The changes apply to term deposit products with terms ranging from nine months up to five years.

The maximum change of 20

More common are one, two, three and five years, which have had their rates slashed by 10 basis points.

Nine month term deposits were cut by just 5 basis points.

Key changes

| Term | Old interest rate | Change | New interest rate |

| 9 months | 2.55% | -0.05 | 2.50% |

| 10-11 months | 2.60% | -0.2 | 2.40% |

| 2 years | 2.60% | -0.1 | 2.50% |

| 3 years | 2.60% | -0.1 | 2.50% |

| 5 years | 2.75% | -0.1 | 2.65% |

Source: NAB. Some interest rates for the same terms will vary depending on payment frequency.

Customers thinking of selecting a NAB term deposit – or those with current NAB term deposits thinking of rolling it over to another term – should check NAB’s current rate page and weigh up their options.

Other term deposit changes

NAB isn’t the only institution to change term deposit rates this week – in just the past few days:

- Greater Bank both lowered and raised various term deposit rates by 40 basis points (0.4 percentage points)

- Heritage Bank decreased interest rates by up to 35 basis points (0.35 percentage points)

- The Mutual decreased five and six-month term deposit rates by 40 basis points (0.4 percentage points)

- Rabobank increased its 30-day term deposit rates by 5 basis points (0.05 percentage points)

Besides NAB, there has been a lot of movement from two other big four banks.

Last month Commonwealth Bank decreased various term deposit rates by up to 25 basis points.

ANZ, meanwhile, made some drastic changes to its Advance Notice products, dropping some rates by as much as 60 basis points.

These rate changes all apply to terms shorter than one year. For example, ANZ’s

This interest rate reduction on a $50,000, nine month deposit could result in more than $200 lost in interest.

How to the big four term deposit rates compare?

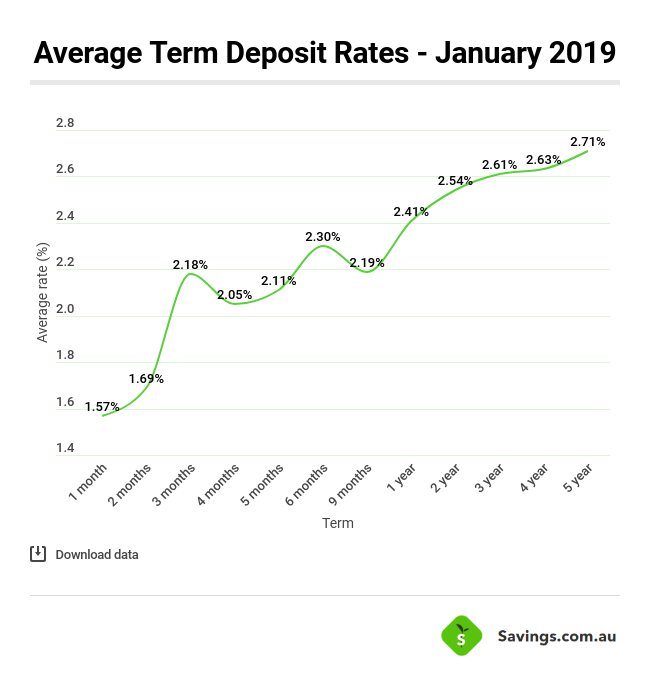

Not well. The Reserve Bank’s Retail Deposit and Investment Rates data for February 2019 shows the average term deposit rates across the big four banks (+ Macquarie) are:

- 1.40% for one month

- 1.85% for three months

- 1.90% for six months

- 2.15% for one year

- 2.35% for three years

- 2.20% across all terms

Compare that to the average rates across all term deposit providers and things look a little brighter. For example, the average term deposit rate for one-year terms is actually 2.41%, compared to 2.15% across the majors.

Bernadette Lunas

Bernadette Lunas

Harry O'Sullivan

Harry O'Sullivan

Denise Raward

Denise Raward

Dominic Beattie

Dominic Beattie