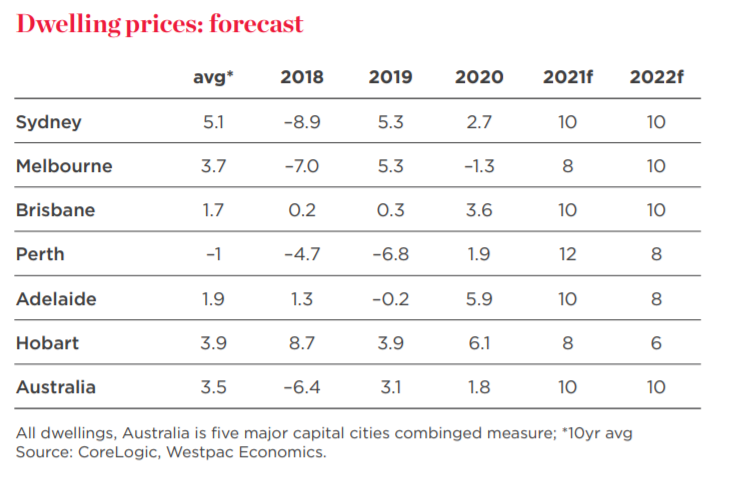

The forecasts are significantly more optimistic than the big four bank's September forecast, where they expected prices would rise by just 4% this year and 10% next.

Westpac chief economist Bill Evans said the last four months had seen a faster and stronger than expected turnaround, with momentum suggesting it will be better sustained.

"The upturn is being supported by record low interest rates; the confident expectation amongst borrowers that these rates will remain low for years to come; ample credit supply; and an improving economic backdrop, as the roll-out of vaccines promises to bring the pandemic to an end and drives a sustained lift in confidence," Mr Evans said.

Buying a home or looking to refinance? The table below features home loans with some of the lowest interest rates on the market for owner occupiers.

| Lender | Home Loan | Interest Rate | Comparison Rate* | Monthly Repayment | Repayment type | Rate Type | Offset | Redraw | Ongoing Fees | Upfront Fees | Max LVR | Lump Sum Repayment | Extra Repayments | Split Loan Option | Tags | Features | Link | Compare | Promoted Product | Disclosure |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

5.54% p.a. | 5.58% p.a. | $2,852 | Principal & Interest | Variable | $0 | $530 | 90% |

| Promoted | Disclosure | ||||||||||

5.49% p.a. | 5.40% p.a. | $2,836 | Principal & Interest | Variable | $0 | $0 | 80% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $250 | $250 | 60% |

| Promoted | Disclosure | ||||||||||

5.64% p.a. | 5.89% p.a. | $2,883 | Principal & Interest | Variable | $248 | $350 | 60% |

| Disclosure |

House prices rose 0.9% in January, the fourth consecutive month of increases, according to CoreLogic, with every capital city and regional location recording an increase in values.

Mr Evans said some of these price gains were off the back of transitory factors, like a catch-up on last year's virus disruption, an unusually active holiday period for markets, and the Federal Government's HomeBuilder scheme.

"However, even allowing for this, the picture is unambiguously strong. Most tellingly, buyer demand has run well ahead of ‘on market’ supply, with sales outstripping new listings by 34% over the last six months and ‘stock on market’ down to just 2.5 months of sales – the long run average is 3.8.

"A lift in new listings will no doubt be forthcoming but for now this is clearly a seller’s market."

NAB Executive, Home Ownership, Andy Kerr, said NAB was also forecasting strong growth in the housing market this year.

“NAB is currently forecasting house price growth of around 10% for Australia’s capitals in 2021, with apartment price growth likely to be a bit more subdued, particularly in Melbourne and Sydney," Mr Kerr told Savings.com.au.

Westpac's forecast is more optimistic than fellow big four bank Commonwealth Bank (CBA), who forecasted house prices would rise by 16% over the next two years.

Central bank may intervene in housing market

Mr Evans said the Reserve Bank (RBA) holding the cash rate at 0.1% until at least 2024 was highly stimulatory to the housing market, but a likely adjustment to its Yield Curve Control policy may push up fixed rates.

"This adjustment will increase fixed term mortgage rates and may take some heat out of the market at the margin but is unlikely to derail what will be a very well-established price upturn by 2022."

In order to prevent the housing market from becoming unstable, Mr Evans said the RBA may be forced to reintroduce Loan to Value (LVR) restrictions on investors.

"They have clearly developed more confidence in these tools following their successful deployment in 2015 and 2017 and the RBA has already indicated these policies are an option if housing market concerns resurface," Mr Evans said.

"Housing credit will continue to see robust gains with investor activity becoming increasingly prominent – stoking fears of ‘overheating’.

"Through 2022 new lending is likely to peak around 50% higher than the previous peak in 2017."

The greatest uncertainty in the housing market is migration, with new dwelling construction running well ahead of population-driven requirements over the past year.

"If borders remain closed for longer or migration inflows are slow to restart that could lead to a market-wide physical oversupply of dwellings by 2022," Mr Evans said.

"How that may influence market conditions and price growth is unclear.

"For example, rental vacancy rates may remain elevated for longer, perhaps even pushing higher, but that may not do much to deter investors seeking expected price gains, particularly as rental yields are likely to remain above funding costs."

Ready, Set, Buy!

Learn everything you need to know about buying property – from choosing the right property and home loan, to the purchasing process, tips to save money and more!

With bonus Q&A sheet and Crossword!

Bea Garcia

Bea Garcia

Denise Raward

Denise Raward

Harry O'Sullivan

Harry O'Sullivan

Rachel Horan

Rachel Horan

Harrison Astbury

Harrison Astbury