It had been a quiet few weeks leading up to Tuesday's RBA decision to keep the cash rate on hold at 4.35%.

Financial markets thought it was a done deal after last week's quarterly CPI data showed underlying inflation in the Australian economy came in lower than expected at 3.9%, compared to the March quarter print of 4%.

Even outlier commentators calling for a rate hike conceded the cash rate would remain on hold.

But the RBA surprised everyone with its hawkish tone, revealing a rate hike had been considered at the meeting and that its old enemy, inflation, was still too high to be considering a rate drop anytime soon.

In fact, the board pushed back its forecast for inflation coming into its target range of 2-3% by six months.

Westpac read the room and announced it was reviewing its forecast the RBA would cut the cash rate in November.

That leaves CommBank as the only one of the big four to hold out for a 2024 rates drop.

The August rates decision seemed to stir some movement on the home loan market, although most of the adjustments were upwards.

Regional Australia Bank varies rates up to 40 basis points

Regional Australia Bank was the first cab off the rank, moving on Tuesday before the RBA decision was handed down.

Rate-fixers at the customer-owned bank originating in Armidale, country New South Wales, must have worked overtime to adjust rates on a large portfolio of home loan products.

There were some hefty increases in fixed rate loans, some up to 40 basis points.

These included Basic Fixed Home Loans and Investment Fixed loans.

The Basic 3-Year Introductory Loan for owner occupiers is now 6.14% p.a. (6.57% p.a. comparison rate*).

There was also minor downward adjustment in rates for some Mortgage Offset Loans for principal and interest (P&I) payments with higher loan-to-value ratios (LVR).

G&C Mutual Bank lifts rates on Essential Worker loan

The customer-owned bank had boasted an eye-catching 5.80% p.a. (5.83% comparison rate) on its Essential Worker P&I owner-occupier home loan since February.

This week, G&C Mutual Bank upped the rate by 15 basis points to 5.95% p.a. (5.98% p.a. comparison rate).

The customer-owned bank's Essential Worker deal still comes with some nice features: the same rate for up to 95% LVR, a 100% offset account, no establishment or monthly fees, and assessing overtime and shift allowances at 100% for eligible workers.

Newcastle Permanent drops fixed rate loans

Going the other way, Newcastle Permanent cut 10 basis points on a range of its Residential and Investment Fixed Loans, including its Premium Plus Package rates.

Its lowest new fixed rate for owner occupiers is 5.99% p.a. (8.01% p.a. comparison rate) for its two-year Fixed Rate Special Offer loan for P&I payments.

Firstmac and loans.com.au lift rates

Major non-bank lender Firstmac has increased rates on a range of its fixed owner occupier and investment loans, both P&I and interest only, by up to 20 basis points.

The rates on some of its Green and Solar basic and offset loans have risen by a more modest five basis points.

Firstmac's retail brand loans.com.au has also seen a rise on some fixed rate owner-occupier, investor, and SMSF loans by up to 20 basis points.

RIP RAMS

The other big news on the home loan market this week was Westpac's announcement it was shutting down its RAMS business to new mortgages, effectively immediately.

RAMS' existing home loans will be absorbed into Westpac's lending book while the big bank is in the process of contacting current applicants.

It follows troubled times for the 33-year-old mortgage brand amid an investigation by regulators into alleged breaches of credit rules, including responsible lending regulations.

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

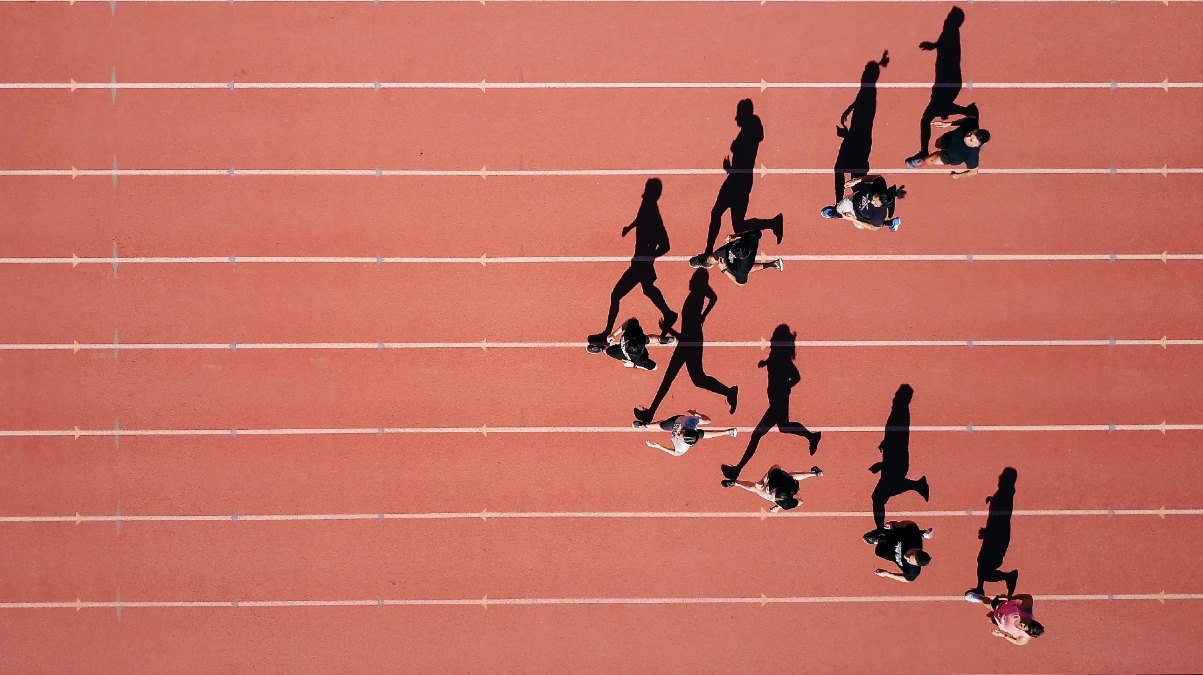

Image by Steven Lelham on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!