Domain's House Price Report for the June quarter reported that across the combined eight capital cities:

- Median house prices fell by 2% to $804,602 (driven largely by Melbourne and Sydney)

- Median unit prices fell by 2.20% to $560,838

Annually, these median prices are still up 6.6% and 4.5% respectively.

The findings follow another recent report by Domain showing that over the June quarter, unit rental prices experienced the largest fall in over 15 years.

Buying a home or looking to refinance? The table below features home loans with some of the lowest variable interest rates on the market for owner-occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

According to Domain, price falls to date have been minimal from the pre-coronavirus March quarter to June, with Domain Senior Research Analyst Dr Nicola Powell saying this is the first quarter to show the impact of COVID-19 on house prices, reversing upward price swings in Sydney and Melbourne.

"While most capital cities declined, the falls have been minimal to-date as unprecedented government stimulus, mortgage holidays, low stock levels and record low interest rates shield values from any significant declines, helping to retain stability in the housing market,” Dr Powell said.

[Low interest rates: More low rate home loans]

Amid lenders extending mortgage deferrals for those under serious financial strain, and the prolonging of the JobKeeper subsidy, Domain said the outlook for property prices largely depends on how well the economy is tracking when the financial stimulus ends.

This is a similar sentiment to the one shared by NAB earlier in July, which found that despite an improved outlook, house prices could fall up to 15% from peak to trough - indicating the price falls recorded by Domain could continue in the coming quarters.

"While prices have held up slightly better than expected, they have now declined for two consecutive months across the capitals and we expect this to continue for some time yet," NAB Chief Economist Alan Oster said.

"This easing in prices in Sydney and Melbourne comes after a very strong period in growth from mid-2019 where prices troughed."

Median house prices: Q2 2020

Notable house price swings could be seen in:

- Melbourne, which recorded a 3.5% decline to $881,369

- Sydney, which recorded a 2% decline in line with the national average

- Canberra, which recorded an impressive 4.1% rise in median house prices to $819,090

“The ACT has not felt the economic impact of the COVID-19 crisis to the same extent as other cities, though the jobless rate has risen, it remains the lowest compared to other jurisdictions, supported by the high public sector employment base, where job losses have been minimal, and industries supporting the public sector," Dr Powell said.

“A resurgence of first home buyers enticed by low interest rates and government incentive schemes have helped many on to the property ladder and supported housing activity.

"Stamp duty waivers on land and off-the-plan purchases, together with the HomeBuilder grant could continue to lure buyers.”

Source: Domain

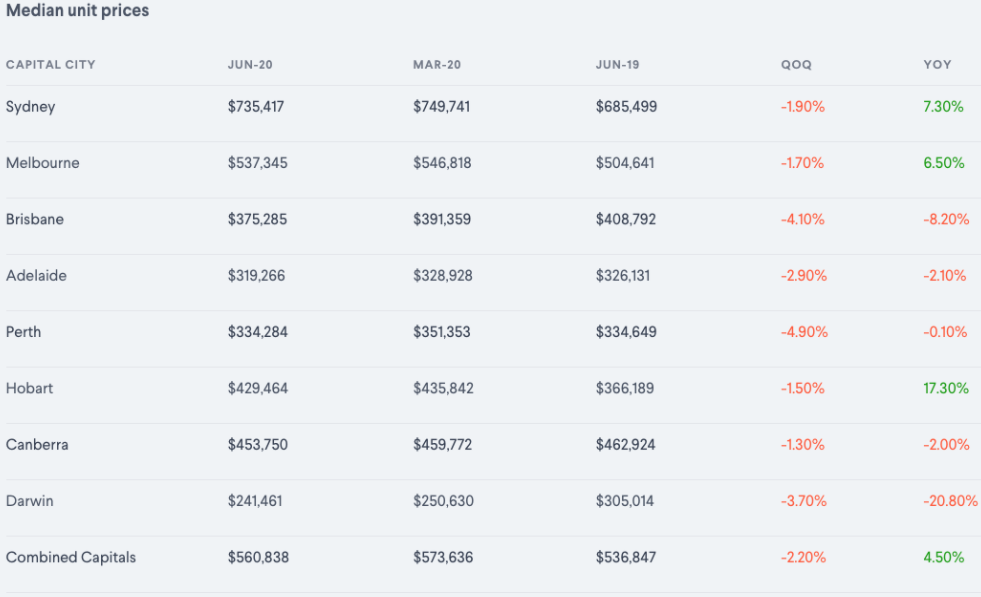

Median unit prices: Q2 2020

Every capital city recorded a fall in apartment prices, but the biggest falls were seen in:

- Brisbane, which saw a 4.10% fall in median prices to $375,285

- Perth, where prices fell 4.9% to $334,282

- Darwin, where prices are down 3.70% to $241,461

Of Perth's unit price fall, Dr Powell said the city has lost almost all of the strong gains it recorded over the previous quarter, pushing unit values down marginally 0.1% the year.

"This has created a window of opportunity for buyers, with values only 0.7% above last years trough but a staggering 20.7% lower than the mid-2014 peak," she said.

“Perth’s housing recovery may have paused in recent months although prices remain relatively stable considering the economic impact of the current health crisis. Improving commodity prices, particularly the states two biggest exports gold and iron ore, will be a pillar of support for the economy.

"A rapidly shrinking supply of advertised listings will also help to rebalance the market."

Source: Domain

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

William Jolly

William Jolly

Harrison Astbury

Harrison Astbury