Navigating the used car market can be stressful and time consuming. However not all Aussies will have the means to buy a new car. The make, model and age of a car will also influence the cost and therefore the savings goal you are setting yourself.

Through the pandemic, used car prices generally skyrocketed as new cars became harder to come by due to supply chain issues and chip shortages. The key to setting yourself the goal is choosing a car in a realistic price range for you - even if that’s seemingly harder to do than before.

Car loan or no car loan?

One option to consider when saving for a car is financing your car. This option can reduce the deposit you need to save as you aren’t paying for the car outright. A smaller deposit also means you can get behind the wheel sooner, and start paying off the car from the get go.

However, car loans come with interest, often 5% p.a. or above. This adds to the ultimate cost of the car. If you take on a car loan, you will need to factor the repayments into your budget.

Balloon payment

A balloon payment is another option to reduce the regular loan repayments. A balloon payment is an agreed-upon lump sum that you will pay to your lender at the end of the car loan term. The balloon amount builds over the period so your monthly payments (from a cash perspective) are reduced.

Balloons can be a significant lump of your loan amount (eg. 30-50%), which is why they have the ability to reduce the amount of your monthly repayments in such a substantial way. However, at the end of your car loan you will need to cough up that amount, so don’t forget about it.

Set your budget and savings goal

Once you have decided on the car you want to buy, you need to set a budget to reach your goal. Pick a timeframe that is achievable. A popular savings method is the 50/30/20 rule.

The 50/30/20 budgeting model can be helpful if you're trying to work out how much to spend on your day to day expenses and still save money. Under this budget, 50% of your income goes towards needs and necessities like rent, bills, transportation, groceries and so on. 30% goes towards wants like entertainment, eating out, travel and shopping and 20% goes towards savings. Using this rule should allow you to put aside 20% of your income towards your car deposit.

https://www.youtube.com/watch?v=2gJ5XbR_urg

Case study

Carl Owne has set himself the goal of saving $5,000 to put towards a car deposit to purchase a second hand car. His ideal car is a second hand Ford Focus priced at $10,000. He plans to pay half upfront and get a car loan for the other half.

He earns $2,000 a fortnight after tax. Using the 50/30/20 budgeting rule, he will put aside $200 per week towards his car deposit.

Using this method, he will be able to save up the $5,000 deposit in just under six months, provided he’s saving for nothing else in that time. Carl will save $200 per week, for 25 weeks: 200 x 25 = $5,000.

Once he has the car loan, he will need to factor that into the 50% necessities bucket.

Money budgeting apps

A great way to hold yourself accountable when saving for a large item like a car, is using budgeting apps. These tools will also allow you to set a date of when you should reach your savings goal. This will help keep you accountable. Your bank might also have budgeting tools built within its app.

You should also be able to set up an automatic transfer (usually on pay-day) when you will deposit a set amount into your saving account. Making this transfer automatic will also help reach the goal on time.

Set up savings account

When saving up for a car, you can create a new savings account to deposit money on pay day. This will help you track your progress and also earn interest while you save. For any savings goal, it could be useful to have a separate account for spending and for savings. This helps you track your progress.

Here are some savings account options:

Savings accounts table

Be realistic

With any savings goal, the most important thing when setting up a time frame is to be realistic. If you work part-time, or inconsistent hours, then you may not be able to set up an auto-transfer into a savings account.

Your circumstances will influence what you can save. The most important thing is to set a goal that you can achieve, and hold yourself accountable. If saving $20 a week is all you can realistically afford, that’s better than nothing. It’s better to set an achievable goal and stick to it than to set yourself an impossible goal and feel deflated when you fall short.

Which kind of car - new or used?

The first question to ask yourself is are you going to buy a new or used car. Both come with a list of pros and cons.

Pros of new cars

-

Car is untouched and (should be) in perfect working condition.

-

No wear and tear to be worried about.

-

You can choose the exact specifications you want e.g. colour, features.

-

New cars often come with a 3, 5, 7 or even 10 year warranty.

Cons of new cars

-

A more expensive option.

-

Depreciation is the ‘silent killer’ - some cars can lose a quarter of their value in as little as three years, meaning tens of thousands of your hard-earned money disappears.

-

Could take days or weeks to get the exact model you’re after shipped from manufacturer to dealership.

Pros of used cars

-

Usually a cheaper option.

-

The depreciation rate usually tapers off after three to five years, meaning the original owner took that hit for you.

-

A much wider market encompassing private sellers and dealerships. This might give you more negotiating power.

-

You can buy the car soon after you inspect it, even on the same day.

-

If the car is only one or two years old it may have some residual manufacturer’s warranty left on it, which is automatically passed to you.

Cons of used cars

-

You run the risk of buying a car with significant wear and tear or mechanical issues.

-

As cars get older, cost of repairs and maintenance could outweigh the value of the vehicle.

-

While it’s important to look for a full service history and receipts, chances are if the car has had more than one owner this may have been lost to the sands of time, or the logbook has gone missing.

-

When the car nears milestones such as 100,000km or 200,000km it’s likely some big services will need to be completed.

-

You might not get the exact combination of colour and features you desire at your price range and ideal odometer reading. In this sense you might have to be less picky.

-

Warranty may have expired on older cars, and if bought through a dealership may have only a very limited warranty as guaranteed under Australian Consumer Law.

-

Harder to get competitive secured finance if the car is older than a few years.

Additional costs to consider

Aside from the price tag on a new or used car, you also need to factor in the following costs associated once you purchase the car:

-

Stamp duty

-

Inspection fees

-

Compulsory third party insurance

-

Comprehensive insurance

-

License fees

-

Roadside assist

Stamp Duty state by state:

|

State or Territory |

Estimated duty payable |

|

VIC |

$1,780 |

|

NSW |

$1,270 |

|

QLD |

$1,270 |

|

SA |

$1,630 |

|

WA |

$2,265 |

|

TAS |

$1,700 |

|

ACT |

$1,700 |

|

NT |

$1,270 |

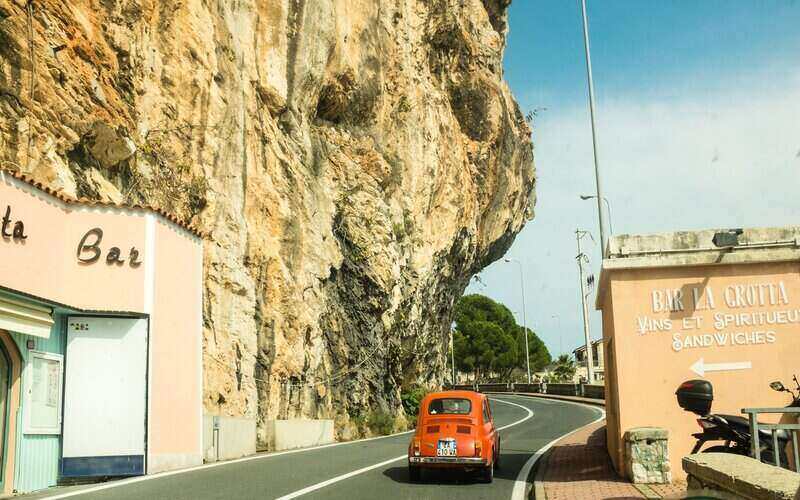

Image by Chris Holgersson via Unsplash

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Jacob Cocciolone

Jacob Cocciolone