It is now recommended by APRA that banks increase their 'buffer' from 2.5% to 3.0% on top of their loan serviceability rate (explained further below).

APRA's change is expected to reduce the borrowing power of property buyers by around 5% - someone who could borrow $1 million under the old buffer could now only borrow about $950,000.

It was widely tipped APRA would tighten debt-to-income (DTI) ratio criteria, which experts argued would be unfair and inefficient.

In its rationale for the move, APRA said adjusting serviceability is relatively easy to implement, while DTI limits would be more "operationally complex to deploy consistently", potentially leading to 'credit rationing' by the banks.

APRA chair Wayne Byres said Wednesday's announcement is a targeted action designed to reinforce financial stability.

"While the banking system is well capitalised and lending standards overall have held up, increases in the share of heavily indebted borrowers, and leverage in the household sector more broadly, mean that medium-term risks to financial stability are building," Mr Byres said.

"The expectation is that housing credit growth will run ahead of household income growth in the period ahead.

"With the economy expected to bounce back as lockdowns begin to be lifted around the country, the balance of risks is such that stronger serviceability standards are warranted."

In the June quarter, more than one fifth of all new home loans were to applicants borrowing more than six times their income.

There was little mention of prudential standards or tightening lending criteria in Tuesday's Reserve Bank monetary policy announcement, though Governor Dr Philip Lowe provided some foreshadowing.

"In this environment, it is important that lending standards are maintained and that loan serviceability buffers are appropriate," Dr Lowe said.

How the experts reacted

Adjusting serviceability buffers has some rationale compared to DTI ratios, according to Peter Tulip, chief economist at the Centre for Independent Studies.

"Ideally, we should remove the whole paternalistic apparatus and let lenders and borrowers find mutually agreeable terms," Mr Tulip said on Twitter.

"If APRA knows something about the relevant risks that the parties do not, it should tell them.

"But at least serviceability buffers have a paternalistic rationale. The debt-to-income ratio that APRA is considering does not even have that."

ANZ's head of Australian economics David Plank said more tightening could come.

Less than 24 hours after the RBA's post meeting statement flagged the importance of loan serviceability buffers, the Australian Prudential Regulatory Authorityhas announced an increase in [serviceability buffers]," Mr Plank said.

"In the context of the current strength of the housing market this is a modest change.

"As such, further macroprudential tightening seems more likely than not ... APRA's upcoming information paper on the framework it applies to macroprudential policy will be important in this context."

Westpac's head of credit strategy Brendon Cooper said the new restrictions are designed to minimise impacts to first home buyers.

"There will be a greater impact on investor lending than owner occupied," Mr Cooper said.

"One of the notable features of the current increase in house prices has been the dominance of owner occupied lending and APRA is now setting itself to rein in any further pressure that may be applied as investor growth accelerates."

However, the Housing Industry Association (HIA) was not supportive of the announcement.

"Over 90% of renters aspire to own their own home but less than half of them expect that they will ever achieve this goal. Today’s announcement by APRA will make this goal even harder," HIA chief economist Tim Reardon said.

"First home buyers are the group who are typically constrained by serviceability thresholds. It is this group that will be hit the hardest by these changes.

"Restricting access to credit for new households seeking to enter the housing market will put further downward pressure on the rate of home ownership in Australia."

Serviceability rates explained

Serviceability rates are often a calculation of the 'floor' rate, plus a 'buffer'.

This is ensure the borrower can still repay their home loan amid economic shocks, downturns or interest rate rises.

On a 1.99% home loan, a borrower would be assessed on their ability to repay the mortgage at an interest rate of 4.99% - the interest rate plus the new APRA buffer of 3.0%.

However, serviceability rates are also often calculated on standard variable rates, which are usually much higher than discounted rates.

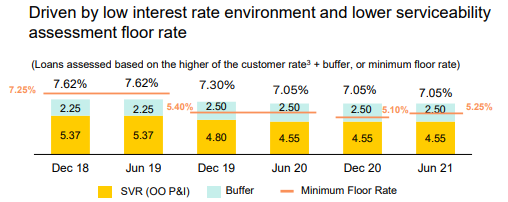

Only two years ago, APRA's loan serviceability 'floor' was as high as 7.25%, however changes made in 2019 allow banks to set their own floors, now typically around 5%.

A few months ago, CBA increased its own minimum floor rate from 5.1% to 5.25%, but no one else followed.

A snapshot of how CBA rates the serviceability of its customers is below.

Source: CBA

Photo by Ben Carless on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

.jpg)

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Harrison Astbury

Harrison Astbury