ING's new 'Future Focus: Homeownership report' found almost half (46%) of this group said COVID-19 had made home ownership more achievable.

Millennials said they used the lockdown to get on top of their property goals, by moving travel budgets to a home savings account (59%), taking on a side hustle (37%), and moving back in with their parents (36%).

The report found in order to save and buy a house sooner, half of all millennial home buyers said they would consider living on the city fringes and the outer suburbs (45km or more from the city).

More than one in five (22%) said they plan to buy a smaller property in a cheaper area and rent it out until they can afford their forever home, while one in 10 (9%) said they would consider buying a property with a friend or family member to get on the ladder quicker.

The report also found Millennials were making significant sacrifices and using different tactics in order to achieve their homeownership dream.

Almost half (48%) said they would limit their personal shopping, reduce dining out experiences (42%) and recreational drinking (28%), give up their gym membership (21%), and date less (24%).

ING’s Head of Home Loans Julie-Anne Bosich said the pandemic had galvanised the younger generation's resolve to own a home.

"What this research suggests (is) millennials and Australians in general haven’t given up on the great Australian dream of owning their own home, they’re just re-thinking how they go about getting there and re-evaluating where they might want to live," Ms Bosich said.

“It suggests many people, especially millennials are being savvy by taking advantage of record low interest rates, government assistance and a weakened housing market to get on the property ladder.”

The Great Australian Dream

The report found more than half (61%) of the nation's adult population thought home ownership was important right now.

Low interest rates (39%), a more affordable housing market (33%) and new government schemes (32%) were all key factors contributing to a sense that buying a home in the post-COVID market was more achievable than it was previously.

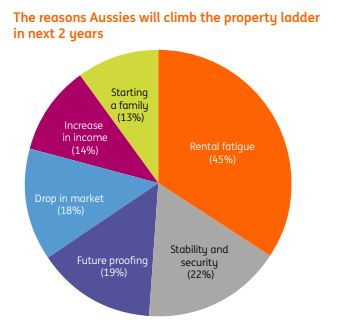

Australians looking to buy within the next two years said they were tired of renting (45%) wanted greater stability and security (22%), and recent events had shown them the importance of getting into the market to protect their future (19%).

Source: ING

Rather than holding out for their next home or planning a property portfolio, it appears Australians were setting more realistic homeownership goals to get on the ladder sooner.

Most people were setting their sights on owning one home (68%), with few people wanting to purchase an investment property (8%) or flip a house for profit (5%).

Barriers to entering the property market were deposit costs (42%), fears of long-term debt (25%), and the prospect of an impending recession (22%).

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Rachel Horan

Rachel Horan