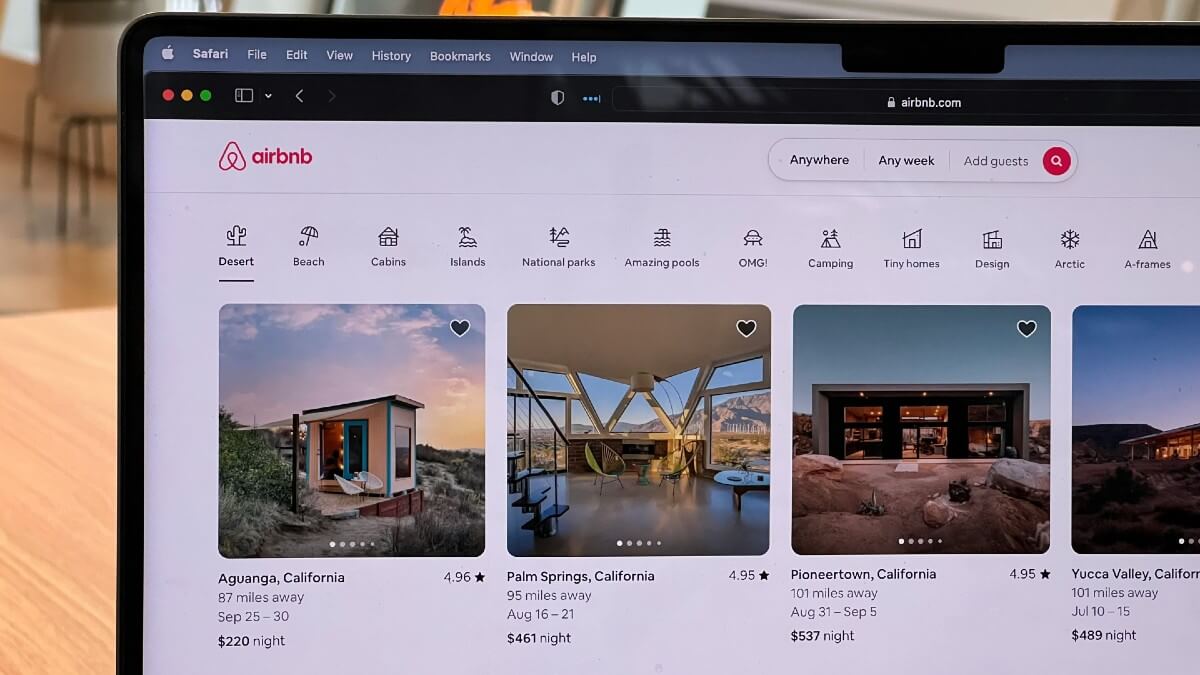

In 2021, the typical host on Airbnb in Australia earned $11,464 or more.

To offset cost of living struggles, a survey based on 82,287 Australian hosts found 41% use the extra cash to help cover everyday essentials such as food and other items.

Almost 40% of the respondents said the money they earned through hosting has helped them stay in their current home.

Total host earnings increased by 30% globally in the September quarter compared to the same time last year, according to Airbnb figures.

Airbnb CEO and Co-Founder Brian Chesky said now is the perfect time to put your place on Airbnb.

“Today, just like during the Great Recession in 2008, people are especially interested in earning extra income through hosting,” Mr Chesky said.

“That’s why we’re introducing an easy way for millions of people to Airbnb their homes.

“With Airbnb Setup, every new Host can get free, one-to-one guidance from a Superhost from their first question through their first reservation.”

See Also: How Airbnb affects regional and coastal rental markets

New Airbnb host features

The company has announced a bunch of new features designed to help millions of people take the step and become hosts. This includes:

- One on one guidance with a ‘Superhost’

- Expanded damage protection from $1 million to $3 million

- Expanded guest identity verification - all booking guests travelling to the top 35 countries and regions on Airbnb

Supporting this, a new YouGov survey (1,027 respondents) commissioned by Airbnb in October has revealed almost a quarter of Australians indicated they’d consider becoming a host on the platform to take advantage of the renewed appetite for travel.

If you’re considering putting your place on Airbnb, holiday travelers within the country favour homes that have pools, wifi, air conditioning, kitchens, and free parking.

See Also: Airbnbs in Brisbane face 50% council rate hikes

Image by Taylor Heery via Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Rachel Horan

Rachel Horan

Jacob Cocciolone

Jacob Cocciolone