No matter whether you’re rich or poor, or even young or old, there are plenty of money guidance books out there for anyone who’s in need of a little financial advice.

If you’re eager to learn about how to retire in peace, how to invest, how to be smarter in spending and saving, or how to get out of bad financial habits, these books will hopefully show you how to take control of your future and freedom.

Once you’re confident you’ve found the right finance book, it’ll be the perfect time to snuggle up with a cup of tea on the couch or sit out in the sun with your feet up and start reading.

Before we get into it, it’s important to note that these books are not in order from best to worst. They’re simply placed in no particular order - it’s up to you to decide which will be worth reading first.

Additionally, the books compiled in this popular 15 list are derived from numerous websites and their recommendations for the best personal finance books to read.

The 15 finance books to put on your reading ‘to do’ list

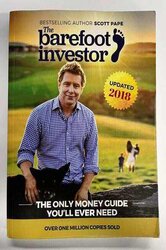

1. The Barefoot Investor by Scott Pape

With one in every 20 Australian homes owning this book, there’s no wonder it’s included in this list.

Scott takes you on a journey that focuses on eliminating debt, living in the now, and retiring in peace with the end goal of taking charge of your personal finances.

The book's methodology follows a three step phase: plant, grow, then harvest your money in simple “do this do that” language.

Who should read this book?

A great book for beginners of all ages who are struggling to live a financially comfortable life.

Key Takeaways

-

Set up different accounts that will plan where all your incoming money will go

-

Buy your home with a 20% deposit to avoid paying lenders mortgage insurance

-

You don’t need $1 million to retire with the ‘Donald Bradman Retirement Strategy’

-

Set up monthly money date nights, even if you’re single!

Source: Hanan Dervisevic

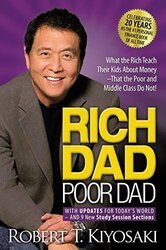

2. Rich Dad Poor Dad by Robert T. Kiyosaki

As you may have guessed, this book follows the story of two fathers; one is financially wealthy, the other is financially poor.

The book is an allegorical story about Kiyosaki and his two dads and their starkly different financial views. While “poor dad” is Robert’s biological father, an educated college professor, “rich dad” is Kiyosaki’s best friend’s father, a wealthy entrepreneur.

In this book, you’ll dive deep into financial literacy, acquiring wealth through assets, and what it means to be financially free.

Who should read this book?

A great book for people who want to become financially independent.

Key Takeaways

-

Use your money to buy assets, not liabilities

-

Being financially smart can only be learned through experience e.g. master accounting, investing, etc.

-

Give yourself opportunities and avoid fear/self-doubt

Source: Amazon

3. Money: Master The Game by Tony Robbins

Money: Master The Game follows seven fundamental steps people can take to secure financial freedom. It is based on extensive research and interviews with more than 50 financial experts including Burton Malkiel and Ray Dalio.

The end goal for readers is to become financially free by designing a lifetime income plan.

Who should read this book?

Readers of every income level can learn something important from this book.

Key Takeaways

-

Always set 10% of your earnings aside - saving is essential and must be done

-

Understand why you want money. When you know what you’re after, you’ll have a better idea of how to get where you want to go

-

Divide your assets into three groups - security, risk/growth, and dream

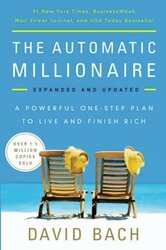

4. The Automatic Millionaire by David Bach

A simple, practical guide that takes you through a step-by-step plan for building wealth and retiring early.

With several practical pieces of money related advice, Bach’s philosophy follows three rules: you don’t have to make a lot of money to be rich, you don’t need discipline, you don’t need to be your own boss.

Who should read this book?

This book is great for people who think they need a lot of money to retire at a young age, when in actual fact this isn’t the case. It can teach you how to retire as a millionaire with a house at 55.

Key Takeaways

-

Have automatic payments set up for things like rent, utilities, and credit cards

-

Pay yourself first - take 10 to 20% from each paycheck and put it into a savings account

-

Saving small amounts every day (and committing to it) will go a long way

Source: Amazon

5. The Richest Man In Babylon by George S. Clason

Clason tells his financial advice through engaging tales and stories from the ancient times of Babylon.

The book explains seven financial rules that will set you on a path to wealth, success, and its accompanying joys. The common theme from the tales is that if a person works hard and learns from their mistakes, they will become wealthy.

Who should read this book?

A good read for those who are ambitious for financial success and want to learn through fiction tales and effective storytelling.

Key Takeaways

-

If you’re in debt, live on 70% of your earnings. With the rest, save 10% and use the remaining 20% to pay off your debts

-

Spend less than you earn

-

Plan for retirement in advance (build your egg nest)

Advertisement

Looking to take control of your retirement? This table below features SMSF loans with some of the most competitive interest rates on the market.

Lender | |||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Variable | N/A | More details | |||||||||||

| FEATURED | loans.com.au – Variable SMSF Loan P&I <70%

| ||||||||||||

Disclosure | |||||||||||||

loans.com.au – Variable SMSF Loan P&I <70%

Disclosure

| |||||||||||||

| Variable | N/A | More details | |||||||||||

Reduce Home Loans – Ezy SMSF 70 Metro (Refinance)

| |||||||||||||

Disclosure | |||||||||||||

Reduce Home Loans – Ezy SMSF 70 Metro (Refinance)

Disclosure

| |||||||||||||

| Variable | More details | ||||||||||||

Disclosure | |||||||||||||

Firstmac – SMSF Loan P&I <70%Disclosure

| |||||||||||||

| Variable | N/A | More details | |||||||||||

Liberty Financial – Residential SMSF (LVR <80%) | |||||||||||||

| Variable | More details | ||||||||||||

La Trobe Financial – SMSF Residential | |||||||||||||

| Variable | More details | ||||||||||||

Yard – SMSF Loan <60% LVR | |||||||||||||

| Variable | More details | ||||||||||||

Disclosure | |||||||||||||

Firstmac – SMSF Loan P&I <80%Disclosure

| |||||||||||||

| Variable | N/A | More details | |||||||||||

WLTH – Ocean SMSF 60 P&I ($50k - $3.5) | |||||||||||||

| Variable | More details | ||||||||||||

| FEATUREDRate will drop 0.25% on 3rd of June | loans.com.au – Variable SMSF Loan P&I <80%

| ||||||||||||

Disclosure | |||||||||||||

loans.com.au – Variable SMSF Loan P&I <80%

Disclosure

| |||||||||||||

- Minimum 30% deposit needed to qualify

- Available for purchase or refinance

- No application, ongoing monthly or annual fees.

- Dedicated loan specialist throughout the loan application

6. Your Money Or Your Life by Vicki Robin

Your Money or Your life is a nine-step guide to lowering your personal expenses and taking control of your finances in order to enjoy your life rather than just make a living.

In this book, you’ll learn how to alter your attitude between your money and time, get out of debt, implement saving tactics, and ultimately reach financial independence.

This guide isn’t necessarily going to take you on the road to wealth. Instead, it’s going to inspire you to think about how to live with enough so you can enjoy your life.

Who should read this book?

This book is good for people who yes, want to become financially independent, but wish to put their happiness first.

Key Takeaways

-

Be aware of where your money is coming and going

-

Save money through good habits rather than strict budgeting

-

Invest your savings and begin creating wealth

-

Where and when you spend your money is your choice and your choice only

7. The Millionaire Next Door by Thomas Stanley and William Danko

The Millionaire Next Door dives into the process of achieving financial independence through numerous case studies. Authors Stanley and Danko studied and interviewed people who have already become millionaires to get their insight.

This is one of the main differences between this book and others out there - instead of teaching you how to become wealthy, it shows you what actual millionaires have already done.

In essence, the book aims to eliminate the myths about the rich and wealthy.

Who should read this book?

A great book if you want to read about real millionaires (true examples) and how they got to where they are today.

Key Takeaways

-

In order to become rich, one must not only earn a lot, but also develop frugal habits

-

Save regularly and invest wisely

-

Live below your means

-

Avoid economic outpatient care (spending too much money on others) to reach your goal

Source: Amazon

8. She’s on the Money by Victoria Devine

Dubbed a millennial money guide, She’s on the Money is a book that shows you how to be more secure, independent, and informed with your money.

As a financial adviser, Devine understands what millennial life is really like and how difficult it can be to deal with all things money related. Along with some clear financial steps and a twelve month plan to help you get started, the book also goes through the psychology surrounding money.

Who should read this book?

The intended audience of this book is millennial women who never know where to start with managing money and wish to develop their financial literacy.

Key Takeaways

-

Take control of your relationship with money

-

Establish short, medium, and long term goals - make sure they’re achievable

-

Start investing

-

Understand your cash flow - the money going in vs the money going out

Source: Penguin Books

9. Broke Millennial: Stop Scraping By and Get Your Financial Life Together by Erin Lowry

A simple and savvy guide that takes you on a step-by-step journey from flat broke to a financial badass.

The book covers all the basics like debt, investing, negotiating salaries, and budgeting, but also dives deep into the matters we face with money in real life such as:

-

Managing student loans without feeling stressed about them

-

How to manage splitting a bill evenly when you’re out with friends

Who should read this book?

A great book for millennials who are cash-strapped and need to take control of their money.

Key Takeaways

-

Examine your relationship and feelings towards money, budgeting, and saving

-

Know and understand your credit score and report

-

Your debt-to-income ratio should never exceed 43% of your gross monthly income

10. Financial Freedom: A Proven Path to All the Money You Will Ever Need by Grant Sabatier

After waking one morning to find he had $2.26 in his bank account, Sabatier knuckled down to have a net worth of over $1,000,000 five years later.

In his book, Sabatier outlines a seven step process that shows you how to get out of debt, make your job optional, and more importantly, live the life you want.

Additionally, he informs the reader that retiring at a young age is achievable. In fact, you need less money to retire at 30 years than you do at 65.

Without giving too much away, Sabatier suggests there are several levels of financial freedom - when you tick all these boxes, you are in fact ‘financially free.’

Who should read this book?

This book is a good read for people who don’t know where or how to start understanding what their financial goals are in life.

Key Takeaways

-

Start a side hustle that is profitable and can turn into a passive income stream

-

Understand yourself, your goal, and what you want from life

Source: Amazon

11. Secrets of the Millionaire Mind: Mastering the Inner Game of Wealth by T. Harv Eker

After Eker failed at over a dozen businesses, he decided to sit down and evaluate his own relationship with money. What he found was he imitated his parents' financial strategies and that most of us actually do this subconsciously.

His book goes through the different ways to undo this financial blueprint to reprogram your thoughts, feelings, actions, and results towards money thus increasing your income and accumulating wealth.

Who should read this book?

A great read for people who want to change the way they view money and wealth into something of their own.

Key Takeaways

-

If you’re not fully committed and invested to creating wealth, chances are you won’t

-

You tend to replicate your parents' income and money-saving strategies - you need to alter this mindset and realise you’re the one at the wheel

-

Poor people focus on spending their money while rich people focus on making, keeping, and investing their money

12. The Total Money Makeover: A Proven Plan for Financial Fitness by Dave Ramsey

Radio talk show host and author Dave Ramsey takes you through some simple steps for eliminating debt and setting yourself up for success.

Ramsey suggests implementing the following to your everyday life: follow a monthly budget, save for emergencies, eliminate debt, invest for retirement, and buy only what you can afford.

The book is also filled with factual stories from people who have followed his advice and succeeded.

Who should read this book?

This book is intended for every reader no matter whether you’re a high earner or in thousands of dollars in debt - everyone can learn something from it.

Key Takeaways

-

Start paying your debts off from smallest to largest, then start saving

-

Grow your emergency fund - you want to have a minimum 3 month buffer

-

To live a better life than most, you have to do what most people won’t do - the sacrifices you make now will pay off in the long run

Source: Amazon

13. I Will Teach You To Be Rich by Ramit Sethi

This book presents a 6-week program that will help you start managing your money better by cutting costs in every area of life and automating your retirement planning.

One particular takeaway from this book is the author’s approval of guilt-free spending on the things you enjoy. In other words, you don’t have to get rid of everything you love in order to become rich.

Who should read this book?

This book is great for people who are looking for manageable steps to get their finances on track. It’s also great for readers who don’t have a strong understanding of financial literacy and are looking to learn.

Key Takeaways

-

You don’t need to be a finance expert in order to be rich

-

Automatically direct where you want your money to go

-

Start investing as soon as you can, even if it’s $1

-

You can still spend extravagantly on the things you love, just cut down on the things you don’t

14. Mindful Money by Canna Campbell

As an experienced financial advisor, mother, and partner, Campbell knows all about the challenges of maintaining balance when you’re time-poor.

In her book, she teaches you how to look at your finances with holistic and powerful mindfulness in order to take charge of your own personal finance management and embrace what you love.

Who should read this book?

If you’re struggling to maintain your personal finances while juggling with real-life issues, this is the book for you.

Key Takeaways

-

Adjust your mindset - get rid of all the negative thoughts and start moving forward

-

Have a ‘mindful money number.’ It is the amount of passive income you need that would allow you to stop working completely or cut back

-

Invest on a regular basis. This includes re-investing your passive income to increase growth opportunities

15. Retirement made simple by Noel Whittaker

Retirement made simple is a simple yet comprehensive book that goes through all the things an Aussie needs to know about when heading towards retirement.

Superannuation, pensions, investments, and insurance are all touched on in the first chapters while the later chapters touch on how to make the most of the freedom of retirement.

The book also has handy calculators and case study examples to get the message across.

Who should read this book?

Although the book is not catered for any specific age group, it’s a great read for people in their twenties or thirties who are yet to have a retirement plan set in place for when the time comes.

Key Takeaways

-

You want to arrive at retirement with your home paid off

-

Injecting money into superannuation is the best way to make money for the future - don’t stop doing this even when times get tough

-

Downsizing is an effective way of unlocking capital

See Also: How much do you need to save to retire comfortably?

Source: Booktopia

Savings.com.au's two cents

With hundreds of finance books to choose from at the tip of your fingers, there’s certainly a book out there for everyone.

Whether you’re looking to start saving for an early retirement, want to know how to budget properly, are keen to get investing, or simply want to learn how to save while living life to the fullest, this top 15 list has it all.

Of course, if these books don’t tickle your fancy, there are other finance books out there that may suit your needs better.

Once you find the right book, I wish you ‘happy reading and learning!’

Advertisement

Need somewhere to store cash and earn interest? The table below features savings accounts with some of the highest interest rates on the market.

- Bonus variable rate for the first 4 months on balances up to $250k and high variable ongoing rates.

- No fees and no monthly requirements to earn interest.

- Easily open an account online in 3 minutes.

Image by Vincenzo Malagoli via Pexels