New data on university revenue reveals the impact that missing international students have had on the Australian real estate market.

Missing international students have had a direct effect on landlords who specialise in leasing residences to these tenants, and fewer students mean increased vacancies and lower rents.

This is seen in CBD vacancy rates remaining elevated despite other markets tightening.

Property prices, too, have experienced a boom despite the absence of international students for the best part of two years.

Universities hit hard

Australian universities lost $868.1 million worth of international student revenue in 2020, compared to 2019.

That equates to 2.5% of their nearly $35 billion of total revenue.

Top 10 Universities by Lost Share of 2020 International Student Revenue ($ millions)

| Rank | University | 2020 Revenue | Change from 2019 | % Change from 2019 |

| 1 | Federation University Australia | $125.2 | ($60.1) | -48.0% |

| 2 | Central Queensland University | $122.3 | ($55.7) | -45.5% |

| 3 | University of the Sunshine Coast | $46.3 | ($18.3) | -39.5% |

| 4 | Charles Sturt University | $113.5 | ($42.6) | -37.5% |

| 5 | Australian National University | $249.0 | ($83.6) | -33.6% |

| 6 | Southern Cross University | $75.0 | ($24.5) | -32.7% |

| 7 | La Trobe University | $159.2 | ($44.0) | -27.6% |

| 8 | University of Wollongong | $144.6 | ($37.4) | -25.9% |

| 9 | Swinburne University of Technology | $150.1 | ($32.0) | -21.3% |

| 10 | RMIT University | $454.4 | ($74.0) | -16.3% |

Source: Juwai IQI, Mitchell Institute

Landlords hit harder

According to the report, landlords have lost an even larger share of foreign student rental income.

Juwai IQI's report said that universities have managed to enrol more than 100,000 international students who are living overseas and studying remotely.

But these offshore students occupy no Australian apartments, sign no leases, and pay no rent.

Juwai IQI Co-Founder and Group Executive Chairman Georg Chmiel said that suburb profiles have already greatly changed.

"Several suburbs that had large student populations before the pandemic have transitioned over the past 18 months," Mr Chmiel said.

Victoria has been hit the hardest when it comes to lost international student university revenue and property market impact.

The state lost $742 million of its foreign student revenue in 2020.

New South Wales ranked second behind Victoria in terms of both absolute and the proportion of revenue lost.

Overall, NSW saw a drop of $675.5 million from 2019 to 2020 in international student generated revenue.

On top of that, the state's universities lost 8.9% of their foreign student revenue.

Queensland lost $347.7 million in lost total revenue to go along with $153.1 million in international student revenue in 2020, or 11.3% of the 2019 level.

States Ranked by Lost Share of 2020 International Student Revenue ($ millions)

|

Total Revenue |

Fee Paying Overseas Student Revenue |

|||||||

|

1 |

ACT |

$1,609.9 (-$233. 5) |

$11.7 |

($313.5) |

$318.5 |

($82.1) |

-25.8% |

|

|

2 |

Queensland |

$5,734.5 (-$347.7) |

$120.5 |

($195.3) |

$1,350.8 |

($153.1) |

-11.3% |

|

|

3 |

Victoria |

$10,251.2 (-$742.0) |

$321.4 |

($540.0) |

$3,211.9 |

($343.8) |

-10.7% |

|

|

4 |

New South Wales |

$10,351.0 (-$675.5) |

($41.1) |

($400.6) |

$3,068.9 |

($272.7) |

-8.9% |

|

|

5 |

Tasmania |

$712.9 (-$65.1) |

$18.0 |

($55.2) |

$130.1 |

($11.1) |

-8.5% |

|

|

6 |

Northem Territory |

$308.3 +$34.4 |

$42.8 |

$51.7 |

$50.6 |

$12.3 |

24.3% |

|

Source: Juwai IQI, Mitchell Institute

Looking ahead

Mr Chmiel said that all international students returning to Aussie shore's as residents is still years away.

"Our best estimate is that Australia will get back to 75% of 2019’s resident international student population in 2022, but that getting back to 100% will take until 2024 or 2025," he said.

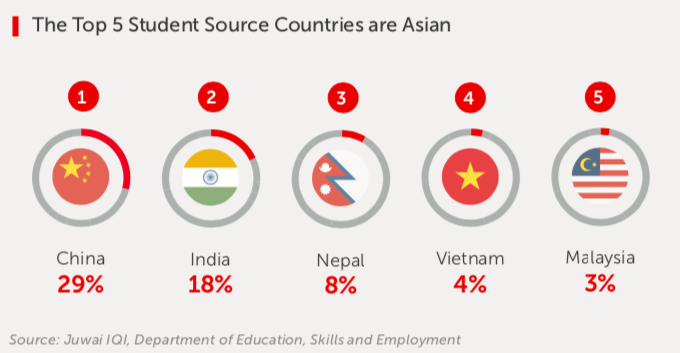

“Three out of five international students hail from countries not considered safe for the early resumption of travel."

Australia looks likely to reopen travel first with the UK, the US, Singapore, Japan, Canada, and Fiji – none of which send significant numbers of students to Australian universities.

Travel from the countries that account for more than 60% of international students in Australia will take even longer.

What will this mean for rental markets?

Mr Chmiel believes that students may be forced out of the popular inner city and spread across the regions.

"You may see them leasing in a more diverse range of suburbs as they find that apartments in their traditional neighborhoods aren’t just sitting empty waiting for them to return," Mr Chmiel said.

"And you will see more students concentrate in purpose-built student housing, which offers an alternative to renting on the housing market."

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Image by Mikael Kristenson via Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Brooke Cooper

Brooke Cooper

Rachel Horan

Rachel Horan