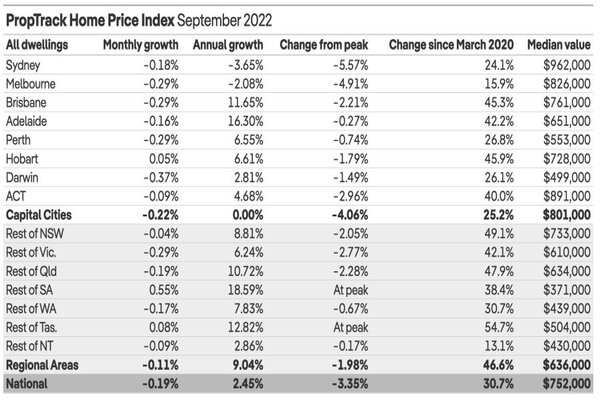

The new data showed that despite the widespread home price falls in September, the actual pace of the falls has began to moderate significantly, with capital city prices reversing to sit at their level a year ago.

Despite the recent falls, prices still remain significantly above their pre-pandemic levels, with regional areas still sitting 50% above their March 2020 averages, as well as 25% above in capital city prices over the same period.

Sydney and Melbourne bucked their own trends, falling only slightly in September after seeing consistently large falls in recent months.

According to the report, home prices are expected to fall across the country in 2022 and into 2023, with a pick-up in market activity for spring in October as public holidays have delayed some selling activity so far.

"The moderation in price falls does not herald the end of declines; interest rates have continued to increase and expectations of a hike in early October will push prices lower throughout spring." the report read.

Source: PropTrack

Sydney and Melbourne saw falls ease

Home prices in Sydney fell 0.18% in September and are now down 3.7% over the past year.

Prices have fallen persistently since March this year, with Sydney seeing the greatest falls of any market

Home prices have fallen 0.29% across Melbourne in September, with the market seeing continued falls since early 2022.

Prices now sit 2% below their level in September 2021 and 5% below their peak earlier in the year.

As higher interest rates continue to constrain borrowing capacities, the price falls are expected to continue over the coming months.

Brisbane and Perth show a strengthening market

In September, Brisbane house prices fell 0.29%, now sitting 2.2% below the price peak recorded in April 2022.

Prices are up 12% over the past year after recording annual growth rates above 30% in early 2022, despite prices remaining 45% higher than in March 2020.

Though the slowdown in Brisbane's price growth has been rapid, strong migration flows to South East Queensland are expected to prevent Brisbane from experiencing the largest price falls through the next year.

A 0.29% price fall was also reported in Perth.

However, with property prices increasing by 6.6% over the past year, paired with the rate of price falls being slower than other capital cities, Perth has maintained a relatively strong performing market.

Adelaide prices fell for a second consecutive month

Despite prices dropping 0.16% in September, Adelaide was the strongest performing capital city market over the past year up 16% - nationwide regional SA was the only market stronger.

The city is likely to see smaller price falls than other markets, as continued relative affordability means typical house values sit around $700,000.

Darwin reported largest capital city decline

In September, prices in Darwin fell 0.37% - the largest decline amongst capital city markets.

The rapid slowdown of price growth in the city has meant prices are up less than 3% over the past year.

Hobart bucked decline trend

Prices increased slightly in September across Hobart - the only capital city to not see a fall in prices.

Despite the increase, prices remain 1.8% below the peak recorded in May 2022, but 46% above their level at the start of the pandemic.

Prices in regional Tasmania also continued to increase.

ACT remains steady

A slight fall was recorded across ACT in September where home prices have been falling persistently; prices are now down 3% from their peak in March.

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Image by Enrique Hoyos via Pexels.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

William Jolly

William Jolly

Harry O'Sullivan

Harry O'Sullivan