The Property Investment Professionals of Australia (PIPA) Investor Sentiment Survey surveyed 1,200 property investors, and found they are “demonstrably more positive” about the market compared to the same time last year.

This is despite slow markets in Sydney and Melbourne and the tight credit environment.

The big reasons for the positive sentiment, according to the survey, is the lack of changes to negative gearing and capital gains taxation.

According to PIPA Chairman Peter Koulizos, Labor’s proposed changes to negative gearing and capital gains tax – where they proposed to limit negative gearing to new housing and halve the capital gains discount – heavily influenced the way that three-quarters of investors voted in the recent Federal Election.

“It’s clear that many investors, regardless of their political leanings, were fed up with being told they were ‘greedy’ when the vast majority only own property and are just trying to improve their financial futures,” Mr Koulizos said.

Property investors not deterred

Despite the looming threat of a continued slide in house prices, property investors are still focused on the long-term merits over short-term losses.

Some 78% of respondents said potential falls in house prices wouldn’t cause them to put their investment goals on hold, with 82% saying now is a good time to invest.

“Long-term capital growth beat out cash flow – both long- and short-term – as the most important aspect when choosing an investment,” Mr Koulizos said.

“When asked why they choose to invest, the most important reason was to provide a better life financially for themselves and their family, while the idea of ‘becoming rich’ was one of the least important reasons.

“The majority of investors are also confident in their local market because when asked the direction of the property market in their state or territory, 53% said it was improving while 41% said it was flat.”

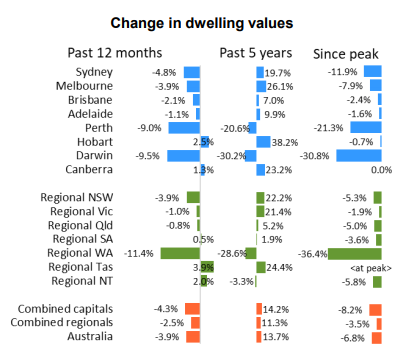

The recent CoreLogic Home Value Index for September suggested the recent slide in property prices may have bottomed, with the national median dwelling value rising by 0.9%: the largest monthly gain since March 2017.

This was largely driven by strong growth in Sydney and Melbourne, where values were up by 1.7%.

Investors now looking outside the major banks

According to Mr Koulizos, restricted access to lending has caused more investors to look to smaller lenders, such as non-banks, over the big four banks.

“Difficulty obtaining finance, as well as the popularity of banks being on the slide over the past year, meant that about 60% of investors are now more likely to consider a non-major bank lender, especially after the outcomes of last year’s Banking Royal Commission,” he said.

The survey found that 27% of investors had secured a loan from a non-major bank lender over the past year, with cheaper interest rates and increased borrowing power cited as the key reasons why.

“Given tight lending conditions and the financial sector’s response to the Banking Royal Commission, a staggering 25% of respondents have found they were unable to refinance an amount they were able to borrow previously,” Mr Koulizos said.

“This situation is potentially one of the reasons why the number of investors in the market has fallen dramatically – with 34 per cent of investors purchasing a property over the past 12 months, down from 43 per cent in the 2018 survey.”

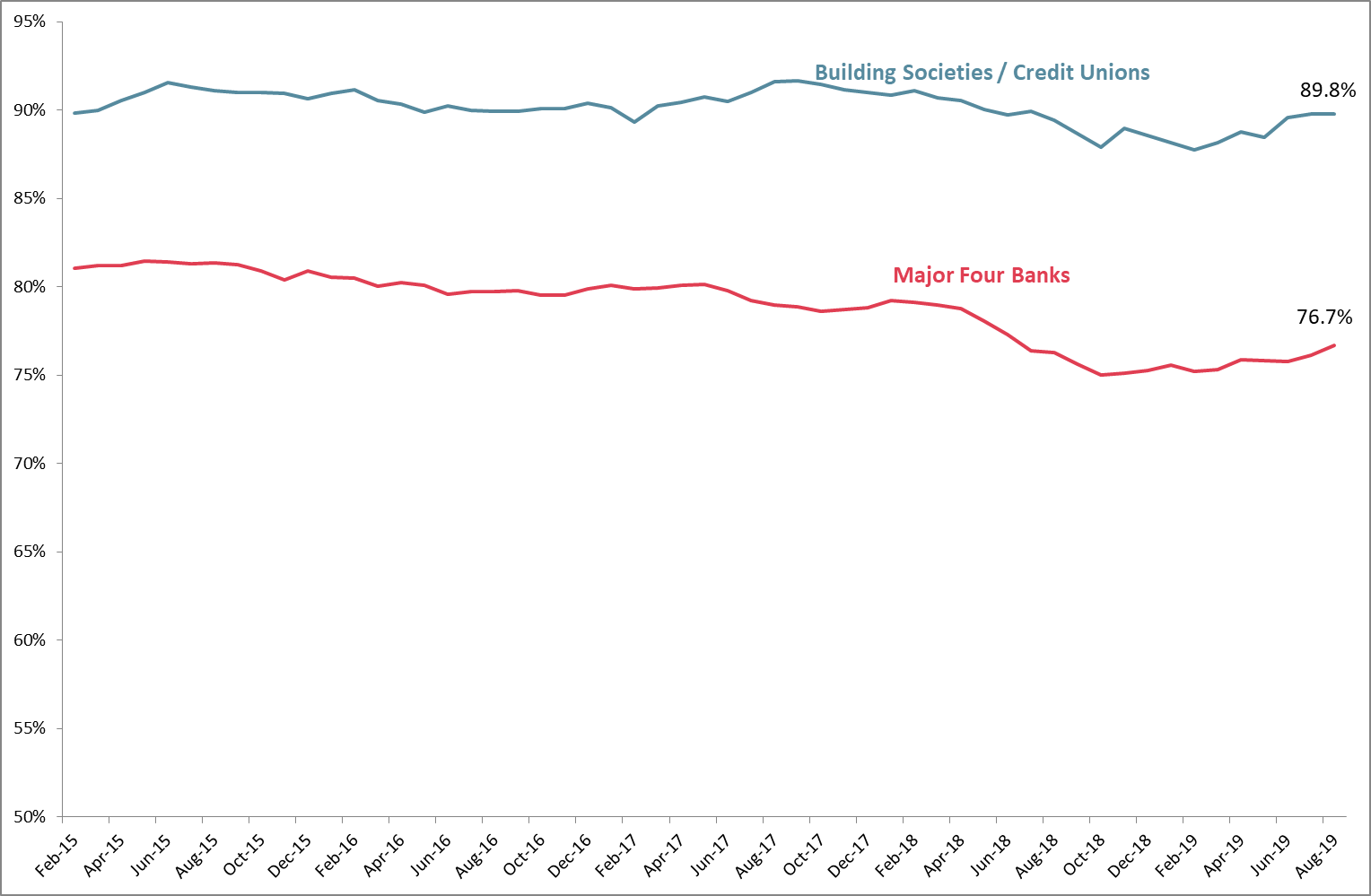

Building society and credit union (aka customer-owned banks) customer satisfaction is eclipsing that of the big banks.

New Roy Morgan research shows just under 90% of customer-owned bank customers declared themselves satisfied over the last six months, compared to 77% of big four banking customers.

Newcastle Permanent took the top gong for monthly banking satisfaction for each month so far this year, having a satisfaction rating of 92%.

CUA (91%) and People’s Choice Credit Union (88%) come second and third respectively.

Roy Morgan CEO Michele Levine said building societies and credit unions consistently outperform the major banks when it comes to customer satisfaction.

“While the disturbing revelations of the Banking Royal Commission saw satisfaction with the Big four banks drop to a low of 75% in October 2018, Building Societies and Credit Unions never dipped below 87%,” Ms Levine said.

“Their challenge is to try to capitalise on this excellent scorecard to gain an increased share of business.”

The latest Quarterly ADI Statistics released by the Australian Prudential Regulation Authority show the customer-owned banking sector’s housing loans grew by 7.8% to the June quarter, while the major banks grew by just 2.6%.

Customer satisfaction: Big Four vs Customer-Owned Banks (building societies/credit unions)

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Denise Raward

Denise Raward

Rachel Horan

Rachel Horan

Arjun Paliwal

Arjun Paliwal