From property, to shares, to gold and even vintage antiques, SMSFs (self-managed super funds) can be a flexible investment choice that lets you tailor your retirement fund based on your needs and interests.

In this article, we’ll go through the basics of what you can invest in with the average SMSF. You should speak to a registered tax agent, financial advisor or the Australian Taxation Office (ATO) for a more complex breakdown of the dos and don’ts of these investments.

Need somewhere to store cash and earn interest? The table below features savings accounts with some of the highest non-introductory and introductory interest rates on the market.

| Bank | Savings Account | Base Interest Rate | Max Interest Rate | Total Interest Earned | Introductory Term | Minimum Amount | Maximum Amount | Linked Account Required | Minimum Monthly Deposit | Minimum Opening Deposit | Account Keeping Fee | ATM Access | Joint Application | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

3.70% p.a. | 5.15% p.a. Intro rate for 4 months then 3.70% p.a. | $844 | 4 months | $0 | $249,999 | $0 | $1 | $0 |

| Promoted | Disclosure | ||||||||

4.50% p.a. | 4.85% p.a. Intro rate for 4 months then 4.50% p.a. | $933 | 4 months | $0 | $99,999,999 | $0 | $0 | $0 |

| Promoted | Disclosure | ||||||||

4.20% p.a. | 4.95% p.a. Intro rate for 4 months then 4.20% p.a. | $899 | 4 months | $250,000 | $99,999,999 | $0 | $0 | – |

| Disclosure | |||||||||

3.05% p.a. | 4.85% p.a. Intro rate for 4 months then 3.05% p.a. | $736 | 4 months | $0 | $99,999,999 | $0 | $0 | – |

| ||||||||||

0.00% p.a. Bonus rate of 4.85% Rate varies on savings amount. | 4.85% p.a. | $992 | – | $0 | $99,999 | $0 | $0 | $0 |

| Promoted | Disclosure |

Self-managed super fund property investment

Many Australians use their SMSF to buy an investment property that provides a regular rental income. According to ATO data, $20 billion was invested in residential investment properties via SMSFs in 2014. Come 2018, that figure was more than $36 billion. In total, property now accounts for 13% of the total assets held in SMSFs.

You can buy multiple investment properties through an SMSF, but it’s crucial to remember: You can’t buy a property through an SMSF if you intend to live in it. According to ASIC, you can only buy investment property through an SMSF if the property meets the following criteria:

- It meets the 'sole purpose test' of solely providing retirement benefits to fund members;

- It must not be acquired from a related party of a member;

- It must not be lived in by a fund member or any fund members' related parties; and

- It must not be rented by a fund member or any fund members' related parties

Investing in property through an SMSF, whether that’s by yourself or with up to four people in a trust, is attractive to many SMSF members because property is a tangible asset that can increase in value and provide a regular income stream.

However, like buying a home, buying or selling a property through an SMSF can involve a lot of fees, such as:

- Upfront fees

- Legal fees

- Advice fees

- Stamp duty

- Property management fees

- Bank fees

Buying a home or looking to refinance? The table below features home loans with some of the lowest variable interest rates on the market for owner-occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Tax implications of buying a property through an SMSF

There can be some major tax advantages to buying a property through an SMSF. Firstly, rental income earned through the property will generally be taxed at 15% in the pre-retirement phase (accumulation phase), not at your marginal tax rate like other income is. In the retirement phase, this income generally won’t be taxed at all.

Secondly, capital gains for properties held for longer than 12 months will receive a one-third discount on any capital gain, so the capital gains tax rate for SMSFs in the accumulation phase is effectively reduced from 15% to 10%.

Other tax benefits to buying property through an SMSF:

- Tax-deductible interest repayments if the property is purchased via a loan;

- You can carry forward your loss each year if expenses on the property exceed the rental income (negative gearing); and

- Rental income and capital gains are generally tax-free once the SMSF is in the pension phase.

The tax rules regarding SMSF property ownership can be pretty complex, so it’s strongly you advised you consult a registered tax agent or visit the ATO’s website for more detail.

Can you invest in commercial property with an SMSF?

Yes, you can also invest in commercial property (such as an office building) through an SMSF. This may lead to more predictable cash flows and a higher yield as commercial rents are often linked to inflation. In fact, non-residential property is arguably more popular with SMSFs than residential property, given that it makes up around $67 billion of all SMSF-held assets while residential property only makes up $36 billion.

According to ASIC, if your SMSF buys a commercial premise, it can be leased back to a fund member for their own business, but it must be leased back at the market rate. The ATO monitors and audits all SMSFs regularly to ensure they’re compliant, and it still has to meet the ‘sole purpose’ test - it must be bought to provide a retirement benefit to members.

[Read more: How to buy property through an SMSF in Australia]

Can you invest in shares with an SMSF?

Yes, you can invest in shares through an SMSF, both domestic and international. In fact, shares are the most popular asset class, with 31% of all SMSF portfolios being made up of shares, according to the ATO’s 2017-18 annual report. Listed shares in SMSFs are worth almost $215 billion.

Shares are a popular investment choice among SMSF investors for a number of reasons:

- They’re relatively inexpensive depending on brokerage;

- They’re easily transferable, and can be bought and sold quickly with little admin;

- They’re a pretty easy to understand product, especially if you’re buying an exchange-traded fund (ETF); and

- They can come with several tax benefits, such as franking credits and capital gains tax discounts.

On the other hand, shares tend to be one of the more volatile asset classes, meaning your portfolio could fluctuate significantly depending on your exposure to them. Plus, there are some restrictions as to how you can purchase shares for an SMSF. Generally, purchases must be made through a broker or via an online share trading service only.

[Read: Property vs shares - which is the better investment?]

Can you invest in cash and term deposits with an SMSF?

You can also invest in cash and term deposits with an SMSF. In fact, this is the second most popular investment option, with over 21% of total SMSF portfolios being made up of this asset class according to the ATO’s 2017-18 data. That’s almost $159 billion.

Investing a portion of your portfolio in a term deposit or savings account can be suitable to conservative investors, as cash is generally the lowest-risk investment class. While cash generally has extremely low interest rates and generates lower returns compared to riskier asset classes, you know exactly what you’ll be earning throughout the entire term. During volatile periods, having a portion of your SMSF deposited in cash can help stabilise your losses.

Looking for a place to store cash? Below are a handful of 6-month term deposits with some of the highest interest rates in the market.

| Bank | Term Deposit | Interest Rate | Interest Frequency | Term | Automatic Rollover | Maturity Alert | Early Withdrawal Available | Minimum Deposit | Maximum Deposit | Notice Period to Withdraw | Account Keeping Fee | Online Application | Joint Application | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

4.30% p.a. | At Maturity | 6 months | $5,000 | $10,000,000 | – | – |

| ||||||||||||

4.40% p.a. | At Maturity | 6 months | $1,000 | $1,000,000 | – | – | |||||||||||||

4.20% p.a. | At Maturity | 6 months | $5,000 | $1,000,000 | – | – | |||||||||||||

4.40% p.a. | At Maturity | 6 months | $5,000 | $19,999 | – | – | |||||||||||||

4.10% p.a. | At Maturity | 11 months | $5,000 | $10,000,000 | – | – |

Cash is also a low maintenance investment class, meaning you can lock your money away in a ‘set and forget’ manner. There’s no need to constantly check and change what you’re investing in with cash, although you do need to be aware of things like the automatic rollover feature on a term deposit, which you might not want.

[Read: Savings accounts for SMSFs and how they work]

Can you invest in fixed-income with an SMSF?

Fixed-income assets, such as corporate or government bonds, are other relatively low-risk options for SMSF investors to consider in their portfolio. Fixed-income assets are a sort of ‘middle of the road’ investment option: they tend to provide a higher yield than cash and deposits, but are also less risky and volatile than shares. Bonds, which can best be described as a way to be paid regular interest in the form of coupons by the bond issuer (who issues bonds as a way to raise funds), can therefore be seen as another ‘defensive’ asset to help you weather volatile market conditions, so it’s worth considering having at least a small portion of your SMSF portfolio in fixed income assets.

Speak to an SMSF or financial adviser about how you can invest in fixed income assets. You can generally buy them through a stockbroker/financial adviser, or via an online share trading account on the ASX.

[Read: A brief guide to buying government bonds]

Can you invest in gold and silver with an SMSF?

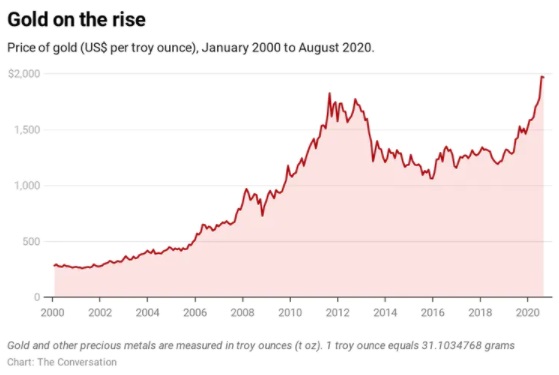

If you fancy yourself as an old-school type of investor, then you might be pleased to know you can also invest in precious metals with your SMSF, such as gold, silver, bullion, platinum and more.

These metals are generally seen as a safer investment than shares, as they tend to hold their value over time and are protected from factors such as inflation (although they definitely are not risk-free). A small exposure to metals like gold and silver in your portfolio may reduce volatility and risk.

The price of gold rose over both the GFC and the COVID-19 crises. Source: The Conversation.

When investing in gold and silver, there are three main ways to do so:

- Through an ETF, where the fund consists of a derivative contract which is

backed by the metal; - Physical coins, which are regulated by stricter rules (see below); and

- Bullion (bars), usually held at a storage facility but can be held in your own home.

If you hold physical coins, they are considered to be a ‘collectable’, and as such are more highly regulated. Under the rules for collectables, the auditor must provide proof of the following:

- Where the asset is being stored;

- Insurance certificate to verify the coins are insured within 7 days of purchase;

- Market valuation from a qualified, independent valuer will be needed if the coins have been sold during the year; and

- The coins need to be revalued at a very minimum at least every three years even if the coins aren’t being sold

The ATO has more detailed information on the rules regarding buying, holding and selling gold in an SMSF.

Can you invest in ‘collectables’ with an SMSF?

In addition to gold and silver, other ‘collectables’ you can invest in include things like:

- Fine art such as paintings, sculptures etc.

- Jewellery

- Wine and spirits

- Classic cars & boats

- Antiques and artefacts

- Special coins and medallions

These assets are relatively uncommon investments among SMSF investors, with only $324 million invested in total as of 2017-18 (less than 0.1% of all SMSF investments). However, this doesn’t mean they aren’t a suitable investment for you, but they can be a riskier choice unless you’re familiar with the type of collectable, or have a fund manager who is.

If you invest in collectables, you also need to follow the ATO’s guidelines:

- They must not be stored at a trustee or related party’s residence;

- Trustees and related parties are not permitted to use any collectables, or lease the;

- Any SMSF collectables are to be insured by the SMSF in a separate policy;

- The decision about where the collectable is to be stored must be documented;

- They must comply with relevant restrictions, including the sole purpose test (that is for the purposes of retirement only); and

- It must be valued by a qualified independent valuer to determine its true market value

The ATO has more information on its website about investing in collectables.

Can you invest in cryptocurrency with an SMSF?

One of the newer investment classes to rear its head in recent years is that of cryptocurrencies, like Bitcoin, Litecoin, Ethereum and others. SMSFs are permitted to invest in any kind of cryptocurrency, per the ATO, as long as the investment:

- Is allowed under the fund’s trust deed;

- Is in accordance with the fund’s investment strategy; and

- Complies with SISA AND SISR regulatory requirements concerning investment restrictions - that's the Superannuation Industry (Supervision) Act 1993 and Superannuation Industry (Supervision) Regulations 1994.

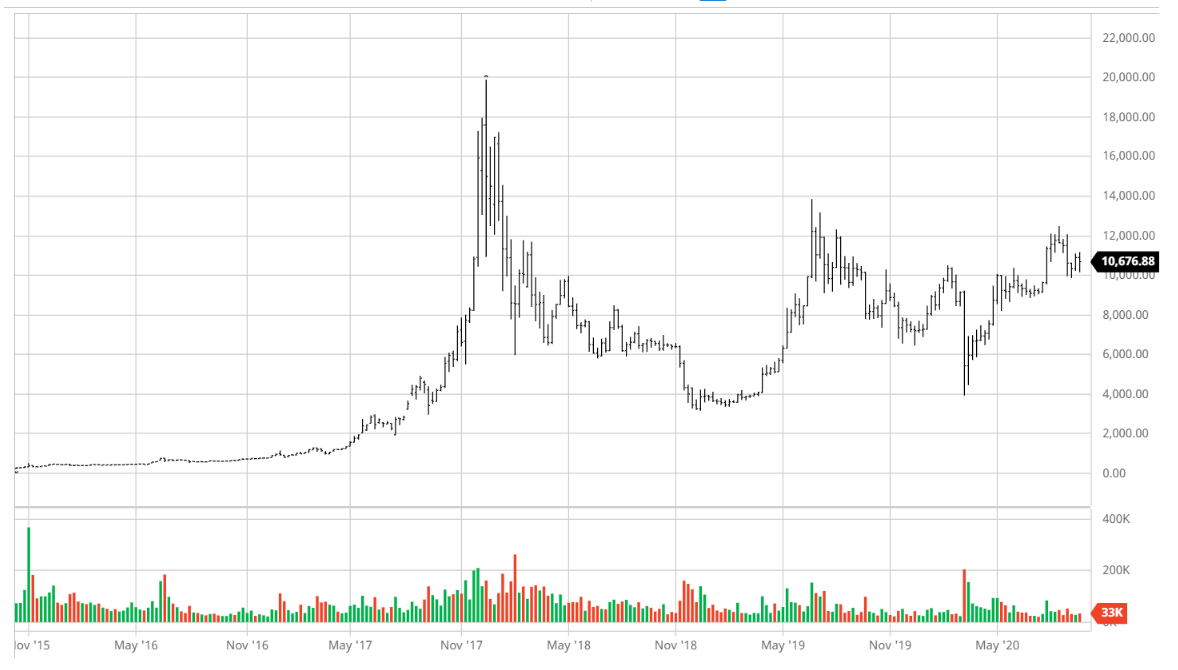

The ATO “strongly encourages” SMSF trustees to seek independent financial advice before investing in cryptocurrency. Crypto is an extremely volatile asset class that could result in either high losses or high returns. As such, it may not be suitable for older investors closer to retirement who don’t want to risk losing a chunk of their savings. The chart below shows the volatility of Bitcoin (in USD) over the last five years as an example.

Source: barchart.com

Refer to the ATO for the ins and outs of investing in cryptocurrency through an SMSF.

Can you invest in infrastructure with an SMSF?

Another relatively stable albeit sometimes higher-risk asset you can invest in with your SMSF is infrastructure, which has generally consistent returns throughout the economic cycle. Infrastructure assets are things that provide and support economic growth, such as:

- Social infrastructure like schools and hospitals

- Transport infrastructure like tunnels, airports, trains etc.

- Energy infrastructure like power plants, renewable resources etc.

People will always use things like roads, hospitals and communication infrastructure, at least for the next few lifetimes, so investing in such assets can provide steady returns during rough market cycles. There are generally three ways to invest in infrastructure through an SMSF:

- Unlisted, physical infrastructure assets, which are harder to buy and sell but offer lower volatility;

- Listed infrastructure equities, which can be bought on the stock market and as such offer higher volatility in exchange for more liquidity; and

- Infrastructure funds, which invest in both listed and unlisted infrastructure assets to get the best of both worlds.

Savings.com.au’s two cents

SMSFs might be more complicated when it comes to investing (and can generally require a higher investment amount to be worthwhile), but they generally have the same choice of assets as any other investor. Investing through an SMSF just might require a bit more reporting, regulation and research on your part.

Whether you’re a fan of basic investment options like shares, cash or property, or are a connoisseur of fine art or rare artefacts and want to include those in your portfolio, it would be wise to make sure you aren’t over-exposed to any particular asset.

Having a highly-diversified portfolio is important, as being overexposed to a single asset class can have serious repercussions during bad times. In August 2019, the ATO said it intended to contact almost 18,000 SMSF trustees and auditors across Australia who were holding 90% or more of their funds in just one asset class.

“Lack of diversification or concentration risk can expose the SMSF and its members to unnecessary risk if a significant investment fails,” the ATO said.

Legally, your SMSF must have an investment strategy, and the ATO says it needs to be revised at least once a year, especially if there are “trigger events” like large market downturns. Your market strategy will generally depend on the type of investor you are:

- If your goal is to build wealth and capital growth, then you might want to invest more in growth assets like shares over defensive assets like cash and bonds.

- If your goal is income generation (earning regular payments), then you might want to primarily invest in lower-medium risk assets like fixed income or blue-chip stocks that provide dividends or investment properties that provide rent, which can be useful for providing regular payments and steady cash flow.

- If your goal is capital preservation (managing risk), then you might wish to primarily invest in defensive assets like bonds and term deposits. This can be especially useful if you’re closer to retirement.

Consider what you’re after with your SMSF and balance your portfolio accordingly, but try not to over-expose yourself to a particular asset class. Have a broad mix of high, medium and low-risk assets in there, and consult a financial adviser if you need help doing so.