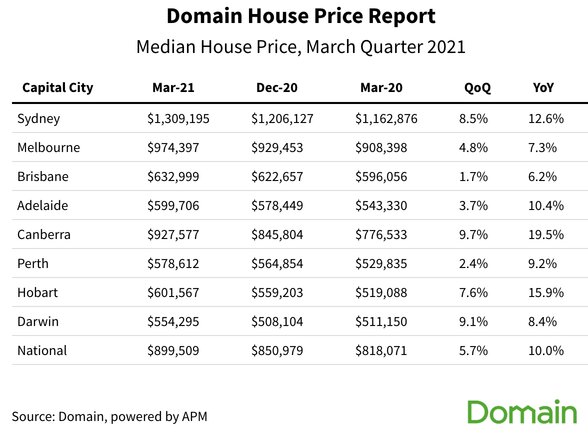

Median house prices reached a new record high $899,509, up 5.7% from the previous quarter, and house prices in every capital city except Perth and Darwin hit record highs in the three months to 31 March.

This is the first time Domain has reported that house prices have risen simultaneously for two consecutive quarters since 2009, after the Global Financial Crisis (GFC).

It also follows recent research from CoreLogic which found March was the strongest month for house price growth in 32 years, reaching a quarterly growth rate of 5.8%.

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

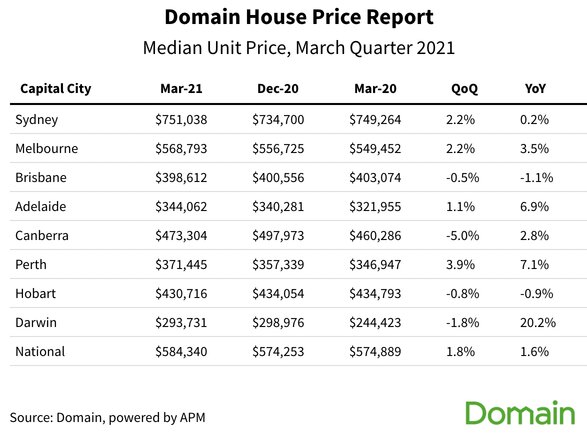

National median unit prices were up 1.7% quarter on quarter to $584,340, and now sit just above their previous 2017 peak.

Domain senior research analyst Dr Nicola Powell said dwelling values had now recovered any losses incurred in the last four years.

"The 8% drop from mid-2017 to early 2019, as well as the 2.1% COVID decline mid-2020, have now been recouped," Dr Powell said.

"Record low interest rates, improved household savings, low listing volumes, post-lockdown lifestyle changes, consumer sentiment roaring to an 11-year high, returning cashed-up expats and government incentives have fuelled demand for housing and a strong market performance.

"It is the first time in a year that price growth across the combined capital cities has outperformed regional areas."

Sydney and Melbourne recorded their fastest median house price increases in nearly 30 years, up 8.5% and 4.8% respectively.

According to Dr Powell, owner-occupiers had been the driving force behind the growth, but the market is forecast to slow over the year.

"This rapid quarterly growth isn’t likely to continue. Prices will still grow but it is unlikely to stay at such sustained growth rates over each quarter," she said.

Previously affordable locations see exponential growth

Property markets in South-east Queensland surged in popularity through COVID, and the March 2021 quarter was no exception.

Brisbane, the Gold Coast, and the Sunshine Coast were all standout performers, with house prices hitting record highs in each location.

"Changed lifestyle preferences post-lockdown and the option of remote working has driven demand to south-east Queensland as buyers are drawn by affordability, liveability, climate and greater value for money,” Dr Powell said.

Elsewhere, Adelaide also saw record-high house prices, with sale transactions at their highest level since 2007.

An end to eviction moratoriums is likely to increase investor activity, according to Dr Powell.

"Adelaide has always largely been an owner-occupier driven market, therefore less exposed to the retreat of investors," she said.

"That said, investors are starting to return, and the lower purchasing price, tight rental market and ending of the rental moratorium could draw more investment activity to South Australia."

In the nation's capital, Canberra house prices breached $900,000 for the first time.

Hobart house prices breached $600,000, also for the first time.

Perth and Darwin, the only two capitals to not record new record-highs for house prices, still saw prices hit their highest point in five years and four years respectively.

Dr Powell said Perth and Darwin benefitted from lower prices compared to the rest of the country, which could appeal to owner-occupiers and investors.

“Record low home loan rates, generous government incentives, improved consumer sentiment has boosted buyer confidence - the same factors supporting market activity across all capital cities," she said.

"Setting Perth apart is the affordability factor, with homeowners aware prices are below peak but rising, creating pressure to purchase before they accelerate too far."

Photo by Ivan Tsaregorodtsev on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

William Jolly

William Jolly