Yesterday, Australia's central bank increased the cash rate by 25 basis points to 0.35%, marking the first time the cash rate has risen in over 11 years.

While the increase only happened yesterday, fixed home loans have been trending upwards for months for a flurry of reasons, one of them being an incoming cash rate rise.

Now that the RBA dished out the first cash rate hike, and with many more already pencilled in for this year by economists, variable interest rates are set to climb.

For reference, CommBank's half-year results show $89 billion in fixed home loans are due to expire in 2023. These homeowners may have locked in a record-low interest rate of less than 2% p.a. at the start of the pandemic.

With major banks now repaying the $188 billion that was accessed through the RBA's Term Funding Facility (TFF) - which is partly what allowed them to deliver such low interest rates during the pandemic - homeowners could face much higher interest rates over the coming years.

Andrew Walker, CEO and Founder of Nano Home Loans, said this represents the edge of a cliff.

"Assuming the other major banks mirror the same structure as the CBA, we could expect to see $400 billion in fixed rate mortgages rolling off into a variable interest rate in the next couple of years," Mr Walker said.

"If market expectations of rising rates are correct, these will be significantly higher, leading to a sharp lift in repayments. We expect those customers will be hungry for better, fairer rates and will look to the newer, digital players such as Nano to refinance."

Mr Walker said Nano has already experienced an uptick in demand, with homeowners already starting to reject the higher interest rates being offered.

"One of Nano’s new customers found that when his fixed rate home loan was about to mature with his current lender, they offered him a new rate of 4.19%, which was double their introductory advertised interest rate," he said.

According to PEXA data for the March quarter, all states experienced a strong annual uptick in refinancing, with Queensland refinances up 42.6%, and WA up 53.5%.

Are Australians ready for a rate rise?

New research from home loans marketplace Joust and Digital Finance Analytics (DFA) found that 42.2% or 1.539 million are currently experiencing mortgage stress.

Most benchmarks define mortgage stress as spending more than 30% of your income on your mortgage repayments.

Over the past month, Joust has seen the biggest increase in refinancing applications since the platform launched in 2020.

According to DFA this may just be the beginning, noting that mortgage stress began swiftly rising in February 2020.

An interest rate rise of 0.5% would see an additional 143,124 plunged into mortgage stress, and a 3% rate rise would see almost one million additional households experiencing mortgage stress according to DFA.

Reserve Bank modelling also shows a 200 basis point increase in the cash rate could increase the occurrence of mortgage stress from 10% to 20% of borrowers.

That said, the modelling also shows the average owner occupier borrower on a variable home loan was 21 months ahead on their mortgage payment in February.

A 200 basis point increase could see that buffer dip to 19 months.

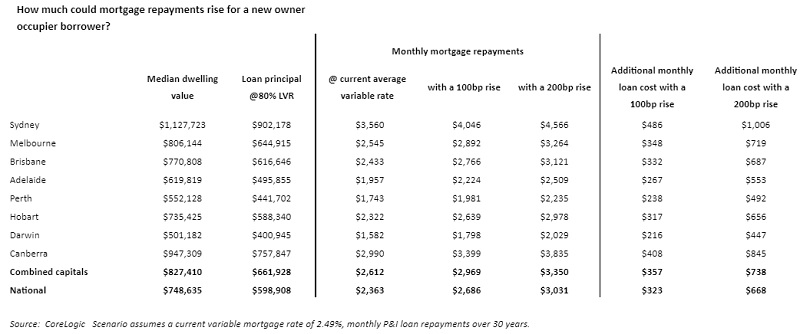

Number crunching from CoreLogic in the table below also shows what rate rises could mean for average borrowers.

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Image by Grant on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Rachel Horan

Rachel Horan

Brooke Cooper

Brooke Cooper