CommBank and Tesla have teamed up, allowing the bank’s customers to access finance for their next electric vehicle (EV) purchase directly through the car manufacturer’s website.

The bank's customers can apply for a secured personal loan with a discounted fixed rate through Tesla's website, with an advertised rate as low as 5.49% per annum (6.92% p.a. comparison rate*).

It’s one of many Aussie banks offering lower rate loans for ‘green’ purchases, such as EVs, low-emissions vehicles, and solar panels.

CommBank has financed more than $50 million worth of personal loans for the purchase of sustainable products since October 2022.

“Tesla has proven to be one of the preeminent and hallmark brands that has propelled the awareness and uptake of EV adoption in Australia,” said Joel Larsen, CBA general manager of personal lending.

“Through this latest announcement we can help more customers realise the benefits of electric vehicles by making finance more affordable.”

EVs accounted for 6.4% of vehicle sales in August, with hybrids making up 10.5% of sales, according to the Federal Chamber of Automotive Industries.

And among the nation’s most popular cars was Tesla, with nearly 33,000 cars sold last month – around 4% of the market.

In June, the Model Y usurped the Ford Ranger ute to become Australia's third-best selling vehicle that month, as waitlisted owners finally took delivery of their EVs.

Of more than 1,000 Aussies surveyed on behalf of CBA last year, 64% said they would consider buying an EV or hybrid car if there was a financial incentive.

Meanwhile, businesses looking to purchase a Tesla vehicle can also apply for finance through the car maker’s site, with the bank offering them a discounted interest rate as well.

The news comes after the NSW Government took its lead from Victoria in recent days, announcing it will scrap rebates and stamp duty exceptions for residents buying eligible EVs from 2024.

Those eyeing a new EV in either state were previously promised a potential rebate of as much as $3,000.

Though, customers buying an EV in Queensland could receive a rebate of as much as $6,000 after the state doubled its offering for eligible households earlier this year.

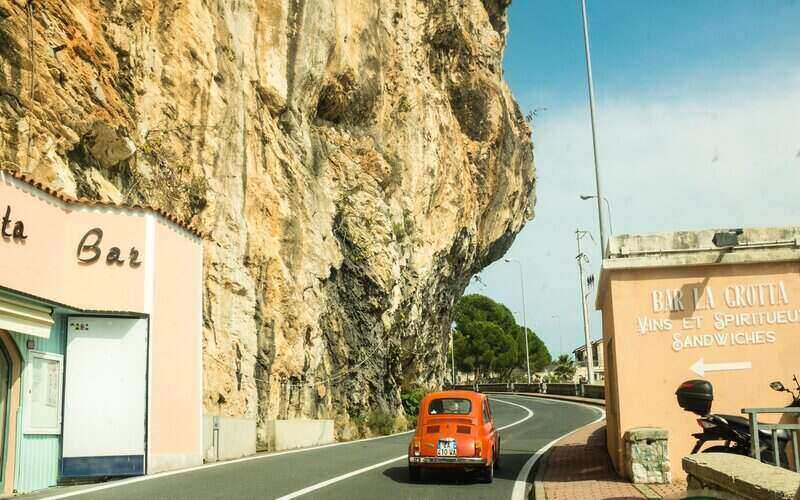

Image by Vlad Tchompalov on Unsplash.

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Jacob Cocciolone

Jacob Cocciolone