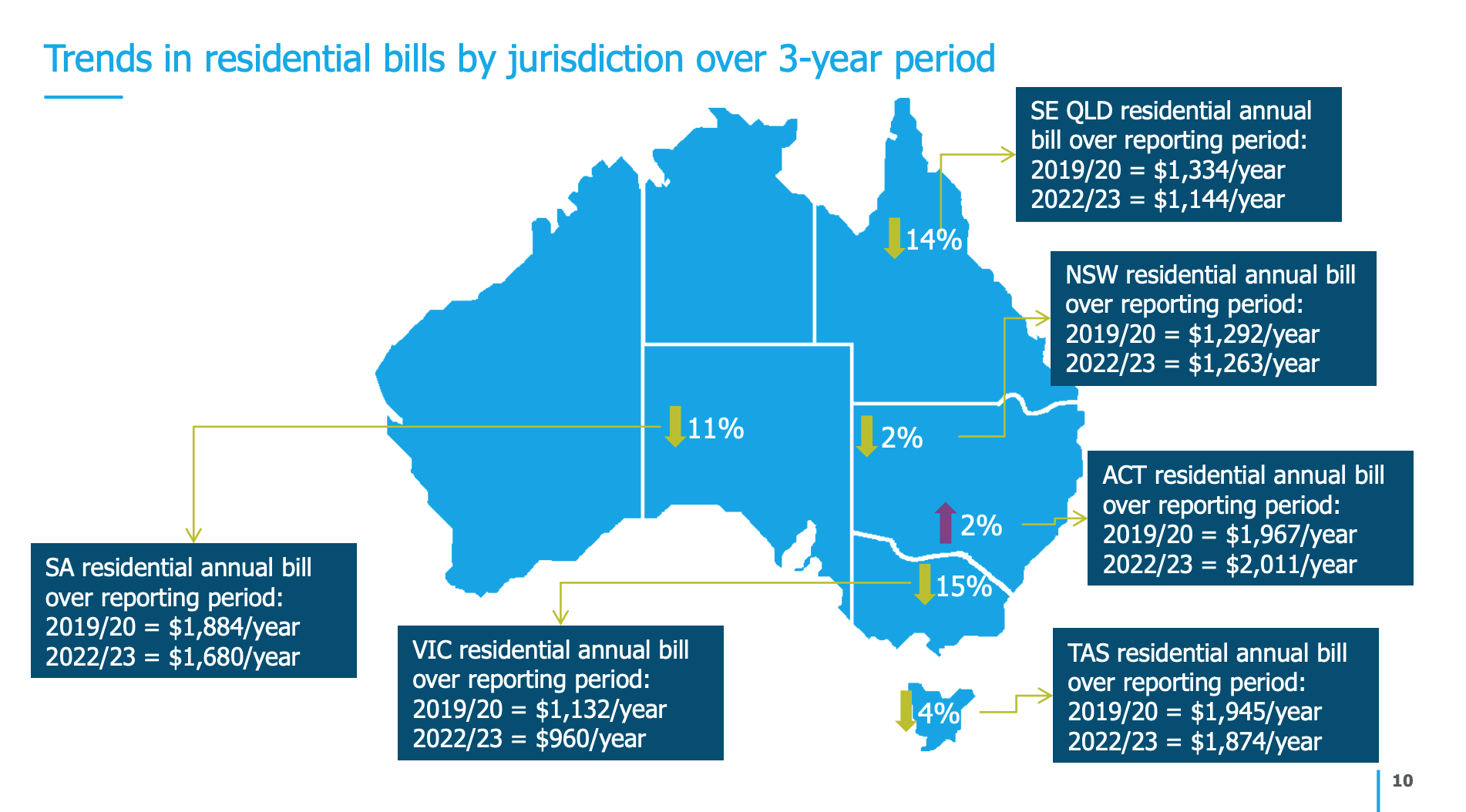

A new report by the Australian Energy Market Commission (AEMC) has found that household electricity bills are expected to fall by an average of $117 (8.7%) by 2023.

All states in the National Electricity Market - Queensland, NSW, Victoria, South Australia and Tasmania - will see electricity prices fall, a welcome relief given up to 96% of Australian households still list rising energy costs as a major concern.

Only the ACT is expected to see electricity prices rise, by $45 over the next three years.

Western Australia and the Northern Territory were not included in the report.

Need somewhere to store cash and earn interest? The table below features savings accounts with some of the highest interest rates on the market.

| Bank | Savings Account | Base Interest Rate | Max Interest Rate | Total Interest Earned | Introductory Term | Minimum Amount | Maximum Amount | Linked Account Required | Minimum Monthly Deposit | Minimum Opening Deposit | Account Keeping Fee | ATM Access | Joint Application | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

3.70% p.a. | 5.15% p.a. Intro rate for 4 months then 3.70% p.a. | $844 | 4 months | $0 | $249,999 | $0 | $1 | $0 |

| Promoted | Disclosure | ||||||||

4.50% p.a. | 4.85% p.a. Intro rate for 4 months then 4.50% p.a. | $933 | 4 months | $0 | $99,999,999 | $0 | $0 | $0 |

| Promoted | Disclosure | ||||||||

4.20% p.a. | 4.95% p.a. Intro rate for 4 months then 4.20% p.a. | $899 | 4 months | $250,000 | $99,999,999 | $0 | $0 | – |

| Disclosure | |||||||||

3.05% p.a. | 4.85% p.a. Intro rate for 4 months then 3.05% p.a. | $736 | 4 months | $0 | $99,999,999 | $0 | $0 | – |

| ||||||||||

0.00% p.a. Bonus rate of 4.85% Rate varies on savings amount. | 4.85% p.a. | $992 | – | $0 | $99,999 | $0 | $0 | $0 |

| Promoted | Disclosure |

Driving the drop in electricity prices is lower gas prices and the introduction of new energy sources like solar and wind.

“It’s great to see prices falling because at the AEMC what drives us is how to keep the lights on and costs down in a decarbonising power system,” AEMC Chief Executive Benn Barr said.

“The three key drivers of household electricity bills – wholesale costs, network costs and environmental costs – are all falling, which accounts for the overall drop that we are seeing.

“There are also regional differences across states and territories in the national electricity market that will affect price outcomes. And what energy offer you have and how much you use will also affect your bill.”

Source: AEMC

South Australians will see the biggest savings, with electricity prices forecast to fall by just over $200 by 2023.

South East Queenslanders aren't far behind, with an estimated $190 yearly saving on their power bill. Victorians will see a $170 decrease on their power bill, followed by Tasmanians who will save $70 a year.

Residents in NSW can expect a $30 saving.

Read: Neobank 86 400 launches 'energy switch' tool

The report predicts electricity prices will fall over the next two years before rising slightly in 2022-23, as capacity decreases with the Liddell Power Station due to close.

But Mr Barr said the outcome for 2023 prices may be different following recent announcements on increasing renewable energy capacity in both NSW and Victoria.

“We conducted our analysis before those announcements were made and so our numbers do not reflect the impact those developments could have on prices," he said.

"In any case, the overall figures show that prices in 2023 will still be lower than they are today."

[See also: How to make your home more energy efficient]

Photo by Rodion Kutsaev on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!