ANZ's 2020 Full Year Result for the year ended 30 September stated that at the start of COVID-19 in Australia, it deferred repayments on a total of 95,000 home loans.

Of these 95,000 home loans, 55,000 accounts have either completed their deferral period or advised their intended action at maturity.

Of these 55,000 loans, 79% - approximately 43,500 - have returned to full repayments, while 20% have requested a further deferral.

The extra 1% have requested a further deferral or sought additional support.

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

Of those deferrals still active, ANZ says half have a savings buffer of at least three months or greater, while one quarter has managed at least one payment during the deferral period.

Four-fifths (80%) of ANZ customers with deferred home loans (past or present) have stable or improved incomes.

Mortgage cliff easing

This data from one of Australia's biggest home lenders further shows the easing of mortgage-related stress in Australia brought on by COVID financial difficulties.

At its peak, the number of deferred loans peaked at around 500,000, worth around $274 billion, in June, while Australian Prudential Regulation Authority (APRA) data showed up to 30 June, one in 10 mortgages across the country were deferred.

But more recent data from the Australian Banking Association (ABA) in October showed almost half (45%) of deferred mortgages are now being regularly paid down.

Banks started contacting their customers to resume payments in September, although options are still available for those who need them.

“These loan deferrals have helped hundreds of thousands of Australian families and small businesses survive the pandemic," ABA Chief Executive Anna Bligh said.

“Right now, it’s really important that people contact their bank to figure out the path ahead. The earlier you speak to your bank, the more options they have to help you find a way through."

Data from Australia's largest home lender and bank Commonwealth Bank (CBA) shows similar numbers to ANZ.

CBA said that the number of its home loans deferred fell from 210,000 in June to 129,000 in mid-October - a fall of 48%.

Over 50,000 of CBA's deferred loans are due to expire and exit at the end of October.

Another of Australia's 10 largest banks, Bendigo and Adelaide Bank, also showed a sharp decline in COVID deferrals today.

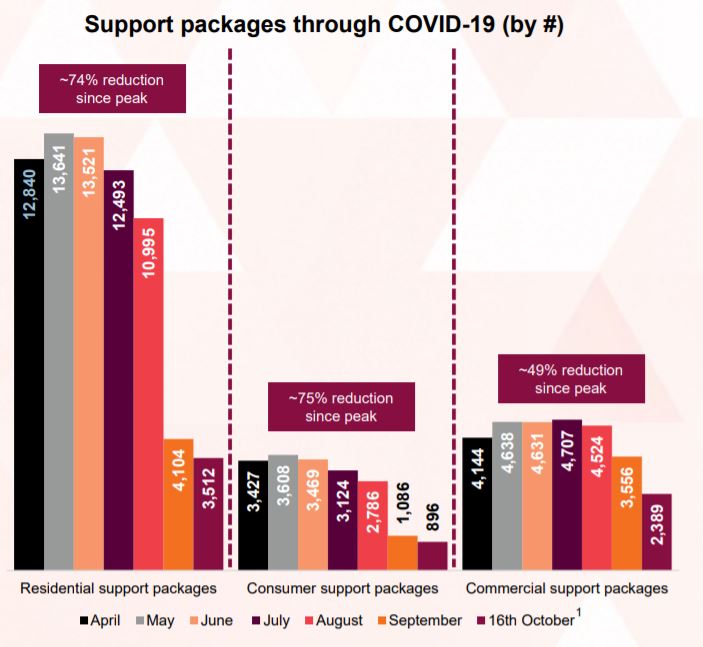

Bendigo's first-quarter results for the 2021 financial year showed personalised support for customers on deferred payments arrangements has fallen by two-thirds, from 12,840 in April to 3,512 as at 16 October.

“It is pleasing to see that our personalised support has enabled more than two-thirds of customers on deferred repayment arrangements to get back on their feet and we are further encouraged by the Victorian Premier’s announcement to reopen Melbourne’s retail and hospitality industries from tomorrow,” Marnie Baker, Managing Director at Bendigo and Adelaide Bank said.

"We also take comfort that our customer base is well-positioned to manage through this uncertain environment, with 48% of customers more than six months’ ahead in their mortgage repayments and almost 40% more than one year ahead.

“It is in the best interests of both our customers and in turn the Bank, for customers to commence repaying their loans as soon as possible, and we will work with our customers to agree appropriate and tailored arrangements prior to their deferral period ending."

Source: Bendigo & Adelaide Bank

According to Roy Morgan, these mortgage deferrals actually helped lower mortgage stress levels to near record lows during the pandemic.

[Read: Have a mortgage deferral? Here's how your lender is expected to help when it ends]

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Harrison Astbury

Harrison Astbury