You may have heard of a credit score; you may even know what your credit score is. But understanding exactly how it works can give you invaluable insights into how lenders assess your applications, what makes a credit score good or bad, and how you can improve yours if it’s taken a beating.

What is a credit score?

A credit score is a number that is calculated by one of Australia’s credit reporting bureaus - Equifax, Experian, or illion - to represent your trustworthiness as a borrower. All three of these agencies operate completely independently from each other, which means you may have up to three credit scores with each one that differs slightly. We’ll get to why in a moment.

Your credit score is generated based on the information in your credit report. Think of your credit report as your school report card and your credit score as your final grade. It will typically range from zero to 1,000 or 1,200 (depending on the credit reporting bureau). It’s used by lenders to determine your eligibility for certain credit products, as it gives them an indication as to your financial management skills.

If you have a ‘good’ credit score, you’ll likely have access to things like a lower interest rate, the ability to negotiate your terms, and more. But if you have a ‘bad’ credit score, you’ll likely need to pay a higher interest rate, have little to no negotiation power, and even be limited in your borrowing power as well as which lenders you can borrow through.

How do I check my credit score?

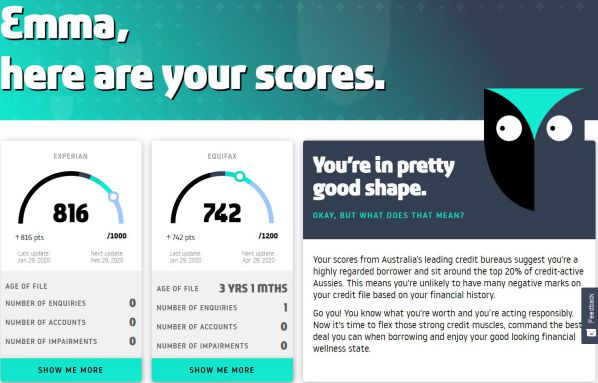

So how do you make sure you’re not in the dreaded bottom 20% of borrowers? For this article I decided to check my own credit score with each of the credit reporting bodies below to see how easy the process is (spoiler: it’s very easy).

You can check your credit score for free by using any of the major credit reporting bodies in Australia, like illion, Experian or Equifax.

It’s important to note that you could have a credit report with more than one reporting agency, so it’s a good idea to check with them all - particularly because credit reporting agencies use slightly different score ranges for each band.

illion (Credit Simple)

illion allows you to check your credit score for free online just by entering your full name, date of birth, address and proof of identity documentation.

Big four bank NAB has partnered up with Credit Simple (a subsidiary of illion) to provide Australians with free credit checks - regardless of who they bank with.

Equifax (formerly known as My Credit File)

Equifax will give you a free copy of your credit report once every 12 months. Other circumstances in which you can access a free copy of your credit report are if you’ve been denied credit within the last 90 days or if you’ve had an error on your credit report corrected.

You can also sign up for monthly subscriptions with Equifax which offer more features and more frequent credit reports.

Experian

Experian will give you a free credit report by email or post within 10 days if you provide several forms of identification, such as a driver’s license or passport, Medicare card, utility bills, bank statements, lease agreement, etc.

Wisr Credit

Wisr is Australia’s first credit score comparison service that allows you to compare your credit score from all the major credit agencies like Equifax and Experian.

It’s free to find out your credit score - all you have to do is enter your details and your driver license number and you’re off!

How is your credit score generated?

As we mentioned, your credit score is generated based on your credit report. Credit reporting bureaus draw up your credit report and subsequent credit score based on the information reported to them; this is why you may have a slightly different score with each agency. Let’s illustrate this with a quick hypothetical example.

Let’s say you have a personal loan. You’ve been a diligent borrower in the past, but come into some money troubles and end up defaulting on your loan. Your lender only reports this default to Equifax, which then goes onto your Equifax credit report. So, your credit score with Equifax is worse than your credit scores with Experian and illion.

This is the short answer to how your credit score is generated; the long answer is a little more complicated.

To understand this, we must discuss the two types of credit reporting used in Australia: comprehensive credit reporting (CCR) and negative credit reporting. All credit reports and scores used to be generated using negative credit reporting, but CCR was introduced to provide a more comprehensive understanding of a person’s borrowing and repayment history, hence the name.

Negative credit reporting

What was once the norm (and is still used by some small lenders), negative credit reporting means a lender is only submitting the negative borrowing habits of a person to credit reporting bureau/s. These negative events could include:

-

Making late repayments

-

Missing repayments

-

Applying for multiple loans or credit cards within a short timeframe

-

Rejections for loans and credit cards

-

Missed bills of $150 or more that are more than 60 days overdue

-

Bankruptcy or serious credit infringements

This information can stay on your credit report for up to seven years and will therefore impact your credit score during this time.

Comprehensive credit reporting (CCR)

Comprehensive credit reporting, also known as positive credit reporting, provides potential lenders with a more comprehensive picture of a person’s borrowing history. Not only will a borrower’s negative behaviours be reported, but also their positive ones. This way, any assessing lenders or people viewing the credit report will have a better idea of said persons' behaviour and trustworthiness as a borrower.

On a positive credit report, the following information will likely be included:

-

The dates accounts were opened and closed

-

Credit limits (not how much you pay off)

-

Frequency of repayments

-

Credit type that was applied for

-

Up to 24 months of repayment history

Despite being introduced back in 2014, most lenders were pretty slow to jump on the CCR train. To hurry the process along, it was mandated that the big four banks had to fully adopt CCR into their credit reporting systems by September 2019 - and they did. But by September 2022, all lenders will be mandated to use CCR when reporting credit information.

How many credit reports do actually you have?

Since there are three credit reporting agencies - as well as two different types of credit reporting - you could potentially have up to six credit reports; one of each type (positive and negative) with each credit reporting bureau.

Most lenders will only use one credit reporting bureau to access your credit report - because getting a copy of your credit report costs money. You can access your own credit report for free once a year, but lenders need to pay to access this information. Hence why they only look at one or maybe two of your credit reports, but only with one credit reporting bureau.

Credit scores and credit reports can be confusing and complicated. Not to mention they’re still a bit of a mystery. Most credit reporting agencies are pretty hush-hush about how they actually score you - though we have a general idea.

What information makes up your credit score?

Unfortunately for us, credit reporting agencies are kind of like Mr Krabs - they keep a tight lock on their secret formulas. While we don’t know exactly how they come up with your credit score, we do have a general idea of what actually affects your credit score. So there’s no need to go all Plankton and try to steal the formula.

Factors that can affect your credit score include:

-

Repayment history

-

Total amount owed

-

Length of credit history

-

Types of credit

-

New credit

All of these factors combined will spit out a credit score with each credit reporting bureau. But the weight of each factor can differentiate between agencies.

What is considered a ‘good’ credit score?

Credit scores are outlined on a five-point scale: excellent, very good, average, fair and low. With this in mind, we’ll consider all credit scores ranging from excellent to average to be a ‘good’ credit score.

Not only does each credit reporting bureau calculate their scores differently, but they also have different scales through which they measure their credit scores.

|

Credit score range |

illion |

Equifax |

Experian |

|

Excellent |

800 to 1,000 |

833 to 1,200 |

800 to 1,000 |

|

Very good |

700 to 799 |

726 to 832 |

700 to 799 |

|

Average |

500 to 699 |

622 to 725 |

625 to 699 |

Generally, a credit score between 500 and 700 is considered to be average. An average credit score may be the minimum required to get a loan through a big bank or major lender - or at least one with a decent interest rate. It may also influence your eligibility for a home loan.

If you have a ‘good’ credit score, chances are you’ve been an astute borrower - paying back your loans on time, sticking to your credit limit, never applying for too many loans at once, and so on. As a result, you may be offered a competitive interest rate on your credit products and have a wider variety of options to choose from.

What is considered a ‘bad’ credit score?

On the lower end of the scale are the categories of ‘fair’ and 'low'.

|

Credit score range |

illion |

Equifax |

Experian |

|

Fair |

300 to 499 |

510 to 621 |

550 to 624 |

|

Low |

0 to 299 |

0 to 509 |

0 to 549 |

When you have a ‘bad’ credit score, you’re seen as a higher risk to prospective lenders. This is why as a general rule, the lower your credit score is, the higher the interest rate you’ll be charged and vice versa. Your ‘riskiness’ is reflected in your interest charges.

To get a low credit score, you may have had trouble managing your financial commitments in the past. Maybe you missed a few repayments, defaulted on a loan or two, or were even declared bankrupt at one stage in the past seven years. As a result, you’ll likely be quite limited in your borrowing options - only having a select handful of lenders to choose from - and you’ll likely need to pay a higher interest rate.

All lenders are required to adhere to responsible lending obligations, which involves making sure a credit product is suitable for the borrower. Depending on the severity of your financial situation, you could have trouble securing finance at all.

Can you improve your credit score?

If you know that you’ve had some of the negative information mentioned above listed on your credit report, there are ways to rebuild your credit score over time. Unfortunately, particularly ‘bad’ credit management mistakes, like bankruptcies or serious credit infringements, can appear on your credit report for up to seven years.

Check your credit report

An easy thing you can do to start off with is check your credit report to make sure all of the information is correct and accurate. If there is any incorrect information on your credit report, this could be influencing your credit score. Some things to keep an eye out for could include:

-

Duplicate listings or incorrect amounts of debt owed

-

Credit you didn’t take out

-

Repayments you made that haven’t been recorded

If you find any mistakes, you can contact the credit reporting body and they will fix it, free of charge.

Pay existing debts on time

Another thing that you could consider doing is making sure you’re paying all existing debts on time. This could include any credit cards, personal loans, mortgages, or any other form of credit you’re currently using. Your repayment history will be shown on your credit report for up to two years, so it’s important to demonstrate good repayment habits, which can indicate your overall reliability as a borrower.

A common way to avoid missing repayments is setting up a direct debit with your credit provider. This way, all you need to do is make sure there is enough money to cover the repayment on the day you choose.

Pay bills on time

While utility and phone bills are not technically forms of credit, late or missed bills can actually affect your credit score. In particular, a service provider bill that is over $150, and is more than 60 days late, can be lodged as a default on your credit report. A default can remain on your credit report for up to five years, and is considered to be a ‘black mark’ on a credit report.

Again, most utility providers allow you to set up direct debits to automatically deduct payments. It’s also important to always inform your provider if you’re moving house, so they don’t send bills to an outdated address. They might be able to send your bills via email instead of by mail, so you’ll never miss a payment.

Minimise new credit applications

If you’re trying to stay on top of your current debt repayments, it might be a good idea to hold off on taking out any new credit. Plus, all credit applications you submit, regardless of whether they’re approved or not, will show up on your credit report. This can affect your credit score.

Submitting multiple applications in a short time frame could indicate to lenders that you’re in financial distress, and can lower your credit score. So, if you’ve just recently submitted an application, it could help to try waiting as long as you can before submitting a new credit application.

Lower credit card limits

Your credit card limit is what is shown on your credit report, not the amount you spend. Meaning, if you’ve got a credit card limit of $20,000, this is what will show on your file - even if you’re only spending $5,000 of that. So, to whoever looks at your credit report, you’re using $20,000, not the $5,000 you’re actually using. If you can lower your credit card limit, this reduces the amount of active credit you have, which can increase the amount you can borrow. It could also positively affect your credit score.

If you need help, ask for it

If you’re struggling to keep up with your current repayments, it could be worth reaching out to your credit provider or service provider for some financial hardship assistance. Additionally, you could consider speaking to a free financial counsellor, who can give you advice and help you with things like budgeting and negotiating with your creditors.

How is it different from a credit report?

The score is the individual number contained within the credit report, which also collates all your information within it. You’ll have more than one credit report out there too; ASIC’s MoneySmart lists four different recognised credit reporting agencies:

- Equifax | equifax.com.au | 13 83 32

- illion | illion.com.au | 13 23 33

- Tasmanian Collection Service | tascol.com.au | (03) 6213 5555

- Experian | experian.com.au | 1300 783 684

These agencies may outsource their credit reporting tools to other companies.

According to MoneySmart, a credit report includes:

- Your personal details (name, DOB, addresses, employment etc.)

- Any credit or loans you’ve applied for

- Any missed payments

- Defaults within the last 60 days

- Other credit infringements (e.g. leaving your last known address without paying a debt)

- Bankruptcies, court judgements, insolvency agreements etc. (these can stay on there for as long as seven years)

All of this information, combined, leads to a final credit score, which will lie somewhere between 0 and 1,200. MoneySmart has a sample Equifax credit report which you can view here.

How to fix mistakes in your credit report

When you get your credit report, it’s important to check everything is correct, like:

- All the loans and debts that are listed are actually yours

- Details such as your name, address, DOB, employment, etc are correct

If you notice that something is wrong or out of date (such as an old home address) contact the credit reporting agency and ask them to correct it. This is a free service.

Why is it important to understand how your credit score works?

Understanding your credit score can be helpful so that you know how to improve it and/or maintain it. When you want to borrow money - from a bank or other financial institution - your credit rating may be one of the most important scores you ever receive. Forget that bad English grade you received in high school - your credit score actually matters in the real world.

When it comes time to buy your dream home, you don’t want to be held back by the silly financial mistakes of your past. As we mentioned, some information will stay on your credit report for up to seven years. So even if it may not seem super important right now, keeping your credit score in check should probably be on your to-do list if you have plans of borrowing in the future.

If you take nothing else from this article, the crux of it is: don’t bite off more than you can chew. Only take out a loan or credit card when you need it and can realistically manage to pay it back. And if you are struggling and need help - reach out to your lender or utility provider. They may be able to help you with a financial hardship arrangement or a flexible repayment plan.

Image by PabitraKaity on Unsplash

Harrison Astbury

Harrison Astbury

Denise Raward

Denise Raward