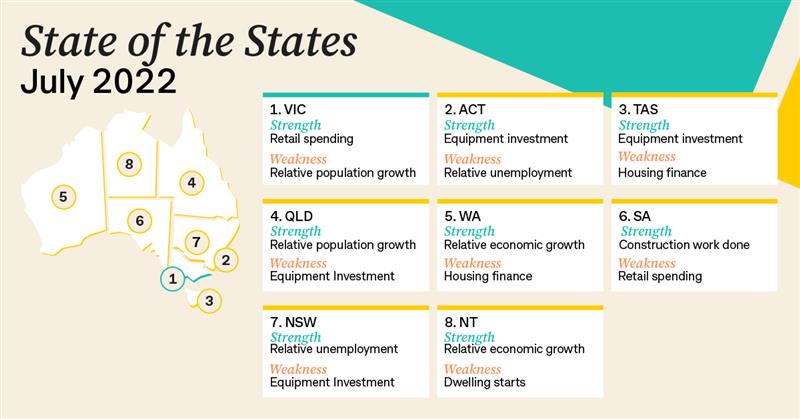

CommSec's quarterly State of the States report has revealed Victoria ranked first on both retail spending and relative unemployment, pipping the ACT and Tasmania when compared to the decade average.

CommSec's methodology measures eight economic indicators including economic growth, retail spending, unemployment and housing finance compared with a region's decade average.

In second place was the ACT, leading the way in terms of equipment investment recording positive growth in the June quarter of $549 million and $222 million respectively.

Compared to the decade average, housing finance in the ACT is up 71.2% and equipment investing is up 60.8%.

Tasmania rounded out the top three, ranking second on equipment investment with $304 million at an increase of 36.1% compared to the decade average.

CommSec Chief Economist Craig James said there was little separating the country’s state and territory economies.

“Victoria may have moved to the top of the economic leaderboard, but there is little to separate the top four economies,” Mr James said.

“Victoria leads the way on two of the eight economic indicators, but showing how even the rankings are, the ACT and South Australia also each lead other economies on two of the eight indicators.

“In terms of future economic performance, much will depend on how economies are affected by growing COVID-19 case numbers and also how they respond to a period of rising interest rates.”

CommSec noted when looking across annual growth rates, those in Queensland exceeded the national average on all of the eight indicators with the next best being South Australia and Western Australia, exceeding the national average on five indicators.

Source: CommSec State of the States - July 2022

ACT sole region with housing finance among key strengths

Despite all states and territories recording positive growth in the housing finance category compared to a decade ago, CommSec's State of the State report revealed the category failed to make the cut as a key strength among the larger regions.

This comes as ABS data published earlier this month revealed new housing loan commitments rose 1.7% to $32.4 billion in May 2022, despite cash rate increases front of mind for homeowners.

Further, recent data from PropTrack revealed new listings dropped 3.1% nationally in June, yet were up 8.5% year-on-year across the country to mark the busiest June for new listings since 2011.

PropTrack Economist Angus Moore said property markets across the nation experienced a boom in new listings to what is usually a slower period.

"There has been a brisk pace of new listings, with more new listings nationally across the first half of the year than during any year since 2015," Mr Moore said.

“Though selling conditions broadly have begun to temper after a very strong spring 2021 and early 2022, fundamental drivers of demand remain strong, with unemployment low, wages growth expected to pick up over this year, and international migration now returning.”

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Image by John Simmons via Unsplash.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!