UPDATE: In January 2023, Nano advised customers that their home loan will come under the AMP umbrella from 27 March 2023.

Nano no longer accepts new home loan applications or refinances.

Launched in 2019 by finance experts Andrew Walker and Chris Lumby, the digital lender boasts home loan approval times in minutes rather than weeks and has some of the sharpest rates on the market.

Mr Walker said he and his co-founder had seen the lethargy and primitive processes used at major banks and wanted to provide customers with a superior mortgage experience.

“We looked at the home loan process in particular, and we asked ourselves some threshold questions like ‘why does it take six to eight weeks to get a home loan approved when the data exists to do it faster?’” Mr Walker told Savings.com.au.

“Why is the process so painful and unfair? And importantly, why if such a large profit pool comes from home lending, why then is the home loan process the most backward process that any of them run?

“We asked ourselves those questions and realised there is a better way to do this. We can use technology, data, and digital capabilities to flip the system on its head.”

Advertisement

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

What home loans does Nano offer?

Nano Home Loans offers owner-occupied and investor home loans for borrowers looking to refinance. Nano said they will be launching home loans for new borrowers in the near future.

Borrowers can choose to make principal and interest or interest-only repayments with Nano. The digital lender’s comparison rate is exactly the same as its advertised rate, at the time of writing, as it charges no fees. There are no applications fees, account keeping fees, or transaction fees.

Am I eligible for a Nano home loan?

If you’re looking to refinance with Nano, you must:

-

Be 18 years or older.

-

An Australian citizen or permanent resident.

-

Have a good credit rating.

-

Have a Pay As You Go (PAYG) income of $100,000 or more.

-

Have a Loan to Value Ratio (LVR) of 75% or less.

-

Have a loan amount between $100,000 and $2.5 million.

At the time of writing Nano does not offer home loans for borrowers who are self-employed, but states it has plans to offer this in the future.

What home loan features does Nano offer?

Nano offers an offset sub-account with all its home loans at no extra charge. Borrowers can access a Nano Visa debit card to use the account, which can be linked to Apple Pay or Google Pay. It boasts instant payments and transfers, direct debits, international transactions with $0 foreign exchange fees, and no fees on domestic or international transactions. Nano said it will soon add BPay for easy bill payments.

Nano also offers the ability to make extra repayments on your home loan at no extra cost.

Why choose Nano over the bigger lenders?

Mr Walker said Nano could offer an approval time significantly faster than the major lenders, approving one home loan application in under ten minutes.

“We use data to make home Loans fast, simple and fair. Homeowners can refinance their home loans and get unconditional approval, not the application time, the approval time in minutes, not weeks,” Mr Walker said.

“There's no paperwork, it's all electronic and can be done on your mobile phone, anywhere, which is incredibly convenient.

“It’s not only convenient, but it’s also what customers demand, everyone can pretty much live their lives through their phone, and home loans hadn’t caught up, and that’s what we’ve done.”

He added thanks to Nano’s competitive rates and zero fees, borrowers who had refinanced were saving on average just under $75,000 over the life of their loan.

No gimmicks and potentially no interest

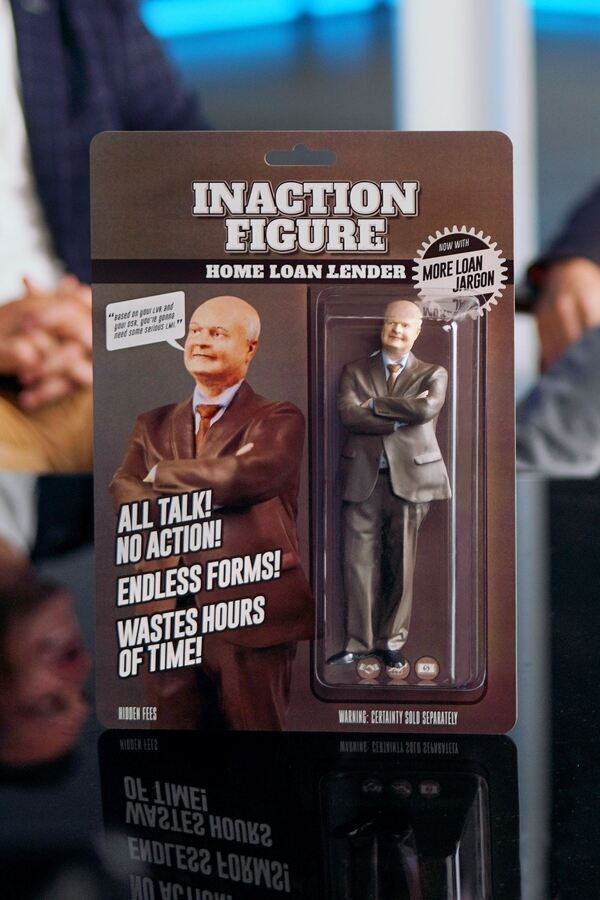

Nano recently launched its home loan ‘Inaction Figure’, designed to represent the “slow, confusing, and painful” traditional home loan process. The lender’s research revealed 79% of Australians had a negative experience with the traditional home loan process. Further, 55% found it slow and riddled with fees, and 72% found it confusing.

Mr Walker said the promotion was part of the lender’s initiative to have some fun and encapsulated the failings of the home loan market.

“People are frustrated with the slow and tedious process, frustrated and confused by the jargon, the language of paperwork, the lack of certainty. The Inaction Figure was the embodiment of everything that we saw that was wrong with the industry,” Mr Walker said.

“Someone that talks jargon and rubbish, doesn't give you straight answers, and tells you the process is going to take way too long is the complete opposite of what Nano stands for.

“People love that because frankly, they all relate to it.”

Nano is also currently running a competition where four borrowers can win their home loan interest-free for refinancing with Nano, or referring someone who refinances. Nano estimates borrowers could save up to almost $200,000 over the life of the loan if they were to win. Two winners will be drawn on 1 September 2021 and another two 10 November 2021.

How to apply for a Nano home loan

If you’re looking to refinance with Nano, simply download their App or head to their website. The lender states it takes only 10-15 minutes to apply and you’ll need to enter details like:

-

Personal details (ID, address, DOB).

-

Details of your desired home.

-

Loan amount and loan length.

-

List of debts and expenses.

-

Employment status and salary.

Nano will then digitally access your property valuation from its valuation partner, review your credit score and last two years' worth of repayments on all credit payments, review your income and expenses, and verify your identity.

Depending on your application and details, the lender can then provide approval in as little as ten minutes, up to a couple of days.

Transparency and simplicity

It can be common to see a flashy advertised rate, designed to draw unsuspecting borrowers in, that has an extortionate comparison rate which would see you paying through the nose on fees.

Mr Walker said Nano strived for transparency and simplicity and urged borrowers to do their homework.

“Look carefully at the comparison rates and don't get caught out by huge fees which put people at a disadvantage in the long term,” he said.

“We’d love to have borrowers who are experiencing this as our customers, as we cherish our customers and look after them.

“We believe that excellence is at the core of what we do.”

First published on August 2021

Photo by Paul Hanaoka on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Jacob Cocciolone

Jacob Cocciolone