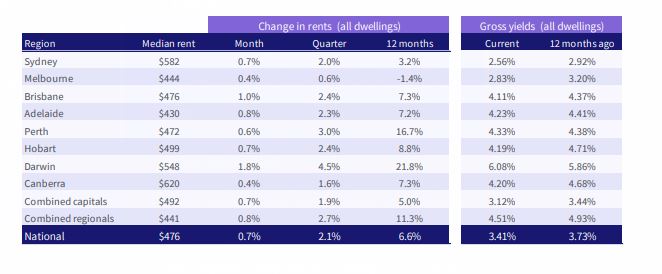

CoreLogic's Rental Review for the June 2021 quarter found a 2.1% rise in rents, down on the 3.2% rise over the March quarter.

National gross rental yields were 3.41% in the June quarter, down from 3.55% in the March quarter and down from the 3.73% seen a year earlier.

Regional rents continued to outpace capital city rents, rising by 2.7% in the June quarter, compared to a 1.9% rise in capital city rents, with both seeing a reduction in growth from the previous quarter.

Despite the reduced growth, annual regional rental growth reached 11.3% in June, the highest annual growth on record, with the CoreLogic series commencing in 2005.

CoreLogic’s Head of Research Australia, Eliza Owen, said the rental market was seeing growth not seen in more than a decade.

"Following subdued rental performance through much of the 2010s, the Australian rental market has seen an increase in values due to many of the same factors that have led to the current housing price upswing," Ms Owen said.

"These factors include increased government stimulus through COVID-19, accumulated household savings through lockdown periods, the swift economic recovery seen as restrictions eased, and a lack of rental supply in some markets have also exacerbated rental price increases, particularly in major centres of regional Australia."

Canberra remained the most expensive city to rent, with median house rents reaching $668 per week and median unit rents at $521 per week, while Adelaide was the most affordable.

Regions with some of the highest rental yields included Logan in Brisbane, Sydney's Central Coast, Melbourne's West, and Adelaide's North.

Source: CoreLogic

According to the Australian Bureau of Statistics, May saw new lending to investors increase by 13.3%, which Ms Owen said was also affecting the rental market.

"It is interesting to note that, as with house prices, rent prices are seeing a deceleration in growth at

the national level and across each of the capital cities," she said.

"This may reflect affordability constraints, but there could also be higher levels of rental supply as investor activity in the market increases."

CoreLogic's release coincides with recent research from Domain, which found vacancy rates were at their lowest ever point, and rent prices were at record highs in most capitals.

Diverse rental conditions across the nation

Ms Owen noted despite the strong headline figures, closer inspection revealed a massive range in rental growths, with 21.8% annual growth in Darwin, while Melbourne rents dropped 1.4%.

Sydney and Melbourne unit rents both saw declines in the year as international border closures and lockdowns impacted their markets, but the two cities are steadying.

"In fact, Sydney unit rents have begun to creep higher in recent quarters, including a 1.8% uplift in

the three months to June," Ms Owen said.

"Melbourne unit rents have also started to show signs of stabilising, with values remaining flat over the quarter.

"Recent lockdown conditions across Sydney may impact rental markets where there are high concentrations of renters in affected industries, such as hospitality and tourism."

Ms Owen said the growth was likely to continue, albeit at a slower pace.

"Very high rental growth is unsustainable while income growth remains subdued," she said.

"The result will likely be more subdued growth rates in the coming quarters, especially as investor participation trends higher, delivering more rental supply."

Photo by Gunnar Ridderstrom on Unsplash

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Harry O'Sullivan

Harry O'Sullivan

Denise Raward

Denise Raward

Alex Brewster

Alex Brewster

Rachel Horan

Rachel Horan