Australia’s unemployment rate is tipped to reach 10% (possibly higher) thanks to coronavirus and the resultant shut down of businesses all over the country. The number of jobs worked has already decreased by 6%, and the statistics show those who rent are disproportionately affected compared to those who own their own home.

While the banks are offering mortgage holidays to home loan customers who’ve been financially affected by COVID-19, there are fewer options available to renters, with the government advising landlords and tenants to sit down and work it out.

If you’re struggling to pay your bills, you can try asking your landlord for a temporary rent reduction.

Why might a rent reduction be necessary?

While both landlords and tenants are among those affected by the economic fallout of COVID-19, there’s plenty of analysis that shows those who rent are disproportionately affected compared to those who don’t. Analysis of data from the Australian Bureau of Statistics (ABS), Australian Taxation Office (ATO) and the Productivity Commission by The Conversation found 2.5 million Australian households rent privately, and just over half are in the bottom 40% of households by income. About one-third are low-income households paying more than 30% of their income in rent - and that was before COVID-19 struck.

The average disposable household income for landlords meanwhile is A$135,000 a year, versus A$82,000 for non-landlords. That isn’t to say every landlord is wealthy - 90.2% of Australia’s 2,150,000+ property investors held only one or two rental properties, and 77% of those owning one rental property had individual taxable incomes of under $100,000.

But that doesn’t change the fact that, on average, those who own properties are in a better position financially to weather the coronavirus storm, and with social distancing paramount during a pandemic, people need a place to stay. And while the Morrison Government has recently placed a six-month moratorium on rental evictions for those “unable to pay rent due to financial distress as a result of the COVID-19 pandemic”, there’s no hard and fast rule for rent reductions, with the Prime Minister instead saying all parties (landlords, tenants and banks) need to work cooperatively, and that rental assistance measures would be left up to the different State Governments (more on this below).

Unfortunately, that advice of ‘sitting down and working it out’ isn’t a guarantee of affordable housing for everyone in a time when not everyone is interested in doing so.

Received this heartbreaking email today, reproduced with permission. This is what landlords and tenants working it out too often means. These rent rises and evictions must be banned straight away. pic.twitter.com/QDkj8F29Al

— Heather Holst (@HeatherHolst) April 3, 2020

While most people - landlords and tenants - are operating in good faith, there are those who, depending on the side they’re on:

- Will use COVID-19 as an excuse to not pay rent, or pay much less rent than they can afford

- Will use COVID-19 as an excuse to try and squeeze more money out of vulnerable tenants

With so many people out of work or facing reduced hours for the foreseeable future, plenty of renters will be unable to pay their full rental amount. But there’s a lot of confusion around what’s acceptable to ask for in terms of a rent reduction - and how to ask for it.

Here’s how you can appropriately ask your landlord for a rent reduction.

How to ask for a rent reduction

If you haven’t been affected financially by COVID-19, then in all likelihood you should continue to pay your rent as per usual to the full amount, on time. However, if you’re one of the many Australians who has had their income reduced, or seen a fall in working hours, or has become unemployed altogether, then you’re within your rights to approach your landlord for a rent reduction. After all, a sensible landlord would know that it would be better financially to accept less rent in the short-term in exchange for a happy, long-term tenant, rather than an empty property which might be difficult to fill during a pandemic.

The most important thing to do when asking for a rent reduction is to do so in a calm and respectful way. So, when crafting a letter or email to your landlord, make sure you’re as reasonable as possible, and try to include the following things:

- Details about your financial situation: How much money have you lost, how much has your income decreased by?

- Proof of your financial situation: Include a recent payslip from your employer or a communication stating you’ve been let go/forced to accept fewer hours or pay

- How much you’re willing to pay in rent (a 20-25% is generally seen as an acceptable level, but it all depends on your financial situation).

Example rent reduction letters

Here are some example letters from Fair Trading NSW, both from a tenant’s perspective and a landlord’s perspective. The tenant in this scenario is a fitness instructor who is out of work due to gym closures around the country and is asking his landlord for a $250 rent reduction per week for two months.

.png?language_id=1)

His landlord, in turn, agrees to the request, provided the tenant provides some form of proof as to how much income they have lost.

.png?language_id=1)

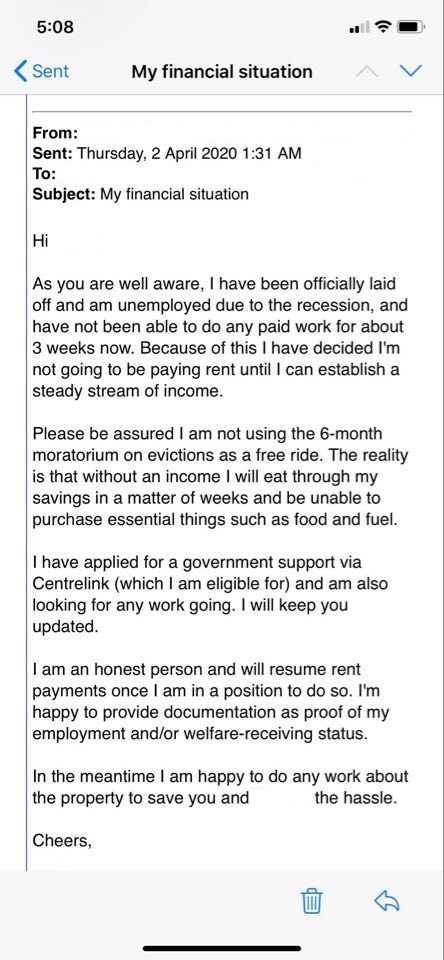

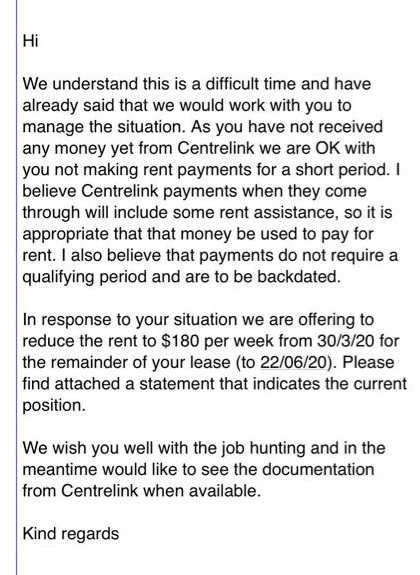

And here is a real-life letter provided to Savings.com.au from a Brisbane-based tenant who we’ll call “Ben” (names withheld), who was promptly let go from his job. In this scenario, he informs his landlord he would be temporarily unable to pay rent, and would resume doing so once he had money coming in via Centrelink.

His landlord agrees to his request and offers a $30 per week reduction in his share of the rent after several weeks of no rent had passed.

In both instances, each party was firm yet fair in their communications with each other, and clearly laid out their position. These are good examples of how tenant-landlord rent reduction talks should go, and more often than not, this will result in some form of positive outcome occurring.

Of course, there’s no guarantee this will work, as humans are fickle creatures and there’s always room for one party or the other to be unreasonable.

What’s all the fuss about rent strikes?

You might have heard some talk about ‘rent strikes’ recently, whether that’s in the form of a pamphlet dropped in your letterbox, or in the form of the 17,000+ people signing a petition to stop paying rent collectively, citing:

- Workers not having enough sick leave to self-isolate for 14 days

- Mass-loss of income for casual workers (who overwhelmingly rent)

- The risk of losing housing during a pandemic

- The need for sick employees to work any shift they can get to pay their rent

Essentially, a rent strike is the act of withholding rent for a period of time - it can also be done for mortgage repayments. Tenants' Union NSW Senior Policy Officer Leo Patterson Ross told SBS News that rent strikes are an indication people feel unsupported by the government.

“They've tried to negotiate with landlords and agents and have got nowhere and they're really, really scared about what's going to happen to their homes,” he said.

While you could, technically, get away with not paying rent at the moment due to moratorium on evictions, that doesn’t necessarily mean you should.

The first port of call should always be to contact your landlord to ask for a reduction in rent: Demanding to not pay any rent at all is really a worst-case scenario and should be avoided at all costs, because afterwards, while you could technically get away with just flat out refusing to pay rent or demanding to pay a certain amount, this would lose you a lot of goodwill and could even result in your landlord placing you on a tenancy blacklist.

COVID-19 won’t last forever, and when it’s over, you may find yourself facing greater difficulties in finding a new place once your landlord tells you they won’t be renewing your lease.

Are there any relief measures available for tenants and landlords?

Yes, there is. Four states have announced assistance packages for renters and landlords - we have a complete article on them here, but we’ll also give you a quick summary of the key changes now:

- Queensland: Is providing $2,000 in rental relief ($500 per week for four weeks) to landlords, applied for by tenants with less than $10,000 in savings

- NSW: Landlords will also receive a land tax rebate up to 25% if they are accommodating tenants under financial stress, six-month moratorium on new forced evictions if the tenant has lost 25% or more of their income

- Victoria: $2,000 capped rent-relief if renters have less than $5,000 in savings and are paying more than 30% of their income in rent (aka rental stress)

- Western Australia: Residential landlords will receive $2,000 grants if their tenants are struggling after having lost their job.

Check your states' housing department website for more informatikages available on on the relief pacfor landlords and tenants.

What can you do as a landlord?

If you’re a landlord reading this (maybe you’re a landlord who also rents), then there’s also a number of things you can do to help alleviate the pressure, on both yourself and the tenant.

- See if you’re available for any of the rental assistance packages listed above

- Ask your bank for a mortgage holiday: You can offer your tenant a rent reduction and then ask your bank for a mortgage repayment holiday (this will make your overall loan slightly more expensive, however)

- Go interest-only for a while: Interest-only loans are popular with investors, as you only pay the interest component of the loan for a period of time, and as an investor, the interest component is tax-deductible. This method can also make the loan slightly more expensive in the long-term.

- Cut back on other expenses for a while: If you are faced with a tenant unable to pay 100% of their rental income, check out our guide on ways to save during COVID-19 to see what else you can cut back on to make up for it.

None of this is ideal, but giving a tenant a slight reduction in rent in the short-term could ensure they stay in your property long-term, and having a long-term tenant is generally more profitable than constantly recycling them. As long as they are reasonable and upfront about their request for a rent reduction, try to take it into consideration.

Savings.com.au’s two cents

As a tenant, you’d be well within your rights to ask for a rent reduction if you’ve lost your job or suffered reduced working hours, but your landlord could equally refuse your request if they deem it to be too high or if you come across as unreasonable or demanding. As much as tenants like to demonise landlords sometimes, if you’ve lost 20% of your income but ask for a 50% reduction in rent then your landlord might not be the bad guy in that scenario.

Use the letters we provided in this article as a guide as to how you can approach your landlord for a rent reduction, and remember to back up your request with proof, like a letter of termination or an email from your employer asking you to take fewer hours.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Jacob Cocciolone

Jacob Cocciolone

Harrison Astbury

Harrison Astbury