CommSec Pocket is a micro-investment platform offered by Australia’s biggest bank, but how does it work?

The popularity of apps like Raiz and Spaceship Voyager has seen micro-investing take off in recent years - so much so, the Commonwealth Bank (CBA) decided to get in on the action with a micro-investment platform of its own.

Launched in mid-2019, CommSec Pocket is designed to be a cheaper alternative to CBA’s trading platform, CommSec.

This page can help you discover how it works, understand the benefits and risks, and figure out whether or not it may be suitable for you.

Need somewhere to store cash and earn interest? The table below features savings accounts with some of the highest interest rates on the market.

- Bonus variable rate for the first 4 months on balances up to $250k and high variable ongoing rates.

- No fees and no monthly requirements to earn interest.

- Easily open an account online in 3 minutes.

What is CommSec Pocket?

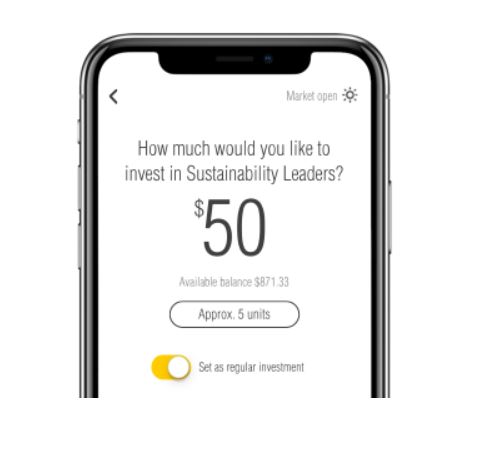

CommSec Pocket is a micro-investing (investing with small amounts) app from CBA which allows you to invest as little as $50 in seven different exchange traded funds (ETF). ETFs are essentially managed funds that can be bought and sold on a stock exchange (like shares) that are made up of a range of different companies, allowing you to easily increase your diversification and exposure. They are typically designed to track the movement of an index, such as the ASX 200 (representing the 200 largest companies on the Australian stock exchange) or an industry index such as health or technology.

You’ll need to link a CBA transaction account to deposit funds in your CommSec account and from here you can start investing. The app allows you to invest lump sums or set up recurring fortnightly or monthly investment top-ups.

Designed to help people get into investing who don’t have a large disposable income or who are daunted by the prospect of investing a lot of their savings, CommSec Pocket is far cheaper than its CommSec colleague. CommSec has a minimum investment amount of $500 and a brokerage fee of $29.95 per trade, compared to the $50 minimum of Pocket and $2 brokerage fee.

How do you invest with CommSec Pocket?

CommSec Pocket has seven different ETFs available for customers to invest in, each with a theme. Unlike Raiz, there’s no option to create a customised portfolio of ETFs. The seven investment options are:

Aussie Top 200 (IOZ)

This ETF contains 200 of the biggest companies on the Australian Securities Exchange (ASX).

It returned 1.34% p.a.* on investment in 2020 and has an average annual return of 7.64% p.a.*

Aussie Dividends (SYI)

The 30-odd companies within this ETF are known for paying above-average dividends, on top of providing potential capital gains.

It returned -0.12% p.a.* on investment in 2020 and has an average annual return of 6.73% p.a.*

Global 100 (I00)

Global 100 gives investors access to some of the top 100 companies in the world.

It returned 7.74% p.a.* on investment in 2020 and has an average annual return of 3.26% p.a.*

Emerging Markets (IEM)

The IEM ETF gives investors massive diversification, as its made up of more than 800 companies in emerging economies like China, Taiwan, Korea, and India.

It returned 6.63% p.a.* on investment in 2020 and has an average annual return of 9.49% p.a.*

Health Wise (IXJ)

The 100 or so companies in the Health Wise ETF are all medically-based, looking to extend and improve human life.

It returned 2.47% p.a.* on investment in 2020 and has an average annual return of 5.57% p.a.*

Sustainability Leaders (ETHI)

Made up of around 200 companies, the Sustainability Leaders ETF gives investors exposure to ethical and sustainable companies.

It returned 22.92% p.a.* on investment in 2020 and has an average annual return of 22.20% p.a.*

Source: CommSec

Tech Savvy (NDQ)

This ETF of around 100 companies is made up of the biggest technology and non-financial companies on the NASDAQ.

It returned 34.78% p.a.* on investment in 2020 and has an average annual return of 21.75% p.a.*

*Note: Past performance is not a reliable indicator of future performance. Investment return data sourced by Blackrock.

How much does it cost to invest with CommSec Pocket?

CommSec Pocket charges $2 per trade for investments less than $1,000 or 0.2% of the trade value for amounts above $1,000. If you were to invest the minimum amount of $50 per trade, you’re being charged 4% on a trade, which can seriously cut into any gains you’re looking to make.

There is also a late settlement fee. Cash is debited from your account two days after your trade is done, if there are insufficient funds when CBA debits, you’ll be charged a $10 fee.

What are the benefits of using CommSec Pocket?

There are many benefits to using CommSec Pocket, including:

-

Seven portfolios: The portfolios available offer exposure to a massive range of companies across the globe, making diversification simple.

-

Minimum investment amount: The minimum investment amount of $50, far less than regular investing platforms.

-

Low cost: CommSec Pocket charges only a $2 brokerage fee for trades under $1,000.

-

Recurring payments: The app allows you to set up fortnightly or monthly recurring payments.

-

Investor resources: CommSec Pocket has a large range of educational resources available to investors to increase their knowledge.

What are the risks of using CommSec Pocket?

As with all investment, there are risks to using CommSec Pocket including:

-

Market risk: The nature of share markets are to rise and fall. Your investments will be impacted by these fluctuations.

-

Currency risk: CommSec Pocket provides access to companies across the globe. Exchange rates will impact your investment.

-

No customisation: Although CommSec Pocket has seven ETFs to choose from, you cannot customise which companies you wish to invest in these

-

Liquidity risk: If you need the funds in an emergency, you may not be able to get your money back for a day or more.

-

Higher minimum investment: Other micro-investing apps like Raiz and Spaceship allow you to invest with as little as $1 with no brokerage fee.

How to start using CommSec Pocket

If you think CommSec Pocket might be something you’re interested in, here’s how to get started:

-

Download the app or go online to sign up.

-

Sign up using your CommSec ID or CBA NetBank Client number. If you don’t have a CBA account then you’ll need to open one.

-

Review the details of your account and deposit money from your chosen transaction account.

-

Choose an ETF to invest in.

Savings.com.au’s two cents

CommSec Pocket has a large range of ETFs to choose from with high exposure to a wide range of companies globally. However, the app has a higher minimum investment than Raiz or Spaceship, while sporting the same amount of ETF options as Raiz.

Ensure you do your research prior to investing to see if CommSec Pocket is for you and consider seeking advice from a qualified financial adviser before making any major investment decisions.

Photo by Ishant Mishra on Unsplash