Raiz (previously known as Acorns Australia) was one of the first micro-investing apps to launch in Australia and it quickly spawned a cult-like following from savvy millennials who liked the idea of being able to invest with their spare change.

The appeal of micro-investing apps like Raiz is that you really don’t need to know much about investing, nor do you need a lot of money to get started. Young people have always had two things working against them when it comes to investing: a lack of knowledge and a lack of funds. Raiz addresses both of these barriers to entry by making investing in the stock market easy and accessible. You can quite literally invest in shares with the leftover five bucks in your wallet.

Even finance expert Noel Whittaker loves Raiz, saying he’s always hoped for a product that’s available to: “anybody with a few dollars to invest, where investment could be automatic and your money placed in share-based investments without the hassle of going through a broker, paying brokerage or trying to save a big lump sum to get going.”

What is Raiz?

Noel pretty much summed it up for me above but I’ll explain it in a little bit more detail.

Raiz is a micro-investing platform delivered via a downloadable app which allows users to automatically invest their spare change in a selected mix of exchange traded funds (ETFs), choosing from six different diversified portfolios with varying risk portfolios.

Raiz has become so popular among millennials in particular because it allows them to invest small amounts of money in the background without it really impacting their lifestyle.

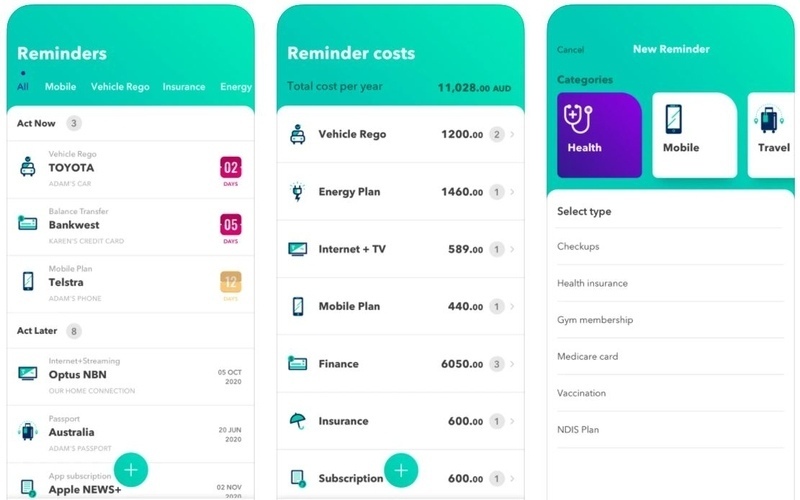

Raiz has also launched several other app features like Raiz Kids, Raiz Insure, Raiz Super and Raiz Rewards.

How does Raiz work?

When you sign up, you’ll need to select an investment portfolio. There are six to choose from: Conservative, Moderately Conservative, Moderate, Moderately Aggressive, Aggressive and Emerald, which is their ethical investment fund.

Each of their portfolios is comprised of varying allocations of the same seven ETF’s (with the exception of the Emerald portfolio which invests in ethical/sustainable ETFs) based on different degrees of risk. The portfolios have been designed to suit different investment goals in terms of what is an acceptable level of risk for you and how much time you want to stay in the market.

Source: Raiz

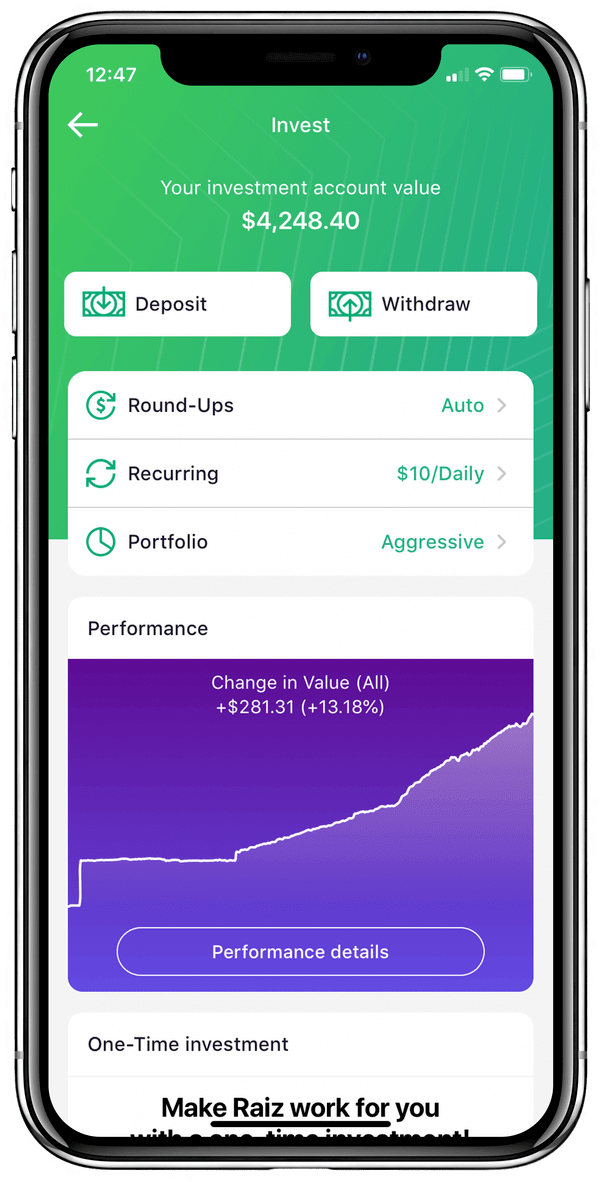

You can make a lump-sum deposit into your Raiz account or set up recurring deposits from the bank account that’s linked to your Raiz account. Raiz also has an automatic ‘round-up’ feature where you can choose to round up purchases to the nearest dollar amount and invests the change into your investment portfolio.

So if you’ve bought a latte for $4.20, Raiz could automatically round that purchase up to $5 and invest the 80 cents for you into the portfolio you’ve chosen. If you buy a $4.20 latte every day, you’ll have automatically invested $292 by the end of the year - just for drinking coffee!

When you deposit money into your Raiz account, your deposit gets distributed into the seven ETFs in your selected risk portfolio in proportion to the percentage allocations.

It balances the portfolio automatically despite market fluctuations and if your account gets too far out of balance, Raiz will rebalance your positions by selling and/or buying shares or fractional shares of the seven ETFs in your portfolio.

You can withdraw your money from your Raiz account at any time.

Is Raiz safe?

Firstly, Raiz is an ASX listed financial services company with an Australian Financial Services License (AFSL) and is overseen by ASIC, so you know it’s a legit company.

Money in your Raiz account is held by an independent Custodian (Perpetual Corporate Trust Limited). If Raiz ceased to exist, Perpetual Corporate Trust will still hold the assets associated with your investments in trust so that your money is returned.

In terms of how safe investing is, there’s no cut and dry answer. All investments carry an element of risk and returns can never be guaranteed. Risk impacts can vary for individual investors depending on their age, investment time frame, other investments held and their tolerance for risk.

Remember, it’s time in the market, not timing the market that often matters. The earlier you get started, the longer you have to ride out the stock market waves.

Does Raiz have fees?

For accounts with less than $15,000, there is a monthly $3.50 maintenance fee but no account fee.

Accounts with $15,000 or more won’t be charged a maintenance fee but will be charged an account fee equal to 0.275% p.a. of the balance.

Benefits of investing with Raiz

It’s investing for beginners

One of the reasons Raiz has become so popular is because just about anyone can use it. You don’t need to be an expert at investing. Unlike many other forms of investing where you need at least $5,000 to get started, Raiz makes it possible to invest with your spare change.

Fractional investing

A key feature of Raiz is that it allows you to purchase fractions of ETFs corresponding to the amount of money you’ve got in your selected portfolio.

Fractional interests allow you to consistently invest funds as they become available rather than having to wait until you have enough money to buy a complete ETF unit.

Regular savings

Raiz is based on the principle that regular investing, even in small amounts, can lead to big savings over time. With automatic roundups, you can easily contribute money to your Raiz portfolio as frequently as you like.

From little things, big things grow.

Pick your portfolio

Whether you’re more of an aggressive investor, want to play it safe, or prefer to invest your money ethically, you can easily pick a portfolio into which your money will be invested.

The Raiz portfolios have been constructed by a team of financial industry experts inspired by the ideas of a Nobel prize-winning economist who fathered the famous modern portfolio theory.

You can withdraw and deposit money as you wish

There are no limits as to how many deposits or withdrawals you can make, and you can make them whenever you like.

Disadvantages of investing with Raiz

Fees could eat into returns

For low account balances, the $3.50 monthly fee could easily eat into your returns if you’re not investing enough money regularly.

Don’t expect enormous returns

While Raiz is a great app for investing newbies, even their most aggressive portfolio isn’t actually that aggressive when you compare it with other methods of investing.

So while it’s a good way to get started in investing, don’t expect to see massive returns on your investments.

Savings.com.au’s two cents

If you’re new to the world of investing and the thought of doing so scares the bejesus out of you, Raiz is a good way for beginners to get started with fairly minimal risk.

As always, before you take out any new product, make sure you read the product disclosure statement (PDS) and gain a thorough understanding of the fees, risks, and features of the product.

Article first published 13 March 2020, last updated 1 April 2021.

Photo by Uljana Maljutina on Unsplash

Emma Duffy

Emma Duffy