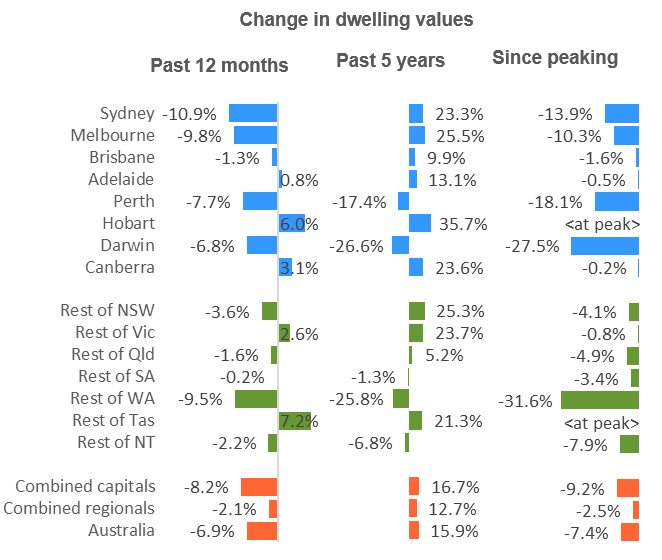

This follows a fall of 0.7% in February and now means the average dwelling price in Australia has fallen 7.4% since it peaked in mid-2017.

Sydney’s dwelling values have fallen 0.9% over the month, 3.2% over the quarter and 10.9% annually. Across the same timeframes, Melbourne’s values have fallen 0.8%, 3.4% and 9.8% respectively.

Since July 2017’s peak, Sydney’s prices have fallen by 13.9%, while Melbourne’s have declined 10.7%.

Of the other capital cities, dwelling values were down everywhere except for Canberra and Hobart – the former saw no change, while Hobart’s prices actually rose by 0.6%.

| City | Monthly change | Quarterly change | Annual change | Median value |

|---|---|---|---|---|

| Sydney | -0.9% | -3.2% | -10.9% | $782,473 |

| Melbourne | -0.8% | -3.4% | -9.8% | $624,425 |

| Brisbane | -0.6% | -1.1% | -1.3% | $489,832 |

| Adelaide | -0.4% | -0.5% | 0.8% | $426,990 |

| Perth | -0.4% | -2.9% | -7.7% | $442,716 |

| Hobart | 0.6% | 1.2% | 6.0% | $464,168 |

| Darwin | -0.6% | -3.9% | -6.8% | $400,316 |

| Canberra | 0% | 0% | 3.1% | $595,212 |

| Combined capitals | -0.7% | -2.7% | -8.2% | $597,860 |

| Combined regional | -0.4% | -1.0% | -2.1% | $376,728 |

| National | -0.6% | -2.3% | -6.9% | $524,149 |

Source: CoreLogic

CoreLogic’s head of research Tim Lawless said although the pace of falls has slowed somewhat in March, the downturn has become more geographically widespread.

“The outlook for the housing market will continue to be affected by uncertainty related to the federal election, lending policies and more broadly, domestic economic conditions,” Mr Lawless said.

“Federal elections generally cause some uncertainty, which is likely amplified more so this time around considering the potential for a change of government which will also involve significant changes to taxation policies related to investment.

“If elected, the Opposition have flagged that changes to the capital gains tax discount and negative gearing would take effect from January 2020.”

On a positive note, Mr Lawless said first home buyers have been much more active relative to other areas of the country, with housing now “very affordable”.

“As dwelling prices trend lower or level out, household incomes are edging higher and mortgage rates remain around the lowest level since the 1960’s.

“First home buyers are clearly taking advantage of the improved levels of affordability and less competition in the market.”

Rate cuts to be a key factor

The last few months have seen home loan interest rate changes from a number of institutions, the majority of which have been rate cuts.

Large institutions such as ING, AMP, NAB, Loans.com.au, ME Bank, Macquarie, BOQ and Bankwest all made changes to their home loan products in March.

The Reserve Bank of Australia (RBA) is strongly rumoured to cut the cash rate in 2019, which, if carried out, should result in reduced rates on mortgages.

Mr Lawless said such rate cuts could offset the fall in property values.

“While any cuts to the cash rate may not be passed on in full, a lower cost of debt will provide some positive stimulus for the housing market,” he said.

“Arguably, this stimulus won’t be as effective as previous interest rate cuts due to the high serviceability buffer applied to borrowers, whereby lenders are still required to assess serviceability at a mortgage rate of at least 7% despite mortgage rates which are now available around the 4% mark or even lower.”

New home sales also trending down

The sale of new homes is also falling, according to the Housing Industry Association’s new home sales report.

HIA’s Chief Economist, Tim Reardon said:

“New home sales remained subdued in February, with just a 1.0 per cent increase across Australia, against a

“More recently the market has entered a significant downturn as other factors – regulatory restrictions, credit squeeze and falling market confidence – have accelerated this downturn.

“Sales for the three months to February are now 18.1 per cent lower than at the same time last year. Approvals for new homes, which is a trailing indicator of new home sales, show the market is 8.1 per cent lower than in the same three month period a year earlier.”

For feedback or queries, email will.jolly@savings.com.au

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Bea Garcia

Bea Garcia

Brooke Cooper

Brooke Cooper