The first stage of fintech Douugh’s money management platform has launched on Australian shores offering a digital money app and associated micro-investing platform.

Managed by global investment manager BlackRock, Douugh’s micro-investing platform enables customers to invest in one of six diversified portfolios alongside single stocks such as Tesla, Microsoft, Apple and Disney.

Douugh Founder and CEO Andy Taylor (pictured below) said as interest rates increase to combat rising inflation, people are experiencing erosion in the value of their money and investment gains.

“In a time of such great economic uncertainty, it is the right time to lean into our core responsible micro-investing service, which will help everyday Australians adopt sustainable money habits to live financially healthier lives,” Mr Taylor said.

"Our platform provides a seamless customer experience combined with education, helping Aussies get ahead financially."

To cater as an ‘all-in-one’ money management platform, Douugh will look to launch a card and account product in the fourth quarter of 2023 - similar to the likes of Revolut - to help Aussies smooth cash flows and increase investing velocity.

The fintech's platform has been thrown a curveball after its collaborator, Volt Bank, collapsed in mid-2022.

“After dealing with the delays resulting from the closure of Volt Bank, Douugh is now firmly on track to deliver the reimagined card and account product, which will unlock the potential for the business by giving us a unique, mass market value proposition,” Mr Taylor said.

Douugh portfolios and performance

In similar fashion to the likes of other popular micro-investing platforms on the Australian market, Douugh customers can choose from up to six specific diversified portfolios tailored to their investment preferences. These are offered as three ‘core’ diversified portfolios and three ‘sustainable’ diversified portfolios.

Douugh users can invest in their preferred portfolios or companies for as little as $1 with the flexibility to invest as much, or as little, as they choose.

The following portfolio returns are based on an annualised portfolio performance rate since their inception. For core diversified portfolios, this period is from 11 April 2008 to 31 January 2023. For sustainable diversified portfolios, this period is from 12 June 2020 to 31 January 2023.

Note: Past performance is not an indicator of future performance.

Core diversified portfolios

- Steady: The ‘Steady’ portfolio is based on an annualised performance rate of 4.58% p.a. with a low fund risk profile.

- Lift: The ‘Lift’ portfolio is based on an annualised performance rate of 7.24% p.a. with a moderate fund risk profile.

- Growth: The ‘Growth’ portfolio is based on an annualised performance rate of 9.04% p.a. with an aggressive fund risk profile.

Sustainable diversified portfolios

- Eco: The ‘Eco’ portfolio is based on an annualised performance rate of 0.41% p.a. with a conservative fund risk profile.

- Renew: The ‘Renew’ portfolio is based on an annualised performance rate of 4.98% p.a. with a moderate fund risk profile.

- Thrive: The ‘Thrive’ portfolio is based on an annualised performance rate of 8.00% p.a. with an aggressive fund risk profile.

Features of Douugh

Autopilot

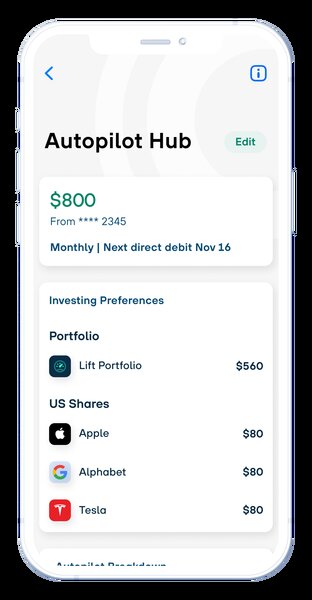

Douugh offers customers the ability to set, forget and auto-invest money for long-term growth with Autopilot.

The Autopilot feature allows Douugh to pull directly from a connected bank account, with customers able to set how much to invest, how often to invest and when to start.

Customers can then choose how much of that recurring investment goes to a specific portfolio or individual shares, with Autopilot taking the reins from there on out.

Portfolios and Shares

Douugh customers can take advantage of either diversified portfolios as outlined above, or individual shares and ETFs from US exchanges.

Importantly, investments across US exchanges using Douugh are protected up to US$500,000 under Securities Investor Protection Corporation (SIPC) scheme.

Financial literacy

Douugh provides customers with updates and alerts to educate customers about key investing and wealth building principles such as compounding, diversification, asset allocation, and risk management. These are designed to support the development of good money habits and increase financial literacy.

Douugh fees and charges

For customers with a portfolio balance of $50 USD or more, Douugh charges a $2.99 monthly fee.

Douugh also charges a $2.99 fee for unlimited share trading and an exchange rate fee of 0.99% on currency conversions for transactions from AUD to USD.

At the time of launch, Douugh does not charge customers brokerage or management fees.

Read more: Who offers micro-investing platforms in Australia?

Header image by Skitterphoto via Pexels, all other images supplied.

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Emma Duffy

Emma Duffy