New ABS data, released on Thursday, shows private unit and townhouse approvals dropped by 24.9% in a month, seasonally adjusted, taking the annual fall in multi-dwelling approvals to 17.2%.

ABS head of construction statistics Daniel Rossi said the drop was driven by a fall in the number of approved large apartment projects.

Conversely, house approvals rose by 10.7% in February recovering from a 9.9% fall in January.

But it was not enough to lift overall new dwellings approvals which recorded a 1.9% monthly drop, seasonally adjusted, taking the annual fall to 5.8%.

Source: ABS

Overall, 12,520 new home approvals were recorded nationally in February, well below the 20,000 new homes a month needed to meet the federal government’s target of building 1.2 million homes over the five years from July 2024.

The monthly read takes the number of new homes approved in the 12 months to February to 163,100, the lowest annual rate of home approvals since the year ending March 2013.

Figures signal no reprieve for buckling housing market

Australia’s largest home lender, Commonwealth Bank of Australia, said Australia is simply not building enough new homes to match demand, with the impact coming through in higher home prices.

Australia’s housing market is continuing to hit record highs in median property prices, with CoreLogic’s Home Value Index growing in March for the 14th straight month.

CoreLogic’s research director Tim Lawless said undersupply is keeping upward pressure on home prices despite the “headwinds” of interest rate hikes and elevated cost of living.

Interest rates play a role: CBA

CommBank said higher interest rates had a part to play in constraining building approvals.

“Much of this reflects funding costs for developers and builders,” CBA said.

“Capacity constraints around labour and materials are well known in the construction industry, as are rising costs.”

The marked fall in multiple dwelling approvals is also not good news for the tight rental market or entry level homebuyers.

The rental vacancy rate nationally was at 1% in February, according to SQM Research, while entry level homes, often units or townhouses, are recording the strongest price growth due to limited supply.

Digging into the data

Queensland led the plunge in total dwelling approvals, down 28.5% for February.

All other states recorded rises, with Tasmania recording a 39.3% jump ahead of New South Wales with a 23.4% increase.

Western Australia recorded a rise of less than 1% for total dwelling approvals although led the country in private house approvals with a 20.7% jump.

House approvals were up across all states, seasonally adjusted.

However, the figures were no rosier in trend terms with total dwellings approved down 9% over the year to February with a 20.7% drop in unit and townhouse building approvals.

In dollar terms, new residential building by value fell 19.1% in February over the previous month.

It was matched by a drop in non-residential construction of 16%.

Housing industry hits back

The latest ABS figures show the continuing weakness in Australia’s housing market, according to the Housing Industry Association (HIA).

HIA’s senior economist Tom Devitt singled out the poor showing of higher density housing development, saying it was at less than half at the peak of the apartment boom almost a decade ago.

“Higher density housing development is being constrained by labour, material and finance costs and uncertainties, as well as cumbersome planning rules and punitive taxes, especially on foreign investors,” Mr Devitt said.

“This lack of new work entering the construction pipeline is occurring alongside record inflows of overseas migrants and a pre-existing acute shortage of rental accommodation across the country.”

Mr Devitt called on the federal government to make significant policy reforms to meet its new homes target, including lowering taxes on home building, easing construction cost pressures, and lowering land costs.

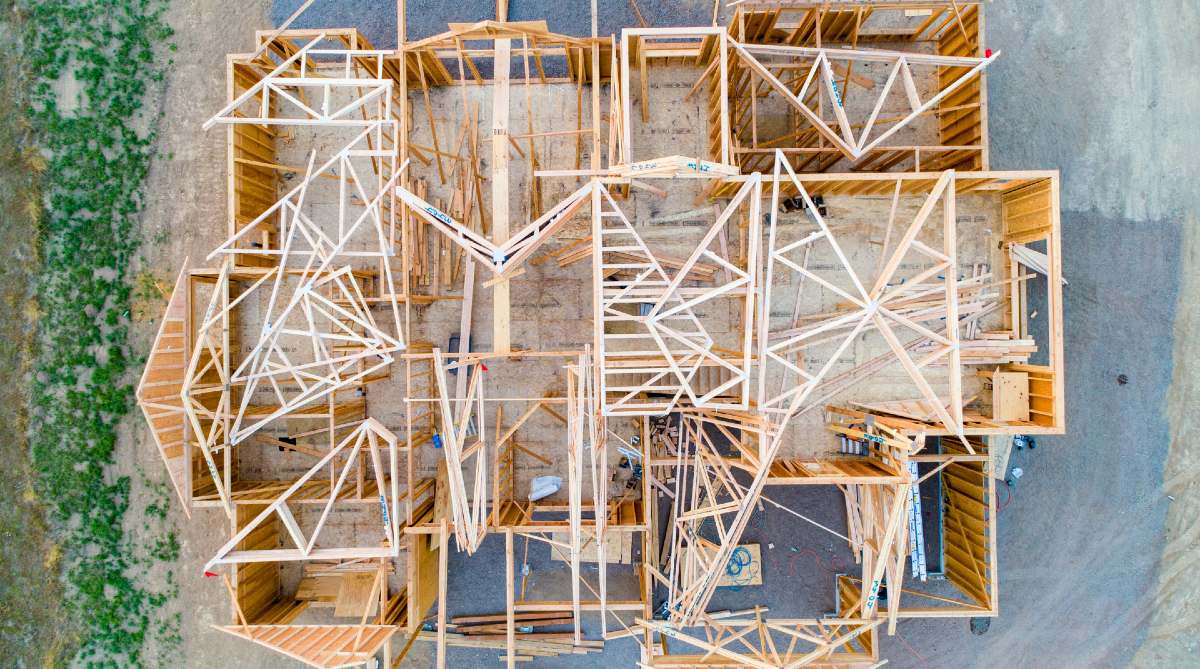

Image by Avel Chuklanov on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!