Moody’s Investors Service has reported on a number of factors that could erode ANZ, Commonwealth Bank, NAB and Westpac’s stronghold on the mortgage market.

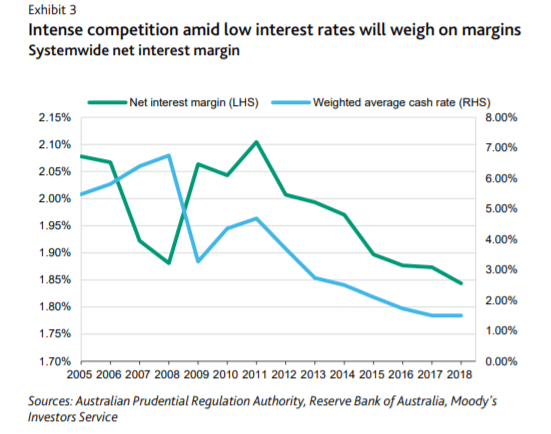

The recent halving of the cash rate from 1.50% to 0.75% is one such factor set to have a larger effect on the big banks in the coming years.

The report states these effects will be more intensely felt in 2020, as monetary policy only started easing in June 2019, which is three months before the end of the big banks’ fiscal years.

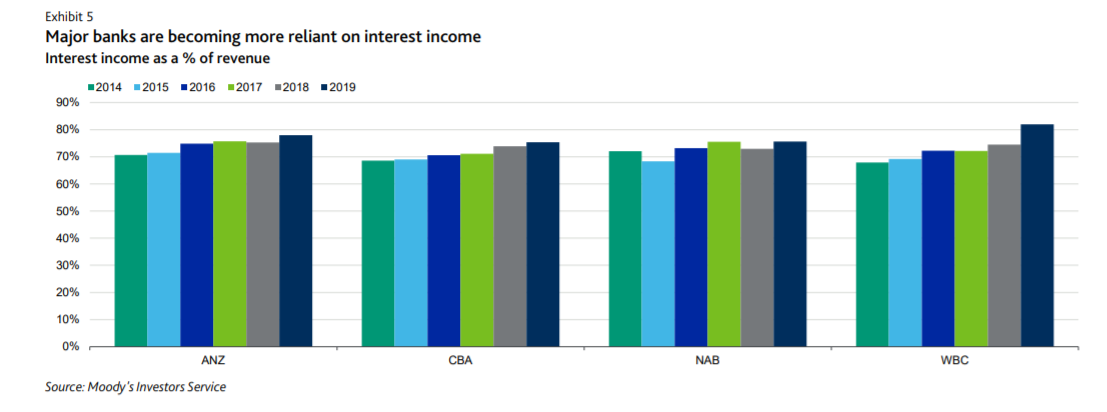

“The impact of low interest rates on the major banks will be more pronounced, now that they have become more reliant on domestic lending for revenue generation, following a number of divestments of overseas businesses, life insurance and wealth management operations,” Moody’s said.\

“This, combined with significant reductions in product fees, has led to a declining share of non-interest income in revenue.

“In addition to the challenge posed by low interest rates, the possibility of further fines for breaches of regulations and top up provisions for customer remediation could restrict profit growth in 2020.”

Big four’s share of mortgage lending decreasing

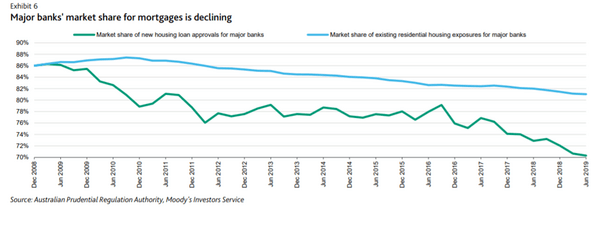

While the big four have about 81% of the total housing market at the moment, according to KPMG, the major banks’ collective market share for new mortgage approvals is much smaller than that.

Moody’s analysis of APRA data shows their market share of new housing loan approvals fell from around 86% a decade ago to just over 70% in June 2019, while their share of existing residential loans has fallen only slightly to that 81% figure.

“Asset growth at the banks is slowing, constraining increases in revenue and profit, particularly as repayments of existing mortgages accelerate,” Moody’s said.

“Many borrowers are effectively paying down their outstanding loan balances faster by opting to not reduce their loan repayment amounts despite lower interest rates.

“This will constrain growth of interest income in the coming years as low rates persist.”

Moody’s also found lower barriers to entry are increasing mortgage competition, something that could soon eat into the big four’s market share.

The report states that APRA (the Australian Prudential Regulation Authority) has relaxed the regulations allowing building societies and credit unions to label themselves as banks, while also introducing a new avenue for the accreditation of restricted bank licenses, allowing institutions to operate as a bank for two years before meeting licensing requirements in full.

Digital banks Volt and Xinja were two examples to gain restricted banking licenses recently, although they now have full licenses according to APRA’s list of registered ADIs.

“As a consequence, competition is increasing not only from existing authorised deposit-taking institutions but also from new entrants,” Moody’s said.

“Since APRA implemented the restricted license regime, a total of four banks have been created and obtained full licenses.

“The new banks do not immediately pose a serious threat to the major banks due to their small balance sheets and limited access to funding. However, this is just a beginning, and new challenger banks will continue to emerge and increase competition for the incumbent banks.”

Technology will level the playing field

The availability of technology to improve bank processes and enhance the customer experience will benefit smaller banks more than the big banks, according to Moody’s.

This will significantly reduce some of the key advantages the majors have, and a major trigger would be open banking.

The Consumer Data Right Act 2019 requires major banks to provide customers with access to data on their credit and debit card transaction accounts by February 2020, and on mortgages from 2020, while smaller banks have an extra 12 months to prepare.

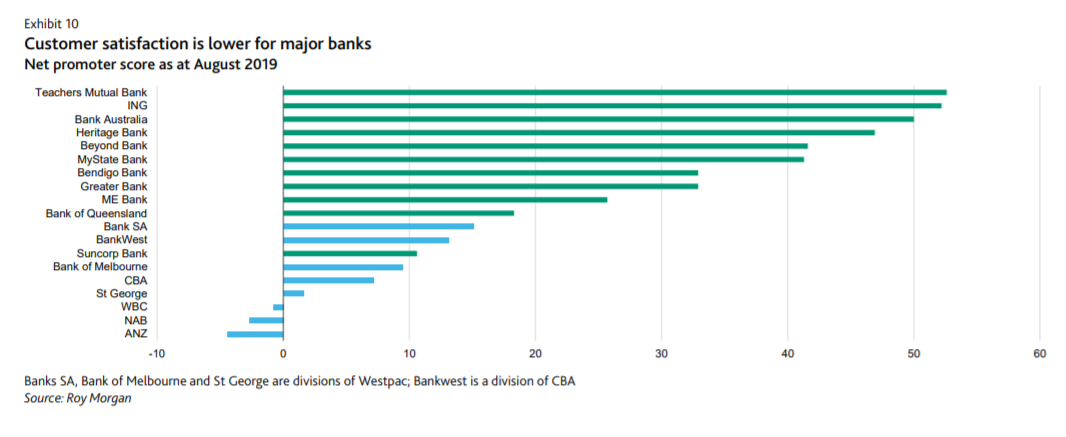

Moody’s report says there are indicators major bank customers are willing to switch banks, something open banking would make much easier.

“For example, the level of customer satisfaction is the lowest for the four among banks in Australia, according to a survey on whether customers would recommend their banks to others,” the report said.

“Furthermore, the top four banks’ reputation has been hurt by findings of misconduct by the Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry.

“Reflecting this, the major banks have been falling in the Reputation Institute’s reputation rankings in the past year, with ANZ and NAB dropping the most.”

A similar study by JD Power last week found the major bank’s majorly underperformed compared to other larger retail banks like ING in customer satisfaction and mobile banking satisfaction.

Smaller firms are also increasingly collaborating with fintech firms to keep pace with technological changes, and as it becomes easier to replicate important functionalities, the big four could lose the technological advantage they once used to employ.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Harrison Astbury

Harrison Astbury