A wide variety of rates were increased, including 'Breakfree' packages, and non-packaged loans, for investors and owner occupiers.

Some of the more noteworthy changes included:

- Breakfree Residential Fixed 1 Year 80%: 30 basis point increase to 2.29% p.a. (3.36% p.a. comparison rate*)

- Breakfree Residential Fixed 3 Years 80%: 40 basis point increase to 2.79% p.a. (3.37% p.a. comparison rate*)

- Breakfree Investment Fixed 1 Year 80%: 20 basis point increase to 2.59% p.a. (3.91% p.a. comparison rate*)

- Breakfree Investment Fixed 3 Years 80%: 30 basis point increase to 2.99% p.a. (3.85% p.a. comparison rate*)

On Thursday NAB increased fixed rates, following Westpac and CBA which increased last week.

The major banks also increased rates on fixed loans in September-October.

Big four banks weren't alone in increasing rates, however, with Bank of Queensland, Bendigo and Adelaide Banks, and Tic:Toc following on Friday morning.

The bulk of rate increases applied to home loans for investors and owner occupiers, fixed between one and five years, hiked by between 11 and 50 basis points.

Variable rates back in vogue

The cuts haven't stopped for variable rates however, continuing the trend seen in recent weeks.

On Friday Bank of Queensland slashed investor and owner occupier home loans by up to 30 basis points.

BoQ-owned ME Bank also did similar, cutting by between 9 and 14 basis points.

On Thursday, ING cut variable rates by between 10 and 20 basis points.

So why is this happening?

This is basically the opposite of what was seen in 2020 when variable rates largely remained untouched and fixed rates got all the attention.

This was due to banks, particularly majors, tapping into the RBA's Term Funding Facility.

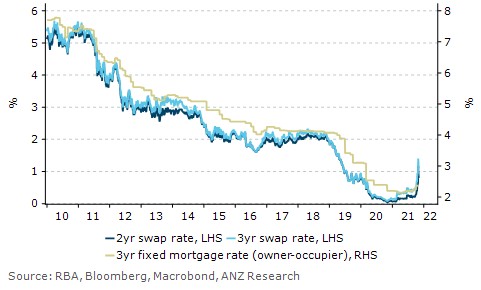

That's now ended and since then wholesale funding rates - called the 'swap' rates - have shot up (graph below), explaining why banks are increasing fixed mortgages again.

What could happen is largely a return to the status quo. Pre-pandemic, fixed loans made up less than one fifth of new mortgages, but now make up nearly half, but this percentage is slowly returning to 'normal'.

Anyone with a slightly cynical mind might also feel that banks are enticing borrowers back to variable rates because they are easy to hike when they see fit - such as if the RBA hikes its cash rate before 2024.

Having nearly half the mortgage book on fixed rates doesn't allow them that flexibility.

Fixed rates to rise sharply: ANZ

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| ||||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

|

Photo by Elekhh on Wikimedia Commons

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

.jpg)

Harry O'Sullivan

Harry O'Sullivan

Denise Raward

Denise Raward

Harrison Astbury

Harrison Astbury

Brooke Cooper

Brooke Cooper