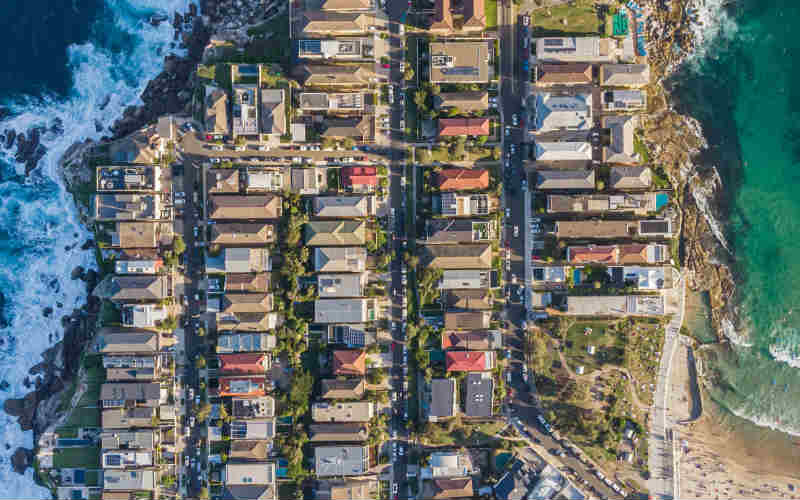

Investing in property is often thought of as a 'less risky' investment choice, so it's no surprise that it's the go-to for many Australians wanting to make their money work for them. Recent figures show there are currently more than 2.24 million property investors in Australia. This means roughly one in five taxpayers owns an investment property. Of these, 71% have one investment property while the remaining 29% have two or more properties under their belts. Most of these investors are more than likely renting out their properties, either positively geared (making a profit) or negatively geared (making a net loss).

Renting your property to a tenant might seem quite straightforward - just find tenants who're going to pay you rent, right? But there's a bit more to it than meets the eye. Let's look at some other important considerations, many of them before tenants even move in.

The world of property investing

Before we get into the process of renting out an investment property, let's discuss the world of investing for a moment. There are considered to be four main types of investments in Australia: shares, property, cash, and fixed interest.

Let's lay out the basics for our current investment-of-choice: property. There are a few notable pros and cons of investing in property.

| Pros | Cons |

|---|---|

|

|

As well as the pros and cons of choosing property as an investment, you'll also need to weigh up ongoing costs associated with owning an investment property. Depending on whether you own a house or townhouse/unit, expenses may include:

-

Council and water rates

-

Building insurance

-

Repairs and maintenance costs

We'll get into landlord insurance and property management fees later on, which could add to the long list of considerations.

If you're feeling a bit overwhelmed, bear in mind that investing in property is considered to be more of a long game. If you invest in shares or cash, it's relatively easy to enter and exit the market as you please, with minimal transaction costs involved. Investing in property requires higher entry and ongoing costs that may only pay off if you're going to own the property for several years. If that's a strategy that aligns with your long-term investment goals, property investment can be a good vehicle for wealth creation.

Is it worth renovating a rental?

Let's say you've already purchased an investment property that you intend to rent out. If it's an older property that's in need of a bit of TLC, you might want to do some renovations before any tenants move in.

There are some notable benefits to renovating a property, even if you intend to rent it. After all, it is still your property - improving it should make it more valuable or desirable. As well, any improvements you make can mean you'll be able to rent it out for a higher amount. It can also attract a higher calibre of tenant wanting to live in your prized asset.

Now, 'renovating' doesn't mean knocking down walls and starting from scratch. Something as simple as a fresh paint job can sometimes make a notable difference and give the property the freshen up it needs.

Here are some easy examples of superficial, as well as some more extreme, renovations that can yield higher rental returns:

-

Replacing old taps and sinks in bathrooms

-

Regular garden upkeep

-

A fresh coat of paint

-

New flooring

-

Adding a bedroom

-

Doing up the kitchen

See: Six home renovation projects that may increase your resale value

As well as more rental income, home renovations can create extra value on top of regular capital growth over time. This effectively means you'll have more equity in your home. Simply put, home equity is the difference between the home's current market value and the balance of any outstanding debt you have on it (that is, your mortgage). Some property investors use this equity to borrow against to expand their investment portfolios.

But back to renovating. When sprucing up your investment property, it's important to keep the demographic of renters you're trying to attract in mind. Is it a four-bedroom house with a big yard located close to a school? Or is it a small, two-bedroom apartment close to the city? These two property types are likely to attract different types of tenants, which means alterations you could consider making to one might not suit the other.

All in all, common sense can go a long way. It may be worth just focusing on key areas, like the kitchen or bathroom, before doing a full-scale property revamp.

Ask yourself: is this renovation task really going to be worth it? Forking out $20,000 gutting and redesigning the bathroom, only to yield an extra $20 in weekly rent might not be worth the money outlaid.

To insure or not to insure

If the property is ready to rent, the next consideration is landlord insurance. In a nutshell, landlord insurance acts as a layer of protection in the event of financial loss, and it's slightly different from normal home insurance.

Landlord insurance is a type of home insurance but as well as covering your building and what's inside it, it covers the situations unique to a landlord. Essentially, it also provides 'tenants insurance' so any problems that may arise with your tenants (damages, accidents, loss of rent, legal expenses, etc.) are covered by your insurance.

While landlord insurance is entirely up to you, one bonus is that landlord insurance policies are usually tax deductible. Let's look at what most landlord insurance policies cover.

Rental loss

Landlord insurance can cover you in the event of rental loss but not when the property is vacant. In this context, rental loss means if the property is damaged by an event and is uninhabitable for a period of time. Landlord insurance will typically cover the rental income you would have been receiving during this time.

Rent default or theft

If you discover you've had a less-than-ideal tenant living in your property, landlord insurance can come in handy. Say they've decided to stop paying rent or seemingly disappear off the face of the Earth, your policy can cover your financial losses. Plus, if the tenant stole a few things on their way out, you can be reimbursed by your insurance provider.

Damage

Normal wear-and-tear is going to happen anyway, so your insurance probably won't cover this. However, malicious damage, like holes in walls or burns to the carpets, can be covered by landlord insurance. In these cases, tenants would be required to cover the cost of repairs, but if they can't/won't, landlord insurance is a good backup to save having to pay for it yourself.

Legal fees

While hopefully you'll never need to appear in court, especially with a good property manager (see more on this below), some policies cover legal expenses involved with remedying issues with a tenant. Coverage could include expenses incurred by attending a tribunal hearing or even retaining legal counsel.

Public liability

Public liability cover is extremely important. It basically insures you if a death or injury occurs on your property, and someone tries to sue you for being liable. Most insurance plans will cover you for up to $20 million, but it's worth double checking your policy. In the unfortunate event that a tenant or visitor is injured on your property and they try to take legal action against you, public liability cover will have your back.

Professional property management vs self-management

When it comes to the day-to-day management of your investment property, you have two main options: you can either do it yourself, or you can employ a professional property manager to do it for you.

The majority of property owners opt for the second option because managing even just one tenanted property can be like a full-time job. There are several key factors you'll need to consider when tossing up between the two options. Let's check the main ones.

The legal stuff

If you decide to self-manage, you'll need to understand the relevant laws, legislation, and obligations you'll be faced with as the property manager. This might include complying with the relevant governing bodies, as well as building safety, strata, and short-term accommodation laws that may affect your property. Failure to be aware of and comply with all the legal obligations can lead to trouble. Ignorance is not bliss, nor a defence, when it comes to obeying rental laws.

You'll also need to know how to complete all the paperwork involved in bringing on and maintaining a tenant. This will include the lease agreement, rental bond lodgement, entry condition reports, inspection reports, vacate documents, and more. Each state and territory has its own tribunal and applicable lease documents, so you'll need to do your own research into what applies to you.

Time management

When you're managing a rental property, you need to be available to fix things that will inevitably go wrong, all the time. So, if your tenant reports their air con isn't working, you'll need to source an electrician (who is fully qualified and covered by insurance), organise a time that suits to complete the work, make sure it's done correctly, and pay the invoice. Not to mention, you'll need to be available for general inspections, looking after other requests from the tenants, chasing up late rent payments or other bills (if applicable), organising and keeping on top of mandatory checks (e.g. smoke alarms), and more.

Finding a tenant

Arguably, the most important part of owning an investment property is finding the right tenant/s to move in. Ideally, these are people who are respectful, law-abiding, clean, and will treat the property with the same care and attentiveness as if it was their own. While this might not seem too difficult, there could be more steps involved than you'd think.

To give you some idea, here are some things you may need to do:

-

Advertise the property for rent

-

Have an application form ready to be completed to collect relevant information

-

Go through submitted applications and verify the information provided through identification, rental history, and employment checks

-

Ensure the applicant can afford to pay the rent. Generally, 30% of gross income is considered to be the maximum amount that should go towards rental payments

-

Check tenancy databases (e.g. TICA) to ensure applicant isn't blacklisted

-

Be available to conduct regular inspections of the property

By going through a property manager, you won't need to handle any of this logistical stuff yourself. Leasing agents are not only efficient and knowledgeable when it comes to finding the right tenant, they're usually pretty good at picking the good eggs from the bad ones. This might just come with experience, because they've dealt with enough tenants in their time to know what to look for. Regardless, it is still possible to find a tenant yourself, but make sure you have your business hat on.

So, how much does a property manager cost?

Managing a rental property is no breeze. There's a lot involved in the day-to-day of owning an investment property and dealing with tenants can be considerable work. If you'd rather not have the stress or simply don't have the time, hiring a property manager to take care of your investment property is typically quite affordable. Commission fees in Australia can range from 5 to 8% of weekly rental income, but this can vary. There may also be other fees that apply, for example, when a lease renewal is coming up. Generally, property managers will do everything for you, so you just have to sign on the dotted line. As well, property management fees are tax deductible, just like landlord insurance.

Advice from the property experts

All this may seem like a lot of information to take in at once - because it is. An investment property might be seen as a 'safer' way to invest, but that doesn't mean there isn't still a lot of work involved in entering the market. Despite this, many people still choose to invest in property and are extremely successful in doing so.

For more on how to invest in property and how to do it right, Savings.com.au reached out to some experts in the field for their expert opinions and advice for new property investors.

Expert one: Lloyd Edge, Director and Founder of Aus Property Professionals

Lloyd Edge from Aus Property Professionals. Image Supplied

Mr Edge said one of the most important questions to ask, as a new property investor, is what you're trying to achieve: whether you're investing for a cash flow, or for capital growth.

"Depending on your income, this can be quite a determining factor. If you're on a lower income, getting a property with better cash flow is actually going to help you more, and also help you get a loan," he told Savings.com.au.

"If you're on a higher income, then you might be able to service a larger debt, because you might want to claim the difference on tax, so you can negatively gear it. So that's sort of a strategy in itself.

"Apart from that, I think what's really important is location for property," he said.

"One of the things you really need to look at is where you buy. Get an understanding of where the government is spending money, where the infrastructure's going, where the population is moving to, and the employment rate."

He said it's important to understand these factors, as well as the demographics, so that you're buying an investment in an area where there's demand from tenants.

When asked whether there are any differences between investing in houses versus townhouses and units, he said that it depends on the area, and that that you "need to buy to the demographic".

"If you're in an outer suburb, for example, or family-occupied suburb, then it's important to invest in what people are living in. So, if most of the properties in the area are four-to-five bedroom homes that are occupied by a family, then units are not the right investment," Mr Edge said.

"If you're closer to the city or the interesting parts of the city, units and townhouses would be good options because that's what the demographic wants."

Regarding the comparison between self-management and property management, Mr Edge said he doesn't recommend self-managing because it can "cause quite a lot of headaches".

"You generally need to be close to the property if you're going to self-manage. You might need to go around and organise repairs, and if the tenants don't pay rent, then you've got to actually deal with that. A property manager deals with everything on your behalf. And it's tax deductible," he said.

In terms of finding the right property managers, Mr Edge recommends choosing a company that specifically deals with rentals, rather than a larger real estate agency that's predominantly sales-based, to get the best service.

Expert two: Scott Aggett, Property Negotiator at Hello Haus

Scott Aggett from Hello Haus. Image Supplied

When discussing why fees vary between agencies, Mr Aggett said that it comes down to location, as well as the level of service required to manage the property.

"There are extremes, of course, in terms of set and forget properties that require little monitoring right through to un-renovated properties requiring constant upkeep or with tenants falling behind with rent," he said.

According to Mr Aggett, high value inner city rentals usually command far lower fees when compared to some suburban and regional areas. He said that property management fees in inner city locations can range from 4.5 to 5%, all the way up to 7% in smaller cities.

When asked what is responsible for driving lower prices, he said that it ultimately comes down to competition. Mr Aggett gave his five tips for property investment and choosing a property manager:

-

Look online, on realestate.com.au or domain.com.au, for who has the largest market share of current listings online

-

Make note of the top three offices you see consistently

-

Pay attention to the quality of marketing, focusing on the quality brands that present their clients' homes professionally (good marketing often means more rent)

-

Ask all three to pitch their fees and charges plus their service offering

-

Check online review sites to read customer feedback and service ratings

"With a small amount of homework, you can save yourself thousands of dollars in property management fees."

While Mr Aggett said it shouldn't be all about who offers the lowest fees, investors could be pleasantly surprised by how motivated agents can be to get your business when they know they're competing for it.

As a final tip, he provided Savings.com.au with a script to use when calling your leading option to negotiate a lower price.

"We have reviewed the market and we think you'll be the right fit to manage our investment, however, you are not competitive on fees. We will sign with you if you can do it for "$X".

He said that the 'X' number should be 10% lower than the cheapest rate you were quoted.

Mr Aggett also explained why shopping around is worth the hassle.

"On a weekly investment property rental of $500 per week, the difference between 5.5% and 7.7% is $572 per year. With the average rental investment being held for around 10 years in Australia, that's nearly $6,000 of savings," he said.

Expert three: Cate Bakos, Cate Bakos Property and board member of Property Investment Professionals of Australia

Cate Bakos, board member of Property Investment Professionals of Australia. Image supplied.

Cate Bakos gave her input on what landlords should consider when renting out an investment property.

When discussing rental returns investors can expect, she said that recent, comparable leases should be used as a baseline, as well as the opinion of an experienced, local property manager.

"Rent cycles can occur seasonally in a lot of locations, so being prepared to accept less when the conditions are not conducive to stronger rents is just as important, because a landlord can face vacancy periods if they are unrealistic or refusing to meet the market," Ms Bakos told Savings.com.au.

But she said in the current market with much tighter vacancies in the capital cities, many landlords are seeing strong rental demand. Even so, Ms Bakos said charging fair market rent is important as legislative changes in some states allow only one rental adjustment per year. She said investors should make themselves familiar with the legislative compliance in their relevant state or territory.

She stressed it's important for property owners to be adequately insured through landlord insurance. According to Ms Bakos, owners can face "serious repercussions if anything goes wrong for the tenant and the owner is found to be at fault".

She suggested landlords discuss things like waiting periods, excesses, limitations of cover, and third-party coverage are with their property managers.

"One of the most valuable questions a landlord can ask their property manager relates to adequate insurance cover," Ms Bakos said.

"Understanding the protection and coverage of any given policy is vital, as is any conditions that are applied by the policy."

Lastly, before handing over the keys, Ms Bakos said that the owner should ensure the property feels welcoming and clean.

"The investor should get in quickly and do all of the little things they had planned to do before handing over the keys, so that their tenant can enjoy a peaceful, uninterrupted tenure. This includes arranging maintenance visits, trade upgrades, landscaping/gardening, and any bank valuer visits and quantity surveyor jobs," she said.

"A welcome message is a lovely touch. Landlords need to always remember that their tenant is their customer, and the property is their customer's home."

Saving.com.au's two cents

Clearly, renting out a property isn't as simple as 'buy house = make profit'. There are many things you'll likely need to sort out before you start reaping the benefits of owning an investment property. From minor renovations to finding the right property manager, chances are you could be busy for a while before tenants enter the picture. But buying and renting out property is clearly a highly popular choice made by many Australians who have decided the benefits outweigh the drawbacks.

First published on August 2021

Image by PhotoMIX Company on Pexels

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Aaron Bell

Aaron Bell

William Jolly

William Jolly