In a letter posted to the Bloom website in June, CEO Camille Socquet-Clerc said the app could not find a suitable partner to promote and distribute the fund.

"This meant that, ultimately, we have not generated enough revenue to sustain the operational costs necessary to operate in a highly regulated industry," the letter read.

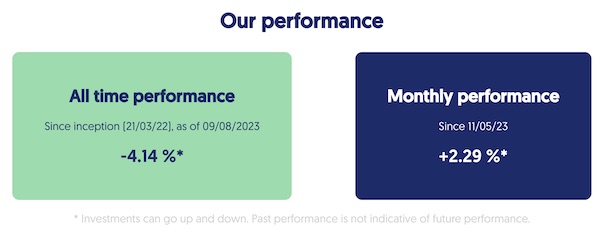

Since inception, the fund's returns were negative, posting a 4.14% loss from 21 March 2022 to 9 August 2023.

In wind-up documents from the MSC Group, distributing proceeds to individual investors is fifth and final on the list of priorities for the fund.

"Investment in the fund carries several risks, one of which is that the fund could be terminated, which can impact the return your investment. The amount you receive may be lower than the amount you initially invested," documents read.

Founded in Queensland by business partners Camille Socquet-Clerc and Bertrand Caron (pictured below), Bloom aimed to democratise green investing and provide a stronger definition of what it meant to be 'green'.

"We use two of the most robust climate science models —Project Drawdown and ClimateWorks to define our investment universe or what we invest in," Ms Socquet-Clerc said in 2022.

“Bloom is for people who want to get competitive returns, not just impact. The backtesting of our portfolio resulted in a 24% return in the year to December 2021."

The five green ETFs, 53 international companies, 24 Australian companies, and other assets it invested in provided rocky returns since global interest rate rises began in mid-2022.

On the consumer level, its $4.50 a month and 0.80% p.a. management fees proved more expensive than a lot of competitors in the saturated micro-investing market.

The $100 minimum investment, while much cheaper than other types of green funds, was much higher than other similar apps with no minimum investment.

Head image by American Public Power Association on Unsplash

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Aaron Bell

Aaron Bell