The cost of refuelling in Australia is set to drop after the Organization of the Petroleum Exporting Countries (OPEC) and its allies (OPEC+) decided to increase oil production by 400,000 barrels per day from August.

This increase is set to impact fuel prices around the world, and bring overall baseline output to 3.65 million barrels per day.

According to NRMA spokesman, Peter Khoury, petrol prices could drop by as much as four cents per litre.

Mr Khoury stated that Australia is "at the mercy of global trading conditions", and that local fuel prices are "not impacted by falls in demand for fuel locally".

The price drop is unrelated to lockdowns in New South Wales, Victoria, and South Australia.

NRMA reported the average prices in each capital city for a litre of unleaded fuel, currently:

- Sydney 150.9 (prices falling)

- Melbourne 146.9 (prices rising)

- Brisbane 141.9 (prices falling)

- Perth 160.5 (prices falling)

- Adelaide 142.1 (prices falling)

- Darwin 149.9 (prices stable)

- Hobart 152 (prices stable)

- Canberra 150.9 (prices stable)

According to the Australian Institute of Petroleum, the national average fuel price recently saw the biggest drop in more than six and a half months, falling by 3.8 cents a litre.

This decrease brought the national average down to 150 cents per litre.

This is a sharp contrast to the start of the pandemic when boosted oil production and decreased demand saw petrol prices drop to around 80 cents per litre in many capital cities.

See Also: Fuel Price Cycles and Prices Explained

Implications for Aussie energy shares

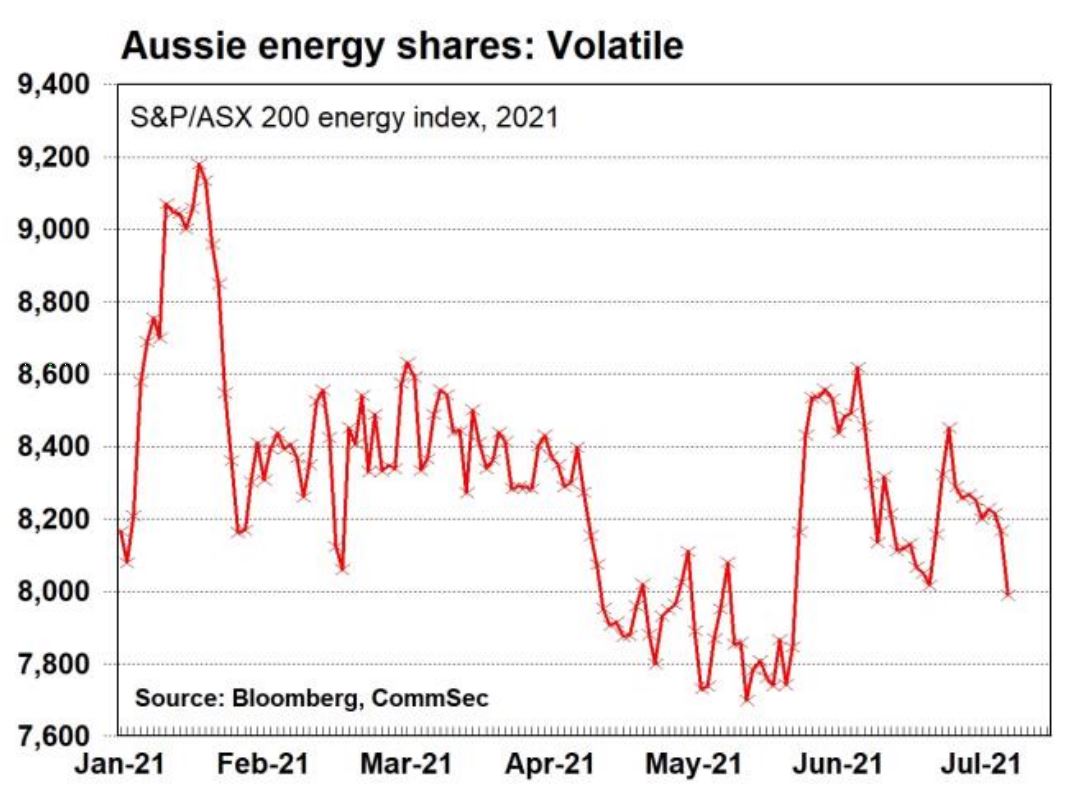

As a result of worldwide oil price drops, including prices weakening in the US, Australian-listed energy shares could feel the brunt of this decline.

CommSec economists project that weaker oil prices could affect Aussie energy shares in the short-term, with an expected lift in Iranian crude exports.

They warned investors in Aussie-listed energy stocks to be "on guard", with global oil prices down more than 1.1% in the Asian trade, and a 2.2% fall in the ASX-200 energy index on 19 July 2021.

Ryan Felsman, CommSec senior economist, said that it was "certainly" going to be a "volatile week for oil exposed ASX-listed companies".

Photo by Jay Skyler on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!