Q1 2020 to Q1 2022, and by 17.3% for units at $610,000.

The data shows between quarter-one 2021 – quarter-one 2022 total sales declined by -17.8% (to 415 sales) for houses and by -32.3% (to 151 sales) for units.

In comparison, between quarter-three 2020 – quarter-three 2021 Hobart Metro’s median price grew by 30.5% for houses and 43.5% for units.

"With the economy entering a new phase of a higher cash rate and less fiscal or government stimulus, there are opportunities for first home buyers," the report read.

"An estimated $972.8 million of projects are planned across the first half of 2022, with a main focus on residential.

"Market conditions continue to heavily favour vendors, as buyers must offer above the initial listing price.

"That said the average vendor premiums in quarter-one 2022 are lower than the past three quarters, which should provide some relief to buyers.

"The dominant proportion of homes sold in Hobart Metro across 2021/22 were in the premium price bracket of $900,000 and above (37.5%)."

Source: PRD

Rental market

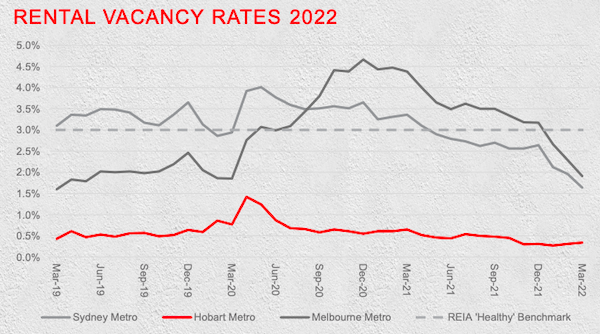

In March 2022, Hobart Metro recorded a low vacancy rate of 0.3%, well below that of Sydney Metro (1.6%) and Melbourne Metro (1.9%).

Vacancy rates in Hobart Metro remained well below the Real Estate Institute of Australia’s healthy benchmark of 3.0%, even throughout COVID-19.

According to the data, Hobart has a median rental price of $550 for houses, and $450 for units.

Hobart Metro’s vacancy rate continues to show a declining trend since April 2020, showcasing historical low trends in the past 24 months.

Source: PRD

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Image by Spencer Chow via Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Harrison Astbury

Harrison Astbury

William Jolly

William Jolly