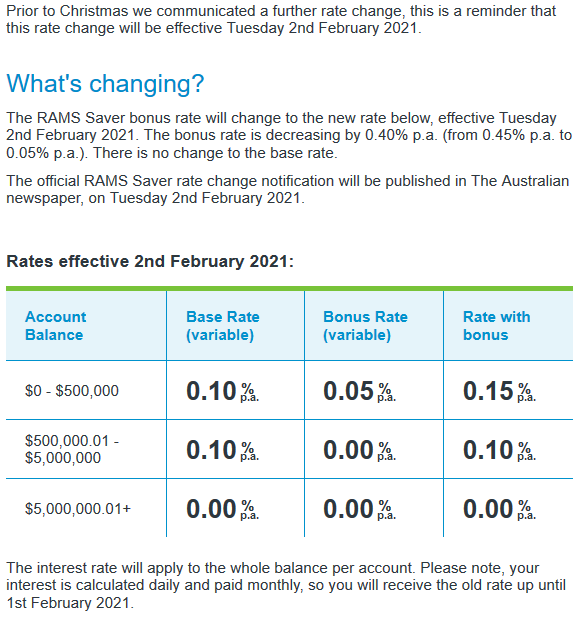

In a note sent to customers, RAMS said it would be cutting the bonus interest rate on its RAMS Saver by 40 basis points, to just 0.05% p.a.

With a base interest rate of 0.10% p.a, this takes the total interest rate to a mere 0.15% p.a.

To earn that 0.05% in bonus interest, customers have to deposit at least $200 each month and make no withdrawals.

At a balance of $10,000, a bonus rate of 0.05% p.a. would result in $5 in extra interest earned over a year.

However, this bonus rate is payable on balances up to $500,000 - at this maximum, 0.05% p.a. would be worth $2,500 in extra interest per year.

Need somewhere to store cash and earn interest? The table below features savings accounts with some of the highest interest rates on the market.

- Bonus variable rate for the first 4 months on balances up to $250k and high variable ongoing rates.

- No fees and no monthly requirements to earn interest.

- Easily open an account online in 3 minutes.

This is the latest in a string of savings account rate changes made by RAMS, which just a couple of years ago boasted one of the highest total interest rates on the market at 3.00% p.a.

As the image below shows, it had this rate as recently as 2019.

Source: RAMS' website, via Wayback Machine.

This interest rate change of 40 basis points was alluded to in December 2020, when the Westpac-owned bank also slashed the same rate from 0.65% p.a to 0.45% p.a. (20 basis points).

Previous changes include:

- Cutting by 10 basis points in November from 0.75% p.a to 0.65% p.a

- Cutting the base rate by 15 basis points in October to 0.10% p.a

- Cutting the bonus rate from 1.10% p.a to 0.90% p.a in September

- Trimming its rate by 45 basis points in May 2020, and by 20 basis points in August 2019

To be clear, RAMS is not the only bank to cut savings account interest rates recently, especially when five cash rate reductions have been made by the Reserve Bank since mid-2019.

But based on Savings.com.au's research, no other bank has cut quite so drastically, as other previous market-leading savings account rates offered by the likes of ING and UBank remain above the 1.00% p.a mark.

For accounts with select conditions, like Westpac's Life account for under 30's, rates as high as 3.00% p.a can be found.

RAMS and Westpac have been contacted for comment on this large change.

Image source: RAMS

Westpac, NAB and Commbank have also cut recently

Three of the four big banks - Westpac, NAB, and CBA - have lowered their own savings account rates so far in 2021, albeit not by the same margin.

Westpac, which owns RAMS, made some 15 basis point cuts to its accounts, including the Westpac life account, which now has a maximum interest rate of just 0.40% p.a for customers over 30 (0.20% base rate + 0.20% conditional bonus rate).

Commonwealth Bank meanwhile lowered savings rates by just 5 basis points, although with rates already so low it barely has room to move.

The GoalSaver account (CBA's non-introductory account) has a total interest rate of 0.45% p.a, with 0.40% p.a tied up in the bonus rate.

NAB followed suit by making cuts of up to 15 basis points: The NAB Reward Saver now has a maximum rate of just 0.40% p.a (0.05% base rate + 0.35% bonus rate).

In other, bigger savings account news, neobank 86 400 was purchased by NAB, while Xinja has handed back its banking license and returned all deposits to customers.

Image source: Frinkiac

Denise Raward

Denise Raward

Harrison Astbury

Harrison Astbury