If you don’t want to seem rude, you feel uncomfortable bringing it up, you’re a secret shopaholic and haven’t told your partner yet, or all of the above - just know that you’re not alone. Talking about money can be awkward at the best of times.

Maybe you’re earning more than your partner and you’re happy to pay slightly more, or you want to split bills right down the middle - both are totally fine. Find what works for your relationship where you both feel comfortable and happy.

So whether you want to get serious about buying a house together, or you’re sick of your boyfriend always letting you pay for nights out but don’t know what to do about it; you may need to have that uncomfortable conversation.

Why is it important to talk about your finances with your partner?

Before we get to the ‘how’, let’s figure out the ‘why’. While it might seem obvious that talking about your finances together is important, you may not know exactly why that is.

1. Helps with decision-making

Rebecca Maher, Managing Director at ProForce, said talking about money as a couple is important to ensure both people are contributing to your decision making.

“Money is a very emotive subject. Respecting that by being vocal and forthcoming with each other brings any existing frustrations and hesitations around joining financial forces,” Ms Maher told Savings.com.au.

“Failure to do this will mean any challenges or hiccups you naturally experience will be met with ongoing resistance to sticking it out and working through versus communicating around them and working out a solution together.”

Lacey Filipich, Director and financial educator at Money School, said that by making decisions together, you can also make the most of your combined resources when saving and investing, or working towards major financial goals like buying a house.

“If you don’t talk about money with your partner, you could be inadvertently working against each other and creating conflict that would have been avoided with a simple chat,” Ms Filipich told Savings.com.au.

2. Irons out disagreements

For some couples, disagreements about money are fatal (for their relationship).

Natasha Janssens, certified money coach, said arguments over money are the leading predictor of divorce and relationship breakdown.

“Therefore the more openly you communicate with each other on a regular basis, the more likely you are to avoid small differences turning into major arguments,” Ms Janssens told Savings.com.au.

Sarah King, head of client care and advice at Stockspot, said if you wont' talk about money with your partner, you should question why.

“It may be they’re in debt and don’t want you to know - and you need to know. Even more sinister, some people use money as a form of power and control,” Ms King told Savings.com.au.

“If it’s the former, understand that debt can be transferred to you. If you share the rental lease, the owner can come after you for money if your partner stops paying.”

Ms Maher said feeling heard is very important when managing money together.

“When one partner is more dominant than the other it can become easy for one partner to feel unheard or even unempowered about their money management,” she said.

Ultimately, money can be a sensitive and somewhat taboo subject.

3. Promotes discussions about shared finances

Ms King said combining your money - through things like shared bank accounts and credit cards - can leave you in a vulnerable position if you’re not 100% across your finances.

“A shared mortgage can also cripple you financially if your partner has tax bills they haven’t paid for years,” she said.

“If you don’t understand how your potential life partner affords to live, it’s time to have a conversation – with yourself and with them.”

Ms Filipich said when you’re in a relationship, you effectively become a team, meaning the financial decisions each of you make affects the team in some way.

“While you can continue to split costs and there’s no requirement to have joint accounts, it’s still in your interests to make sure you’re on the same page with your money,” Ms Filipich told Savings.com.au.

“Just being clear on your respective priorities; expectations can be enough to prevent arguments about things as straightforward as splitting the bill at dinner to those as complex as deciding whether one partner should salary sacrifice into the other’s superannuation when on parenting leave.”

What happens if couples don’t financially align?

Money is an important discussion topic for most relationships. But what if you’re not on the same page? Maybe one person has big dreams of owning property, while the other has plans on moving around and renting indefinitely. Is money everything, or are there ways to get around money misalignment?

1. Don’t ignore the issue

Ms Filipich compared ignoring the topic of conversation to not discussing what you like in the bedroom - you might not get what you want and your relationship can suffer.

“Depending on your relationship, you might find your partner making decisions you don’t agree with and aren’t happy to support,” she said.

“You might find yourself becoming the victim of financial abuse, which can be a slow, insidious process that chips away at your financial autonomy but you don’t notice quickly.

“If you’re not willing to talk about money with your partner, you need to have a serious think about whether you’re ready to be in a relationship, and whether this is the right relationship for you.”

2. Find a way to understand each other

If you don’t want your opposing financial goals to end your relationship, that’s totally okay. It’s your life and your relationship. But money is important; it can dictate the kind of life you’d like to live, so you should try to find a way to understand each other.

Ms Filipich said it’s not necessarily a deal breaker to have different financial goals.

“There’s no rule that says you must have joint goals, just like there’s no rule about having joint accounts. You can be working towards different objectives, still be together and still support each other,” she said.

“You just need to be clear about expectations and priorities so you both feel you’re being treated fairly and can work towards what’s important to you.”

3. Talk about your values and money history

Ms Janssens said it’s important to approach financial differences with empathy and compassion, rather than fear or anger, to understand the ‘why’ behind each of your financial goals and money habits.

“A great starting point is to talk to each other about your money past,” she said.

“What was life like at home growing up? What money memories do you have (both good and bad)? What fears do you have about money? Exploring these topics will help you identify as well as communicate why a particular goal is important to you or the reason why you prefer one financial decision over another.”

She said it can also help to go back to your values, put together a list and compare your notes with each other.

“Finding goals that align with both your values can be a way to achieve a compromise,” Ms Janssens said.

How to initiate money talks with your partner

You may be thinking money is a scary topic and it’s going to be like a tornado ripping through your relationship. That’s not the point to this article at all; rather, it’s meant to help with initiating a conversation about budgeting. You may be on the exact same page, and feel the weight lift off your shoulders once everything is out in the open.

With that being said, money can still be a sensitive topic. So, is there an ideal way to bring it up? Should you bring it up casually over coffee one morning, or wine and dine them to then bring it up over the bill?

1. Use life events to initiate conversation

Ms Janssens said most couples don’t talk about money unless there’s an issue. Similarly, Ms Filipich said most money discussions will be triggered by major life events - you move in together, you plan to buy a home together, or you’re getting ready to start a family.

“When the opportunity arises, jump on in. Ask questions, get inquisitive about each other’s point of view, and see where you’re similar and where you differ,” Ms Filipich said.

“Likewise, when something happens that you don’t like, don’t stay silent. Start a discussion about why that’s not going to work for you as soon as you can, so you can deal with it before it becomes a habit or a major issue.

“It can take guts to speak up, but if you’re in a loving and supportive relationship, that should be a welcome behaviour.”

2. Get over your fears but use tact and discretion

Ms Janssens also said you should avoid letting fears or concerns bottle up and instead speak about them at the time.

“Be careful about your timing as well - bringing up an important topic when you have just gotten home from work or are rushing out the door is unlikely to lead to a productive conversation,” she said.

“Instead, find a time when both of you are feeling relaxed and present and can talk things through properly.”

Ms Janssens also said it’s important to avoid using language that may cause someone to get defensive or place blame on anyone for past decisions.

“Instead, speak from the heart about what your needs or concerns are,” she said.

Tips for budgeting in a relationship

If you’re ready to talk money with your partner, but you’re not sure where to start, here are some tips from a handful of money experts for budgeting in a relationship.

1. Agree on the rules and keep it fair

Ms Janssens said it’s important to agree on your rules and keep it fair.

“Will you consult with each other when making a major purchase? If so, what is the threshold? Do you prefer to each keep a separate spending account that enables you to spend what you like without criticism from your partner? Keep bill sharing fair and equal – consider whether sharing bills 50/50 is fair if one of you earns significantly more,” she said.

2. Consider joint accounts for some things but keep other things separate

Ms Maher said you could utilise a household banking structure to support your shared goals, like having joint spending and savings accounts with independent spending accounts to keep your independence.

“Be vocal about what is and isn’t important to you from a lifestyle and spending point of view so there is no secret spending, guilt or frustration associated with your budgeting activities,” Ms Maher said.

“Review [your financial goals] quarterly to ensure everyone is happy and there are no frustrations being harbored.”

Ms Filipich suggests that even if you do combine financial forces you keep your own account that only you have access to.

“This doesn’t have to a secret from your partner, but it does have to be only accessible by you. With one in six women expected to experience financial abuse, that money can be a lifesaver,” Ms Filipich said.

“Remember that it’s okay to be different from each other.”

3. Set up a ‘money date’

Serina Bird, author of The Joyful Frugalista, said it could be helpful to have a money date to talk finances.

“Creating a safe place to talk about money [can be helpful],” Ms Bird told Savings.com.au.

“There's often vulnerability - and sometimes inherited limiting beliefs - around money. It's sometimes easier to talk about sex and religion than money. So it's important to make a money chat fun and safe.”

4. Have a joint savings goal

Ms King said setting a joint savings goal for each week/month is a non-negotiable.

“This should take priority over discretionary spending and give you both something positive to work towards together,” Ms King said.

“After all your joint expenses are taken into account - like bills, food, rent, mortgage repayments, kids expenses - allocate some of your extra money to spend on things individually, to maintain your own sense of freedom and independence.

“Allocating set amounts each month is a good way to ensure you both don’t overspend.”

Ms King said if one person spends more than the other, make sure you are both open and comfortable about it.

“As long as it doesn’t impact your joint savings goal, then it’s okay,” she said.

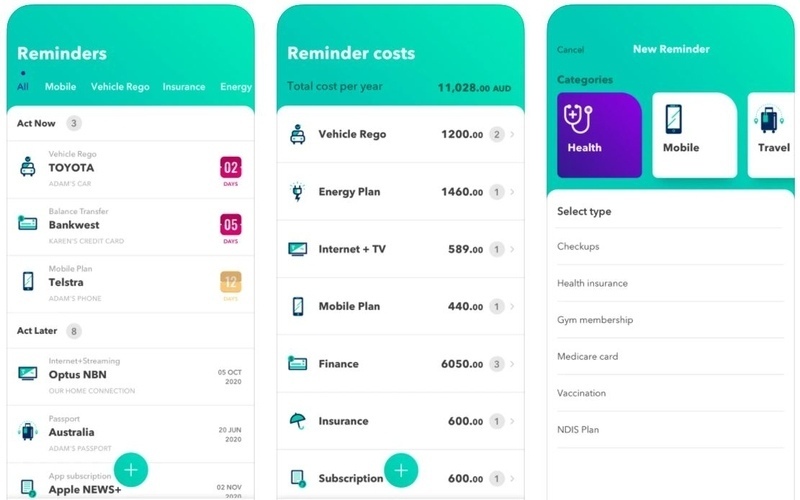

“After a few months, review how it’s all going. If you’re spending more than you should be, perhaps use a budget tracking app to identify areas where you might be overspending.”

5. Only you know what’s best

Ms Filipich said there’s no right or wrong approach to budgeting with your partner; there’s only what’s right and what works for you.

“Forget any supposed rules about combining all your finances just because you’re partnered up,” Ms Filipich said.

“That belief stems from the days when women couldn’t get their own bank accounts - well and truly in the past, thank goodness.”

Savings.com.au’s two cents

Whether this article made you realise you’re ready to get serious financially with your partner, or made you want to run for the hills far away from financial responsibility; just know that there’s no right or wrong way to budget with your partner.

Budgeting can be hard for one person, let alone two. For some couples, talking about money is a point of contention. Unfortunately, sometimes it’s a conversation that needs to be had.

If you still aren’t sure how to initiate a money talk with your partner, you’re not sure how to create a budget to begin with, or you have any other financial concern - you could consider speaking to a financial adviser.

Image by Andrik Langfield on Unsplash

Denise Raward

Denise Raward