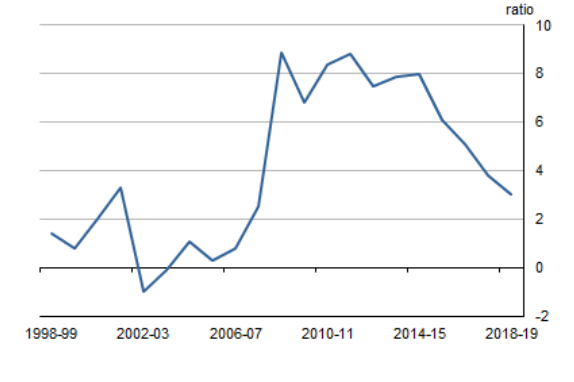

According to the Australian Bureau of Statistics, the ratio represents the rate of household income saved from household net disposable income.

The latest figure represents a 50 basis point fall from 2017-18’s household savings ratio of 3.5% – which was, at the time, the lowest in nine years.

For context, the all-time high savings ratio was 20.40% in the third quarter of 1973, while the lowest was -1.90% in 2002.

According to the ABS, the fall in net household savings can be attributed to

“the subdued rise in household final consumption expenditure outpacing soft growth in gross disposable income”.

“Gross disposable income was impacted by a substantial increase in income tax payable,” the ABS report said.

Federal Treasurer Josh Frydenberg has previously said a fall in the household savings ratio suggests Australians are feeling more confident about the economy and feel free to spend, while former Shadow Treasurer Chris Bowen countered that it’s a sign that Australians’ budgets are under pressure.

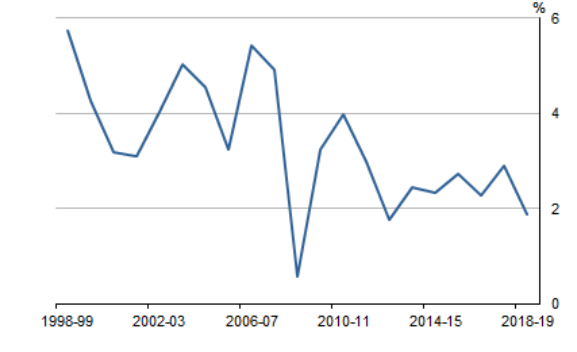

Household consumption slows too

Household consumption growth has also slowed to its weakest rate in six years, growing by only 1.9% in 2018-19.

This data series represents the net expenditure on goods and services by both people and private institutions serving households, on things such as motor vehicles for example.

According to the ABS, the easing growth in household consumption was driven by weaker discretionary spending growth, which declined from 3.3% in 2017-18 to 1.4% in 2018-19.

Purchase of vehicles fell for the first time since 2008-09, while spending on hotels, cafes and restaurants (1.6%) and furnishings and household equipment (1.1%) were also subdued.

Australia’s household final consumption expenditure. Source: ABS.

Economy grows by 1.9%

The Australian economy grew 1.9% in 2018-19 following a 2.9% rise in the previous year, according to the ABS’ data.

Chief Economist for the ABS, Bruce Hockman said: “Australia’s economy continued to grow for its 28th consecutive year, albeit at a slow pace, recording the softest annual growth since the Global Financial Crisis.”

This 1.9% growth is slightly higher than the 1.7% forecast for 2019 by the International Monetary Fund (IMF) last week.

According to the ABS, the 2018-19 Australian gross domestic product (economic) growth is unchanged from the annualised growth published in the June quarter 2019 national accounts, while GDP per capita growth of 0.3% is the lowest annual rate since 2009-10.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!