The rise of ethical investing platforms over the past five years has prompted many Aussies to start the conversation both internally and externally as to how decisions made today can potentially impact generations to come.

Super Obvious is designed to make it simple for investors to align their money with their values, without having to face the potentially daunting and time-consuming task of individually choosing stocks or ETFs.

Super Obvious at a glance

- Invest in one portfolio, the 'Everest Fund', with as a little as $1.

- Has plans to expand its options, including green ETFs.

- A $2/month subscription fee.

- Compares favourably to other ethical investment apps such as Kwala, Bloom, Blossom, but each definition of 'ethical' could be different.

What is Super Obvious?

The brainchild of Phil Jacob (pictured above) and backed by Ellerston Capital, Super Obvious is an ethical investment managed fund providing Australians with access to companies that are seeking to deliver strong returns without causing environmental harm.

Speaking to Savings.com.au, Mr Jacob said having recently had a baby boy, he is more conscious of the state of the planet being left behind to the next generation - and there's a lot of people in a similar boat.

“I’ve worked at a number of great startups in the past that sought to positively impact their respective industries - including the disability and mental health care space - and wanted to do something similar in an area I’m really passionate about, investing,” Mr Jacob said.

“For too long, investing ethically was an area that delivered sub-standard returns and cost a fortune and that’s something we really wanted to change.

“At Super Obvious, we’re providing Australians with access to companies that are seeking to deliver strong returns while doing no harm - for less than the price of a cup of coffee. We strongly believe that at some point, all investing will be ethical investing and we want to be at the forefront of that.”

Investing with Super Obvious

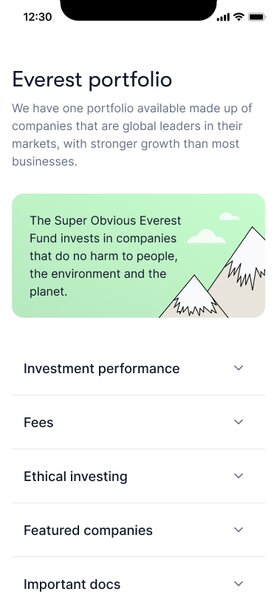

Super Obvious currently offers one managed investment fund called the Everest Fund. This fund is a unit trust registered with the Australian Securities and Investments Commission (ASIC) as a managed investment scheme and is governed by its constitution.

Investing with Super Obvious can begin by opening an account through the Super Obvious App - available through the App Store and Google Play Store - or through the Super Obvious website. Investors will need to provide details including identification documents to verify your identity to confirm they are an Australian resident for tax purposes and not a company or other entity.

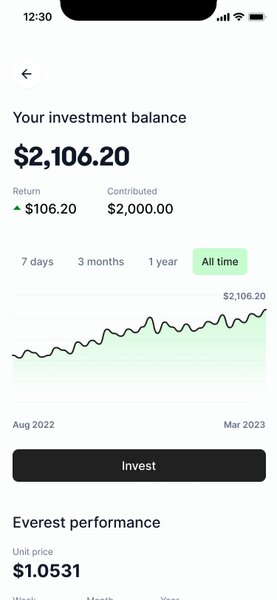

After opening a Super Obvious account, an initial investment can be made in the Everest Fund with as little as $1, with additional investments be made either through the Super Obvious app (pictured below) or website.

Investors can redeem some (or all) of their investments by submitting a redemption request using the Super Obvious App or website. The minimum redemption amount is $0.01 AUD. Redemptions will generally be paid out within five business days of the transaction day.

Super Obvious notes there may be circumstances where your ability to redeem on request from the fund within the usual period is restricted. For example, there may be a freeze on redemption requests where Super Obvious is unable to value the fund's assets due to financial market disruptions.

Super Obvious features, fees and performance

Mr Jacob says the Everest Fund (pictured below) was created to provide a simple and affordable way to invest in a way that considers a better future, both for you and the planet.

“The Everest Fund consists of 30-50 global companies screened by an experienced investment team with a track record of performance,” he said.

“These companies help make the world a better place by doing no harm and are selected from growth sectors such as healthcare, communication, climate change and environment.”

Being ethically driven, every product on the Super Obvious platform is vetted to remove companies in the following industries:

-

Armaments

-

Rainforest and Old Growth Logging

-

Tobacco and Alcohol Production

-

Gambling

-

Coal and Uranium Mining

-

Intensive Farming and Aquaculture

-

Extraction of Oil and Gas

The list of companies within the SuperObvious Everest Fund including their background descriptions and suitability to SuperObvious can be found here.

Mr Jacob details at present Super Obvious offers only the Everest Fund to investors, yet over the course of the next 6 months, the platform will be expanding to additional ethical managed fund products, as well as green ETFs and ethical fixed interest products.

Fees and charges

Unlike many other investing options, Super Obvious charges minimal fees. These consist of a $2 subscription fee per month for balances equal or above $1,000. Super Obvious does not charge performance fees, transaction fees, withdrawal fees or exit fees.

Super Obvious performance

Super Obvious Everest Fund uses the same strategy of the Ellerston Global Mid Small Cap Fund, with an annualised performance rate of 10.69% p.a.

Super Obvious Everest Fund returns are based on an annualised portfolio performance rate respective to the historical unaudited gross returns of the Ellerston Global Mid Small Cap Fund adjusted for management and performance fees and net of subscription fees based on a balance over $1,000. This period is from March 2017 to 28 February 2023.

Note: Past performance is not an indicator of future performance.

Sometimes life circumstances change, meaning financial decisions have to be made. If an investor changes their mind about investing with Super Obvious, there is a 14 day cooling-off period to confirm that the investment meets your needs.

To exercise cooling-off rights, investors must submit a withdrawal request within 14 days initial investment in the Everest Fund or up to the fifth business day after the units are issued. Super Obvious details the monies returned will be of equal value to the price at which the units could be applied for on the day the withdrawal request is received.

Super Obvious investing app compared

With the ethical investment industry growing by the masses each year, Mr Jacob noted SuperObvious is mindful of the fact that investing ethically may often be expensive and performance can often suffer.

“We wanted to buck the trend by offering our first product, the Everest Portfolio at a really affordable price,” he said.

“The big thing that differs us from most of our competitors is we want ethical investments to be accessible to all Australians which is why our barriers to entry are very small - anyone can invest with us with as little as $1 and not be charged through the nose.”

Here’s how Super Obvious stacks up to some of competition in the ethical micro-investing space:

-

Bloom: $0 brokerage; Account fees of $4.50 per month fee with a 0.80% p.a management fee for balances under $10,000; Minimum investment of $100, $5,000 for trusts and SMSFs.

-

Blossom: $0 brokerage; Account management fees of 1% p.a. based on principal amount invested; Minimum investment of $0.

- Kwala: $0 brokerage; $2-4 per month fee, minimum investment $10.

Referral program

If you refer a friend to the Everest Fund, Super Obvious will provide $5 worth of Class X Units in the Fund (Referral Units) to you and your friend, when your friend invests at least $10 in the Fund.

To be eligible to participate in the referral program, Super Obvious detail you must:

-

Be an existing unit-holder in the Fund.

-

Have at least $1 invested in the Fund.

-

Get your unique referral code (Unique Code) (which you can obtain through the Super Obvious app) and share it with a friend who is not currently or previously invested in the Fund.

Your friend must:

-

Not currently or previously be a unit holder in the Fund.

-

Open a Super Obvious account.

-

Enter the Unique Code in the Super Obvious app as they complete onboarding.

-

Invest at least $10 in the Fund as their first investment.

Advertisement

Want to earn a fixed interest rate on your cash? The table below features term deposits with some of the highest interest rates on the market for a five-year term.

Provider | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Annually | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 1000 | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Personal Term Deposits - 60 months | |||||||||||||

| Annually | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 25000 | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Term Deposit - 60 months | |||||||||||||

| Annually | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 1000 | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Online Savings Term Deposit (online) - 60 months | |||||||||||||

| Annually | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 5000 | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Term Deposit - 60 months | |||||||||||||

| Annually | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 500 | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Term Deposit - 60 months | |||||||||||||

| Annually | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 5000 | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Term Deposit - 60 months | |||||||||||||

| Annually | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 1000 | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Term Deposit - 60 months | |||||||||||||

| Annually | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 5000 | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Term Deposit - 60 months | |||||||||||||

| Annually | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 5000 | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Term Deposit ($5000-$49999) - 60 months | |||||||||||||

| Annually | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 1000 | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Fixed Term Deposit - 60 months | |||||||||||||

| Annually | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 1000 | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Term Deposit - 60 months | |||||||||||||

| Annually | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 1000 | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Term Deposit - 60 months | |||||||||||||

| Annually | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 5000 | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Personal Term Investment - 60 months | |||||||||||||

| Annually | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 5000 | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Term Deposits - 60 months | |||||||||||||

| Annually | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 5000 | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Term Deposits - 60 months | |||||||||||||

| Annually | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 250000 | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Term Deposit ($250k+) - 60 months | |||||||||||||

| Annually | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 1000 | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Bankwest Term Deposit - 60 months | |||||||||||||

| Annually | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 5000 | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Macquarie Bank Term Deposit (<$1,000,000) - 60 months | |||||||||||||

| Annually | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 50000 | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Term Deposit ($50,000 - $199,999) - 60 months | |||||||||||||

| Annually | $product[$field["value"]] | $product[$field["value"]] | $product[$field["value"]] | 1000 | $product[$field["value"]] | $product[$field["value"]] | More details | ||||||

Term Deposits - 60 months | |||||||||||||

- Competitive interest rates on all term lengths

- Deposits covered up to $250,000 under Government's Finance Claims Scheme

- Loyalty bonus at renewal

First published on March 2023

Images supplied by Super Obvious.

Bea Garcia

Bea Garcia

Bernadette Lunas

Bernadette Lunas

Harry O'Sullivan

Harry O'Sullivan

Emma Duffy

Emma Duffy

Alex Brewster

Alex Brewster