Domain's 'Queensland Spotlight Report' details the key factors driving the trend, with lifestyle and affordability at the top of young families' list of priorities.

Data shows that 66% of enquiries on Domain to Queensland are coming from New South Wales.

Dr Nicola Powell, Domain's Chief of Research & Economics, said that this internal migration shift doesn't occur often.

"What we’re finding is that people are fast-tracking their decision to move, taking the opportunity to live and work with flexibility and where they choose," Dr Powell said.

"Whilst there is no questioning that cities will always be home to the biggest population, we're witnessing a surge towards regional and less metropolitan areas which are experiencing the biggest impact of internal migration."

The Northern Rivers boom in NSW has been well documented over the pandemic, but Domain's latest report suggests the great COVID migration is now heading further north.

September's Domain House Price Report also reinforced the tree change trend that has been dominating the housing market over the past year.

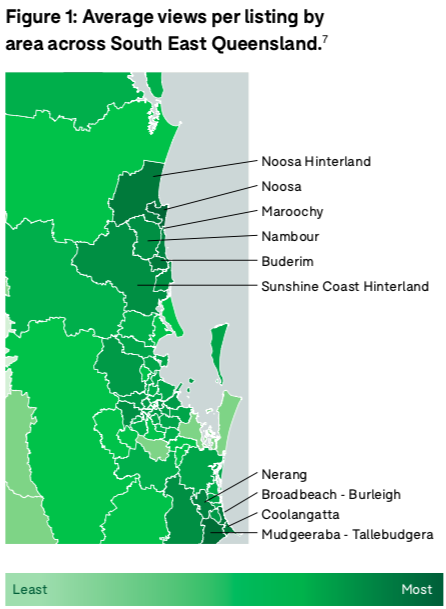

High demand areas

The top 10 areas in hot demand are all in the Gold Coast and Sunshine Coast, with Noosa taking the top spot for the most in-demand area.

James Ruprai, a Sunshine Coast Council executive, said that the coastline and laid back lifestyle are key factors influencing the trend.

"We know Queenslanders love the coast and we’re seeing this shine through with beachside regions topping the charts of most sought after areas," Mr Ruprai said.

"More populated areas in Queensland have always been in demand, however, a population shift is seen as a result of the pandemic, driving a social and lifestyle movement as more city dwellers relocate into regional parts."

Source: Domain

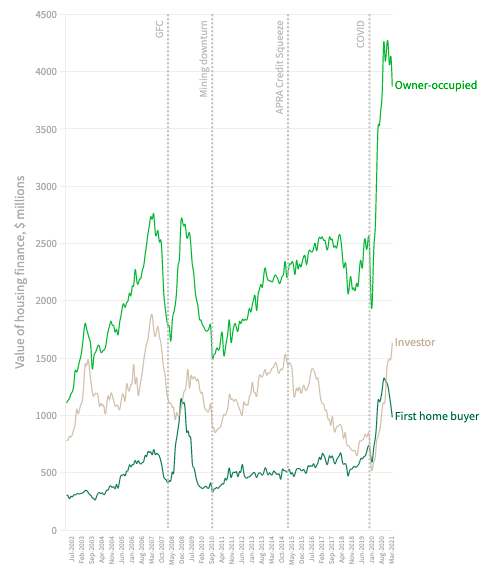

Who is driving the demand?

Owner occupier loans increased 112% from May 2020 to January 2021 according to the report.

In recent months this has begun to drop but still remains close to record highs.

Investor home loan values hit there highest point since 2007 and overtook first home buyers in March 2021.

First home buyers saw an initial surge through 2020, but have been on the decline in 2021, as they are outpaced by investors.

Dr Powell explained why investment in the state has boomed recently.

"Queensland's offer of relative affordability compared to other major capital cities, the lure of lifestyle and more recently Queensland winning the 2032 Olympic bid all provide key selling factors for increased investment within the state," she said.

Queensland value of home loans by buyer type

Source: Domain

Buyers prioritising lifestyle and land

While Brisbane, Gold Coast and Sunshine Coast property markets are all unique, there are a few things they have in common and that is to do with what Queenslanders are looking for in a home: size, property type, property features and location.

Sunshine Coast houses boast the biggest block size at 716sqm.

In Brisbane, the median size of 619sqm for a home in a capital city is still generous compared to other states.

Most purchased property type

| Brisbane | Gold Coast | Sunshine Coast | |

| House | 69% | 45% | 61% |

| Townhouse | 4% | 6% | 5% |

| Unit | 27% | 49% | 34% |

Property Prices

CoreLogic's Home Value Index rose another 1.5% in September, taking Australia's housing values 20.3% higher over the past 12 months.

But despite soaring prices Queensland properties remain cheap in comparison to Australia’s major capital cities, Sydney and Melbourne.

Queensland Prices

| Regional | Brisbane | Gold Coast | Sunshine Coast | |

| Median House price | $417,000 | $678,236 | $792,000 | $825,000 |

| Price Increase over 1 year | 6.9% | 13% | 18.2% | 23.1% |

| Median Unit price | $343,000 | $394,287 | $500,000 | $560,000 |

| Price change over the year | -8% | 2.1% | 9.9% | 14.3% |

Source: Domain

One key factor identified in the report is that 54% of suburbs have a median house price below the crucial $550,000 First Home Concession threshold, and 83% for units.

First home buyers are more likely to get a foot in the door in Brisbane, with 39% of suburbs having a median house price below $550,000, 15% in the Sunshine Coast and 12% in the Gold Coast.

See Also: How Brisbane became Australia's property darling

What's next for Queensland

Queensland is set to experience a "once in a generation" infrastructure boom in the lead up to the 2032 Olympics.

As a result, infrastructure across Gold Coast, Brisbane and Sunshine Coast will vastly improve and there will be a clear roadmap and timeline for the housing infrastructure to be implemented over the next decade, according to Domain's report.

This will also provide assurance to buyers and business owners that proposed developments will stick to schedule.

Big infrastructure projects leave a legacy behind helping to lift the population and benefit the local community in the long term.

"An influx of capital and subsequent job creation, which is expected to be the equivalent of 91,000 full-time jobs in Queensland, in the lead up to the games will be an economic force for South East Queensland," Dr Powell said.

"As a part of this cash injection we will naturally witness significant demand for housing, especially as we prepare to welcome skilled workers to the state.

"What we can forecast is an increased demand for rental properties to host short-mid term workers, which naturally presents opportunities for investors to capitalise on the strong rental demand."

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Image by Luisa Denu via Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Harrison Astbury

Harrison Astbury