This feature allows Raiz users to allocate up to 30% of their portfolio towards residential properties across Australia through a minimum $5 investment.

Raiz notes the new Property portfolio is based on the pre-existing Moderately Aggressive portfolio, which has been altered to include a 30% allocation to the Raiz Property Fund.

The Raiz Property Fund currently comprises 10 properties across Australia, existing as rentals and generating rental income and contributing to the underlying unit value, with the properties revalued twice per year.

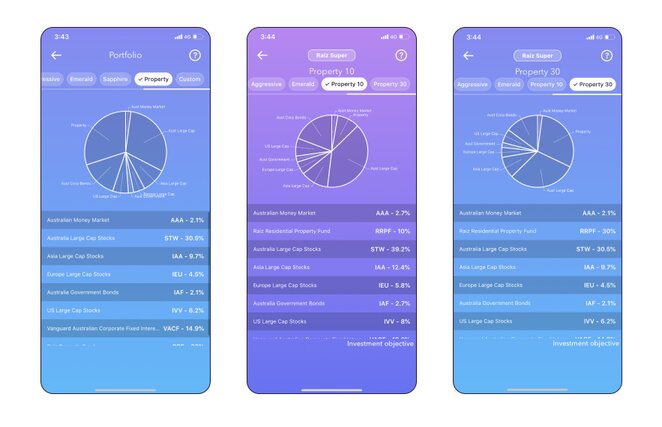

For customers utilising Raiz Invest Super, two new dedicated portfolios (pictured below) will be made available, one with a 10% weighting to property and another with a 30% weighting.

Raiz Chief Operating Officer Grant Brits said residential property is Australia's largest asset class, but it often poses a significant barrier to entry for newcomers.

“With the Raiz Property Fund, we have made it possible for all Australians, especially those who have felt excluded from residential property investment, to benefit from rental returns and potential capital gains,” Mr Brits said.

The new entrant to the fractional property space competes with the likes of BrickX, which allows users to buy and sell ‘bricks’ of a property.

Speaking to Savings.com.au Mr Brits said the Raiz Property Fund is a diversified portfolio of properties, meaning when you invest you are gaining exposure to all properties, rather than just a single property like you would when purchasing a brick from BrickX.

“Investors don’t need to choose properties to invest in, rather they simply invest in the fund which gives them exposure to the properties that our expert team have already handpicked,” he said.

“Furthermore, our minimum investment is only $5, considerably less than most of the products already in the market.

Mr Brits notes there is no cap to the number of investors that can invest in a particular property compared to other market offerings as Raiz Property Fund operates as a diversified portfolio.

“We simply buy more properties as more money flows into the fund,” he said.

Read more: Who offers micro-investing apps in Australia?

Image by fatmawatilauda via freepik. All other images supplied.

Denise Raward

Denise Raward

Aaron Bell

Aaron Bell

Alex Brewster

Alex Brewster