The latest release of the Rental Affordability Index (RAI), released annually by National Shelter, Community Sector Banking, SGS Economics & Planning and the Brotherhood of St Laurence, found the Tasmanian capital remains Australia’s least affordable city for renters after overtaking Sydney in 2017.

According to the report’s methodology, it uses a rental affordability index (RAI) score of zero to more than 200 based on how much of someone’s income goes towards paying their rent.

Households paying 30% of income on rent (commonly-regarded as the threshold for housing stress) have an RAI score of 100, indicating these households are at the critical threshold level for housing stress.

An index score below 80 means between 38%-60% of income is spent on rent, which is classed as “extremely unaffordable”.

| Index score | Share of income spent on rent | Relative unaffordability |

| <50 | 60% or more | Extremely unaffordable rents |

| 50-80 | 38-60% | Severely unaffordable rents |

| 80-100 | 30-38% | Unaffordable rents |

| 100-200 | 25-30% | Moderately unaffordable rents |

| 120-150 | 20-25% | Acceptable rents |

| >150 | 15% or less | Affordable rents |

Source: National Shelter, SGS Economics and Planning, 2019

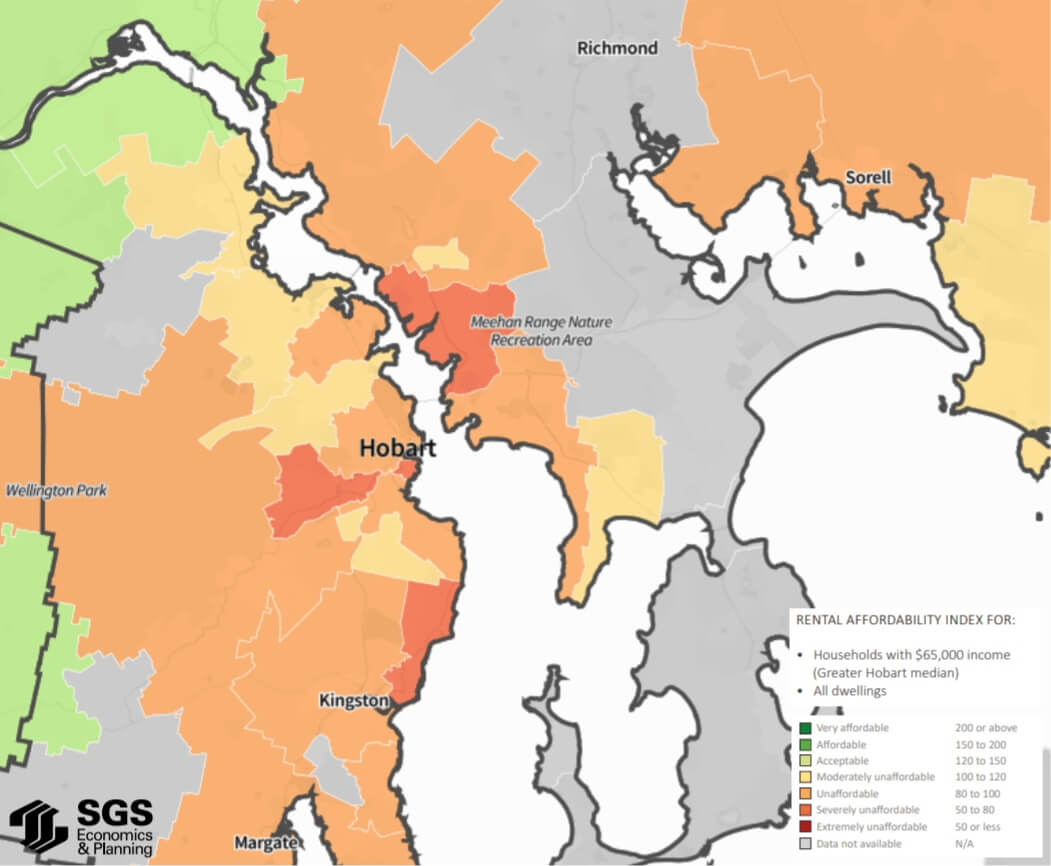

According to the results, Hobart is the only city where rental affordability has dropped below the critical threshold of 100, falling to 93 in June 2019.

This means the average income household is paying 30% of more of their income on rent, which would put them in rental stress.

SGS Economics and Planning Partner Ellen Witte says Hobart is in the midst of a rental crisis.

“The rents have been increasing by 10 per cent per annum over the last three years,” Ms Witte said.

“No matter how hard you work, you won’t be able to keep up with price rises like this. The market is failing and there is an urgent need for the government to intervene.

“There is a lack of new supply, while stock is being lost to the short-term holiday accommodation market. The rights of renters are weak, and the Tasmanian Residential Tenancy Act needs to be reviewed like Victoria has done.”

Source: National Shelter, SGS Economics and Planning, 2019

Greater Adelaide is the second-least affordable region with a score of 112, while Sydney has improved thanks to increasing incomes and static rents.

Perth, Canberra, Melbourne and Brisbane all have “acceptable” affordability ratings, with Perth being the most affordable with 21% of income being spent on rent.

| Region | RAI score | Share of household income spent on rent | Affordability rating |

| Greater Sydney | 119 | 25% | Moderately unaffordable |

| Greater Brisbane | 127 | 24% | Acceptable |

| Greater Adelaide | 112 | 27% | Moderately unaffordable |

| Greater Hobart | 93 | 32% | Unaffordable |

| Greater Melbourne | 128 | 23% | Acceptable |

| Greater Perth | 143 | 21% | Acceptable |

| ACT | 129 | 23% | Acceptable |

Source: National Shelter, SGS Economics and Planning, 2019

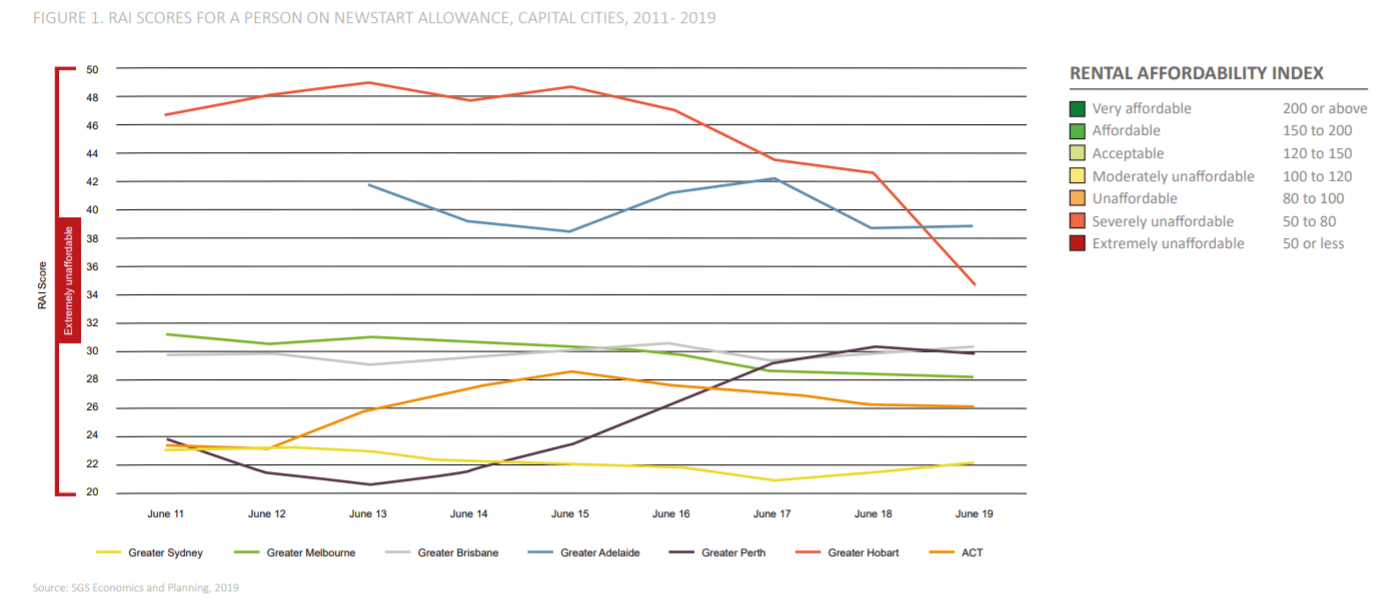

As can be seen below, however, Sydney fares far worse for low-income households.

Renting difficult for Australia’s most vulnerable

While the report shows rental affordability in some cities – including Sydney – has marginally improved, renting is extremely grim for low-income groups like pensioners and those on Newstart.

According to National Shelter, the situation is “untenable” for people on Newstart, with rent costing at least 77% of their income in every capital city.

For such low-income households, the report describes Sydney and Greater Hobart as “critically unaffordable”, while National Shelter Executive Officer Adrian Pisarski said there are no places in Australia where Newstart recipients can comfortably rent.

“Newstart renters in metro Sydney require 4.5 times their current income to achieve affordability,” Mr Pisarski said.

“The most affordable places we have are in regional SA and even there someone on Newstart needs to pay 47% of their income to rent.

“The RAI evidence is conclusive: all Newstart recipients who are renting are living in poverty.”

Source: National Shelter, SGS Economics and Planning, 2019

Pensioners aren’t fairing much better – both singles and dual adults.

“The implications for retirement incomes policy are dire with more people retiring without owning and facing a completely unaffordable rental market,” Mr Pisarski said.

“We know older women are the fastest-growing cohort experiencing homelessness and we’d expect increased rates of homelessness among older people based on these findings.”

Other contributors to the report echoed similar statements, with raising the rate of Newstart a recurring theme:

“People on Newstart are the most vulnerable cohort in the country as they experience the worst levels of housing stress.”

“After paying the rent there are not enough resources left, and people may not even be able to fork out money to go to a job interview. There is an urgent need to raise the Newstart allowance and provide these households a pathway out of the poverty trap.”

SGS Economics and Planning Partner Ellen Witte

“Looking beneath the headline figures, rental stress is affecting the majority of very low-income households in Australia. People on Newstart are being hit particularly hard, being pushed to the outer fringes of our cities and away from opportunities for training and employment.”

“Even in cities with higher than average incomes and better than average rental affordability, the plight of low-income renters continues to deteriorate.”

James Barron, Head of Relations at Community Sector Banking

“Our social security safety net is letting down fellow citizens. There is an urgent need to raise Newstart and its very modest rental supplement and to increase subsidised social housing.”

“The evidence is utterly compelling: the deeply inadequate Newstart rate is a driver of homelessness. This is not the ‘fair-go’ society we cherish.”

“With high rents, single older job seekers and families with young children are in the eye of the affordable housing storm across the country. We are seeing increasing disparities, and the crisis end of this challenge is visible on our streets.”

Conny Lenneberg, Executive Director of the Brotherhood of St Laurence

Raising the rate of Newstart is one of the recommendations the Reserve Bank of Australia has put forward to help stimulate the economy.

Speaking at an ACOSS (Australian Council of Social Services) conference yesterday, Deputy RBA Governor Guy Debelle said as much, as well as saying low wages growth is the new norm.

Asked whether raising it could boost the economy, he said: “There are a number of things which are out there which would provide stimulus to the economy – this is one of them.”

ACOSS chief executive Cassandra Goldie said it was “extraordinary” that in a wealthy country like Australia there are three million people struggling to afford the basics.

“I can’t find anybody else outside of government who doesn’t think that Newstart needs to increase,” she said.

Prior to November’s Melbourne Cup-day cash rate decision, 13 economists also suggested Newstart should be increased, among other things.

According to National Shelter, Australia’s Newstart is the second-lowest unemployment payment in the OECD group of wealthy nations.

The report compared rental affordability results for 10 different groups in total, not just Newstart recipients and pensioners.

The groups in the report are:

- Single pensioners

- Pensioner couples

- Single people on Newstart

- Single part-time worker parent on benefits

- Single working parents

- Single income couples with children

- Dual income couples with children

- Student sharehouses

- Minimum wage couples

- Hospitality workers

Unsurprisingly, dual-income couples have much greater access to affordable rents than lower incomes groups.

In Greater Sydney, for example, this group has an RAI score of 215, with only 14% of their income dedicated to rent, and 13% going towards rent in Hobart.

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Brooke Cooper

Brooke Cooper